FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

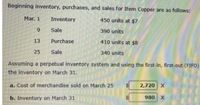

Transcribed Image Text:Beginning inventory, purchases, and sales for Item Copper are as follows:

Mar. 1

Inventory

450 units at $7

9

Sale

390 units

13

Purchase

410 units at $8

25

Sale

340 units

Assuming a perpetual inventory system and using the first-in, first-out (FIFO)

the inventory on March 31.

a. Cost of merchandise sold on March 25

2,720 X

b. Inventory on March 31

980 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The inventory data for an item for November are: Nov. 01 Inventory 20 units at $25 04 Sale 8 units 10 Purchase 32 units at $27 17 Sale 19 units 30 Purchase 23 units at $29 Using a perpetual system, what is the cost of merchandise sold for November if the company uses LIFO? a.$1,013 b.$713 c.$1,342 d.$689arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sept. 1 Beginning Inventory 25 units @ $13 5 Sale 12 units 17 Purchase 30 Sale a. Cost of merchandise sold 24 units b. Inventory, September 30 19 units Assuming a perpetual inventory system and the last-in, first-out method, determine (a) the cost of the merchandise sold for the September 30 sale and (b) the inventory on September 30. $ @ $15 $arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Widget are as follows:Mar. 1 Inventory 200 units at $89 Sale 175 units13 Purchase 160 units at $925 Sale 150 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on March 25 and (b) the inventory on March 31.a. Cost of merchandise sold on March 25 $b. Inventory on March 31 $arrow_forward

- Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item CZ83 are as follows: July 1 Inventory 110 units @ $27 5 Sale 88 units 11 Purchase 122 units @ $30 21 Sale 102 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on July 21 and (b) the inventory on July 31. a. Cost of merchandise sold on July 21 $fill in the blank 1 b. Inventory on July 31arrow_forwardPerpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item FK7 are as follows: Sept. 1 Inventory 115 units at $255 10 Sale 100 units 18 Purchase 110 units at $260 27 Sale 105 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchan September 27 and (b) the inventory on September 30. a. Cost of merchandise sold on September 27 $4 b. Inventory on September 30 8arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 24 units @ $10 5 Sale 17 units 17 Purchase 10 units @ $15 30 Sale 8 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale.$fill in the blank 1arrow_forward

- Beginning inventory, purchases, and sales for Item FK7 are as follows: Sep 1 inventory 115 units at $225 10 sales 100 units 18 purchase 110 units at $260 27 sales 105 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30.arrow_forwardPerpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 200 units at $40 Oct. 7 Sale 180 units Oct. 15 180 units at $45 Oct. 24 Sale 150 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. Purchase a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 47 units @ $23 7 Sale 39 units 15 Purchase 35 units @ $26 24 Sale 17 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forward

- Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item PK95 are as follows: August 1 Inventory 78 units @ $20 9 Sale 64 units 13 Purchase 86 units @ $24 25 Sale 20 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on August 25 and (b) the inventory on August 31. a. Cost of merchandise sold on August 25 $fill in the blank 1 b. Inventory on August 31 $fill in the blank 2arrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 19 units at $24 4 Sold 8 units 10 Purchased 34 units at $21 17 Sold 15 units 30 Purchased 24 units at $24 Using a perpetual system, what is the cost of the goods sold for November if the company uses LIFO? a.$540 b.$507 c.$771 d.$1,206arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item ER27 are as follows: May 1 Inventory 72 units @ $17 9 Sale 58 units 13 Purchase 76 units @ $19 28 Sale 22 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on May 28 and (b) the inventory on May 31. a. Cost of merchandise sold on May 28 b. Inventory on May 31arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education