FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

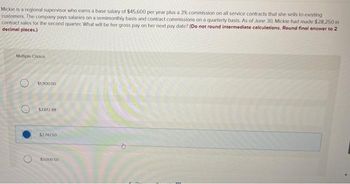

Transcribed Image Text:Mickie is a regional supervisor who earns a base salary of $45.600 per year plus a 3% commission on all service contracts that she sells to existing

customers. The company pays salaries on a semimonthly basis and contract commissions on a quarterly basis. As of June 30, Mickie had made $28,250 in

contract sales for the second quarter. What will be her gross pay on her next pay date? (Do not round intermediate calculations. Round final answer to 2

decimal places.)

Multiple Choice

$1,900.00

$2.612.88

$2.74750

$3000 50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stephanie Parker is a salaried, nonexempt administrator for Forise Industries and is paid biweekly. Her annual salary is $63,000, and her standard workweek is 45 hours. During the pay period ending February 5, 2021, she worked 8 hours overtime. She is married filing jointly with two dependents under the age of 17. Required: Complete the following payroll register for Stephanie's pay. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Company Name Stephanie Parker Forise Industries Filing Status MJ Annual Dependents Salary 2<17 ♥ 63,000.00 Period Salary $ 2,423.08 Hourly Rate $ 53.85 Answer is complete but not entirely correct. Period Ended: Overtime Rate $ 80.77 X Number of Regular Hours 40.00 X Number of Overtime Hours 8.00 $ Regular Earnings 2,423.25 2/5/2021 Overtime Earnings Gross Earnings $ 646.16 S 3,069.41 Xarrow_forwardoperate the flower shop. Anna has an annual salary of $52,000 and Louise is paid $22 per hour. Both employees are paid biweekly (every two weeks). In the pay period ended May 31, 2024, Louise worked 98 hours and is paid time and one-half for hours worked in excess of 80. (a) Determine the gross and net pay of each employee, using the following table. \table [[,,, Federal, Provincial, Total], [, CPP, EI, Tax,Tax, Tax], [Anna Swanson,$92.34, $33.20, $228.10,$ 115.79, $343.89arrow_forwardRequired information (The following information applies to the questions displayed below. Gerald Utsey earned $47,600 in 2021 for a company in Kentucky. He is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2021 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5,4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in ARRendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes. (Do not round Intermediate calculation. Round your final answers to 2 decimal places.) Federal income tax withholding Social Security tax 56.75 13.27 Medicare tax State income tax withholdingarrow_forward

- Marin Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $11 $12 0 8 5 6 Marin Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. prepare journal entries to record transactions related to compensated absences during 2019 and 2020. Compute the amounts of any liability for compensated absences that should be reported on the balance sheet at December 31, 2019 and…arrow_forwardi need the answer quicklyarrow_forwardMonty Company began operations on January 2, 2019. It employs 12 individuals who work 8-hour days and are paid hourly. Each employee earns 13 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as below: Actual Hourly Wage Rate 2019 2020 $ 13 $ 14 Vacation Days Used by Each Employee 2019 2020 $ - $ 12 Sick Days Used by Each Employee 2019 2020 $ 5 $ 7 Monty Company has chosen not to accrue paid sick leave until used, and has chosen to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation…arrow_forward

- Sheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Correct answer icon Your answer is correct Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account…arrow_forward2. A. Luna is a sales agent. His official working hours is 8 hours a day, with a monthly salary of P33,000 (22 working days). For the month of August 2021, he has: a. 10 hours REGOT; b. 5 hours SHOT; c. 8 hours SHRDOT; d. 5 hours LHOT; e 7 hours LHRDOT. How much is his total over time pay? *arrow_forwardIvanhoe Company has 60 employees who work 8-hour days and are paid hourly. On January 1, 2025, the company began a program of granting its employees 10 days of paid vacation each year. Vacation days earned in 2025 may first be taken on January 1, 2026. Information relative to these employees is as follows: Hourly Year Wages Vacation Days Earned by Each Employee Vacation Days Used by Each Employee 2025 $27.50 10 0 2026 29.50 10 8 2027 32.50 10 10 Ivanhoe has chosen to accrue the liability for compensated absences at the current rates of pay in effect when the compensated time is earned. What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2027?arrow_forward

- For the first week of May, Frank Taylor worked 33 hours. Frank earns $16.40 an hour. His employer pays overtime for all hours worked in excess of 40 hours per week and pays 1.5 times the hourly rate for overtime hours. Calculate the following for the first week of May (round your responses to the nearest cent if necessary): 1. Regular pay amount: $ 2. Overtime pay: $ 3. Gross pay: $arrow_forward1. a) Differentiate vesting sick leave and non-vesting sick leave. b) Provide two examples of long-term employee benefits2. Dainty Ltd has an average weekly payroll of $200 000. The employees are entitled to 2 weeks',non-vesting sick leave per annum. Past experience suggests that 56% of employees will take thefull 2 weeks' sick leave and 22% will take 1 week's leave each year. The rest of the employeestake no sick leave.a) Calculate the expected annual sick-leave expense for Dainty Ltd (on the basis of averagesalaries).b) Provide the journal entry necessary to recognise the sick-leave entitlement expense as itaccrues each week.c) In the current week an employee with a weekly salary of $600 has been off sick for the firsttime this year. The employee took 2 days off out of her normal 5-day working week. Assumingthat PAYG tax is deducted at 30%, what would the entry be to record the employee's weeklysalary (round amounts to the nearest dollar)?arrow_forwardCarranza, a nonexempt salesperson with Verent Enterprises, earns a base annual salary of $31,750 with a standard 40-hour workweek. In addition, a 3 percent commission on all sales during the pay period applies. During the weekly pay period ending August 26, Carranza closed $26,400 in sales and worked 4 hours of overtime. Required:What is the gross pay for the period?Note: Do not round your intermediate calculations. Round your final answer to 2 decimal places. Gross pay:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education