FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Bear Island Ltd has a weekly payroll of $350 000. The employees receive entitlements to 3 weeks’ sick leave per year. The sick-leave entitlements are classified as non-vesting. Past experience, and experience within the industry, suggest that 60 per cent of employees will use their full 3 weeks’ entitlement each year; 10 per cent of employees will take one week’s sick leave each year; and 10 per cent of employees will take 3 day’s sick leave each year.

REQUIRED

a) Calculate the expected annual sick-leave expense for Bear Island Ltd (on the basis of average salaries).

b) Provide the

Transcribed Image Text:Debit/Credit

Description

Debit Amount

Credit Amount

Enter amount

Enter amount

Enter amount

Enter amount

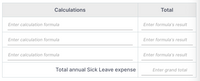

Transcribed Image Text:Calculations

Total

Enter calculation formula

Enter formula's result

Enter calculation formula

Enter formula's result

Enter calculation formula

Enter formula's result

Total annual Sick Leave expense

Enter grand total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Brooks Advertising pays Lee Young $97,290 per year. Requirements 1. What is the hourly cost to Brooks Advertising of employing Young? Assume a 45-hour week and a 47-week year. 2. What direct labor cost would be assigned to Client 507 if Young works 19 hours to prepare Client 507's magazine ad? Requirement 1. What is the hourly cost to Brooks Advertising of employing Young? Assume a 45-hour week and 47-week year. Select the formula below that Brooks Advertising would use to calculate the hourly cost and complete the formula. (Round the hourly cost to the nearest cent.) + Hourly costarrow_forwardDainty Ltd has an average weekly payroll of $200 000. The employees are entitled to 2 weeks', non- vesting sick leave per annum. Past experience suggests that 56% of employees will take the full 2 weeks' sick leave and 22% will take 1 week's leave each year. The rest of the employees take no sick leave. Required: Calculate the expected annual sick-leave expense for Dainty Ltd (on the basis of average salaries). Provide the journal entry necessary to recognise the sick-leave entitlement expense as it accrues each week. In the current week an employee with a weekly salary of $600 has been off sick for the first time this year. The employee took 2 days off out of her normal 5-day working week. Assuming that PAYG tax is deducted at 30%, what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar)?arrow_forwardSheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Correct answer icon Your answer is correct Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account…arrow_forward

- National Storage employs 88 workers with a gross monthly payroll of $135,000. Fringe benefits are 8.8% of payroll for a profit sharing plan and $9.21 per employee for life insurance. What percent of payroll is the total cost of fringe benefits? Round your answer to the neareat tenth of a percent.arrow_forwardBush Enterprises International BEI hires 10,000 employees. Each employee earns twenty days of paid vacation per calendar year. Up to five days of this may be carried forward and taken in the following vear but cannot be carried forward any further. Employees are not paid for any vacations they do not take. As at December 31, 2022, 9,130 employees had used their full vacation entitlement for 2022. The remaining employees are carrying forward an average of 3 days each and they are all expected to use these vacation days. Half of the employee group earn $300 per day and the other half work 8 hour days and earn $15 per hour and this is representative of those who still have leftover vacation earned. What amount of liability for accrued vacation pay should appear in the company's balance sheet at December 31, 2022 ? a. $548,100 b. $783.000 c. $913,500 d. $313,200 e. None of the above Plz answer fast without plagiarismarrow_forwardNielson Corporation has three employees. Each employee is paid overtime at time and one-half after the first 40 hours worked for the week. The current social security and medicare taxes are 6.2% and 1.45% respectively. Social security tax is capped on the first $140,000 of annual wages. The current unemployment tax rates are 3% for state and 1% for federal on the first $8,000 of annual wages. Below is the payroll information for the first week of the new year (therefore, the annual wage caps will not apply). Employee Hourly Rate Hours Worked Federal W/H Rate Roth 401k Deduction Health Insurance United Way Susan W. 27 45 20% 120 150 5 George B. 25.25 50 20% 100 200 5 Maria M. 23 48 15% 75 125 5 a. Prepare a payroll register for the week's payroll (use the form provided to the right).…arrow_forward

- Shadder is a small company that manufactures knitwear products. It employs approximately 120 staff, all of whom are paid by bank transfer. Permanent factory staff are paid on a weekly basis based on the number of hours worked as evidenced by clock cards. Administration and sales staff are paid a monthly salary. The two directors of the company are also paid a monthly salary. Sales staff are paid a quarterly bonus calculated on the basis of sales. Directors are paid an annual bonus based on profits. During peak production seasons, temporary factory staff are hired through an agency and are paid on a weekly basis, based on their output. Supervisors at Shadder authorise documentation indicating the number of items produced by temporary staff. The agency is then paid by bank transfer and it is responsible for paying the temporary staff and for the deduction of tax and national insurance. You will be performing the audit of the financial statements for the year ending 31 March 2021 and you…arrow_forwardCullumber Company purchased $3050000 of 9%, 5-year bonds from Vaughn, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3173740 at an effective interest rate of 8%. Using the effective-interest method, Cullumber Company decreased the Available-for-Sale Debt Securities account for the Vaughn, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $10720 and $11080, respectively.At April 1, 2022, Cullumber Company sold the Vaughn bonds for $3140000. After accruing for interest, the carrying value of the Vaughn bonds on April 1, 2022 was $3147440. Assuming Cullumber Company has a portfolio of Available-for-Sale Debt Securities, what should Cullumber Company report as a gain or loss on the bonds? $-7440. $-123740. $-21800. $ 0.arrow_forwardLister Company currently gives its employees their pay at the end of each week. Lister’s weekly payroll totals $500,000. If Lister extends the pay period so as to pay its employees one week later throughout an entire year, the employees would in effect be "lending" the firm how much for the year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education