ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

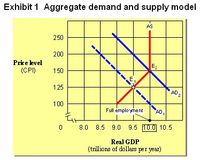

Beginning at equilibrium E1 in Exhibit 1, when the government increases spending or cuts taxes the economy will experience:

Group of answer choices

an inflationary recession.

stagflation.

cost-push inflation.

demand-pull inflation.

Transcribed Image Text:Exhibit 1 Aggregate demand and supply model

AS

250

200

Price level

E.

(CPI)

150

E,

125

AD.

100

Full émplo yment

AD,

8.0 8.5 9.0 9.5 T0.0 10.5

Real GDP

(trillions of dollars per year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Demand–pull inflation occurs when increases until equilibrium output exceeds the full employment level.arrow_forwardWhen disposable income increases, consumption expenditure decreases by the same amount. does not change. also increases, and by an equal amount. also increases, but by less. also increases, and by more. Demand-pull inflation starts with a decrease in aggregate supply. a decrease in aggregate demand. an increase in aggregate demand. an increase in aggregate supply. an increase in potential GDP.arrow_forwardAssume that the housing market is in equilibrium in year 1. In year 2, the mortgage rate that banks charge consumers decreases, but producers are not affected. Also in year 2, the cost of lumber used to build homes decreases. Which of the following is most likely to be the equilibrium change? a The equilibrium will be at point C before the change in expectations and point B after the change b The equilibrium will be at point A before the change in expectations and point B after the change c The equilibrium will be at point A before the change in expectations and point E after the change d The equilibrium will be at point E before the change in expectations and point A after the changearrow_forward

- Demand-pull inflationary pressure increases as the economy approaches full employment. Group of answer choices True. False. PreviousNextarrow_forwardWhich of the following would cause the dynamic DAD curve to shift in (back)? A) a decrease in consumer confidence. B) a decrease in the inflation rate. C) an increase in consumer wealth. D) an increase in the short-run aggregate supply (SRAS) curve.arrow_forwardAn economy is at full employment. Which of the following can create an inflationary gap. Group of answer choices An increase in nominal wages. An increase in income taxes. An increase in government spending. A decrease in government spending.arrow_forward

- Inflation arises due to: Group of answer choices changes in real output, changes in nominal output, and changes in the unemployment rate. inflation expectations, potential output, and the non-accelerating inflation rate of unemployment (NAIRU). inflation expectations, demand-pull inflation, and cost-push inflation. the negative output gap, the positive output gap, and unexpected inflation.arrow_forwardWhen the Fed increases the rate of growth of the money supply to jump start the economy, the unemployment type that will be directly affected is the: Group of answer choices frictional unemployment. natural rate of unemployment. structural unemployment. cyclical unemployment.arrow_forwardIn which situation is a program to reduce inflation likely to have the lowest costs? if the sacrifice ratio is high and the reduction is unexpected if the sacrifice ratio is high and the reduction is expected if the sacrifice ratio is low and the reduction is unexpected if the sacrifice ratio is low and the reduction is expectedarrow_forward

- There is no long-run trade-off between inflation and output because: Group of answer choices monetary policy makers will have adequately controlled unexpected inflation in the long run. fiscal policy makers will have adequately controlled unexpected inflation in the long run. in the short run, output and unemployment are not related. allowing inflation doesn't lead to sustainably higher output.arrow_forwardquestion 3: The Covid-19 pandemic shifted the aggregate supply and aggregate demand curves to the left. Did that increase or decrease real GDP, employment, and inflation rate?arrow_forwardIn a certain economy, the Dynamic Aggregate Supply (DAS) line is represented by the function = - π₁ = Ę ₁ = ₁ π + α ( Y₁ − Ÿ) + D and the inflation expectations formation mechanism is adaptive, that is, E₁+1 Absent a supply shock (v₁ = 0), in a figure representing period t inflation rate, π, on the vertical axis, and period t output, Y₁, on the horizontal axis, the period t DAS line will pass through the pair of points, : OA. (-1) B. (α, Y) ○ C. (Y) D. (πt, Yt)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education