Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you please solve this financial accounting issue without use Ai and chatgpt?

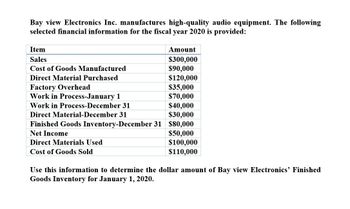

Transcribed Image Text:Bay view Electronics Inc. manufactures high-quality audio equipment. The following

selected financial information for the fiscal year 2020 is provided:

Item

Sales

Cost of Goods Manufactured

Direct Material Purchased

Factory Overhead

Work in Process-January 1

Work in Process-December 31

Direct Material-December 31

Amount

$300,000

$90,000

$120,000

$35,000

$70,000

$40,000

$30,000

Finished Goods Inventory-December 31 $80,000

Net Income

Direct Materials Used

Cost of Goods Sold

$50,000

$100,000

$110,000

Use this information to determine the dollar amount of Bay view Electronics' Finished

Goods Inventory for January 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me fastarrow_forwardWaterway Industries's accounting records reflect the following inventories: Dec. 31, 2019 Dec. 31, 2020 Raw materials inventory $ 90000 $ 74000 Work in process inventory 114000 126000 Finished goods inventory 100000 92000 During 2020, Waterway purchased $1650000 of raw materials, incurred direct labor costs of $250000, and incurred manufacturing overhead totaling $160000.How much is total manufacturing costs incurred during 2020 for Waterway? $2072000 $2060000 $2064000 $2076000arrow_forwardConcord Corporation's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory. Dec. 31, 2020 O $2190700 O $2110700 Ⓒ$2260700. O $2010700 $310000 300000 190000 Dec. 31, 2019. $260000 160000 150000 During 2020, $920000 of raw materials were purchased, direct labor costs amounted to $684700, and manufacturing overhead incurred was $736000. If Concord Corporation's cost of goods manufactured for 2020 amounted to $2150700, its cost of goods sold for the year isarrow_forward

- View Policies Current Attempt in Progress The following data were taken from the records of Shamrock Company for the fiscal year ended June 30, 2022. Raw Materials Inventory 7/1/21 Raw Materials Inventory 6/30/22 Finished Goods Inventory 7/1/21 Finished Goods Inventory 6/30/22 Work in Process Inventory 7/1/21 Work in Process Inventory 6/30/22 Direct Labor Indirect Labor $50,400 39,900 99,600 20,600 27,300 20,100 148,350 25,660 Accounts Receivable Factory Insurance Factory Machinery Depreciation Factory Utilities Office Utilities Expense Sales Revenue Sales Discounts Factory Manager's Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Cash $28,000 5,500 18,100 30,100 8,650 562,100 5,300 64,900 9.610 2,200 98,700 38,200arrow_forwardConstanza Company has the following balances as of the year ended December 31, 2019: Direct Materials Inventory $30,000 Dr. WIP Inventory 69,000 Dr. Finished Goods Inventory 99,000 Dr. Underapplied Factory Department Overhead 8,000 Dr. Cost of Goods Sold 149,000 Dr. Additional information is as follows: Cost of direct materials purchased during 2019 $82,000 Cost of direct materials requisitioned in 2019 74,000 Cost of goods completed during 2019 204,000 Factory overhead applied (120% of direct labor) 96,000 Compute beginning WIP inventory.arrow_forwardSHAMROCK COMPANY Balance Sheet (Partial) For the Year Ended June 30, 2022 ASSETS $ $ $arrow_forward

- The beginning and ending balance of selected accounts of Drea Paper Products Inc. for the year 2020 are given below: Ending Balance Beginning Balance Finished goods P400,000 P385,000 Work on process 520,000 495,000 Raw materials 710,000 750,000 Transactions that transpired during the year were: Raw materials costing P280,000 were purchased for cash. Raw materials costing P220,000 were purchased on account. Incurred factory overhed cost, P135,000. Other materials requisitioned for production, P30,000 Factory wages consisted of: Direct labor, P270,000; Indirect labor, P100,000. Finished goods costing 350,000 were sold for P800,000. Required: Prepare the statement of cost of goods manufactured and sold in good form. Determine the following: a. Prime cost b. Conversion cost c. Product cost.arrow_forwardThe following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2020. Raw Materials Inventory 7/1/19 $54,800 Factory Insurance $5,300 Raw Materials Inventory 6/30/20 49,200 Factory Machinery Depreciation 16,500 Finished Goods Inventory 7/1/19 96,400 Factory Utilities 29,500 Finished Goods Inventory 6/30/20 28,500 Office Utilities Expense 9,250 Work in Process Inventory 7/1/19 22,600 Sales Revenue 561,300 Work in Process Inventory 6/30/20 27,300 Sales Discounts 4,500 Direct Labor 139,550 Plant Manager’s Salary 66,100 Indirect Labor 24,960 Factory Property Taxes 9,710 Accounts Receivable 34,900 Factory Repairs 2,300 Raw Materials Purchases 99,500 Cash 36,300 (a) Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.) (b) Prepare an income statement through gross profit. (c) Prepare the current assets…arrow_forwardCoronado Industries's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory Dec. 31, 2020 O $2050000. $1910000. $2110000. $2010000. $310000 300000 190000 Dec. 31, 2019 $250000 160000 150000 During 2020, $800000 of raw materials were purchased, direct labor costs amounted to $670000, and manufacturing overhead incurred was $640000. Coronado Industries's total manufacturing costs incurred in 2020 amounted toarrow_forward

- The following information is available for the QRS Corporation for 2019: Inventories January 1 December 31 Materials $351,000 $436,800 Work in process 631,800 592,800 Finished goods 608,400 576,000 Advertising expense $ 296,400 Depreciation expense-office equipment 42,120 Depreciation expense-factory equipment 56,160 Direct labor 670,800 Heat, Light and Power-Factory…arrow_forwardThe following data were taken from the records of Waterway Company for the fiscal year ended June 30, 2020. Raw Materials Inventory 7/1/19 $48,100 Factory Insurance $5,600 Raw Materials Inventory 6/30/20 46,200 Factory Machinery Depreciation 18,600 Finished Goods Inventory 7/1/19 99,600 Factory Utilities 29,200 Finished Goods Inventory 6/30/20 21,600 Office Utilities Expense 8,850 Work in Process Inventory 7/1/19 27,700 Sales Revenue 561,400 Work in Process Inventory 6/30/20 25,300 Sales Discounts 4,900 Direct Labor 144,150 Plant Manager’s Salary 64,400 Indirect Labor 24,960 Factory Property Taxes 9,910 Accounts Receivable 29,900 Factory Repairs 2,100 Raw Materials Purchases 99,200 Cash 40,700arrow_forwardThe following data were taken from the records of Waterway Company for the fiscal year ended June 30, 2020. Raw Materials Inventory 7/1/19 $48,100 Factory Insurance $5,600 Raw Materials Inventory 6/30/20 46,200 Factory Machinery Depreciation 18,600 Finished Goods Inventory 7/1/19 99,600 Factory Utilities 29,200 Finished Goods Inventory 6/30/20 21,600 Office Utilities Expense 8,850 Work in Process Inventory 7/1/19 27,700 Sales Revenue 561,400 Work in Process Inventory 6/30/20 25,300 Sales Discounts 4,900 Direct Labor 144,150 Plant Manager’s Salary 64,400 Indirect Labor 24,960 Factory Property Taxes 9,910 Accounts Receivable 29,900 Factory Repairs 2,100 Raw Materials Purchases 99,200 Cash 40,700 Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning