FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1->>

O

O

O

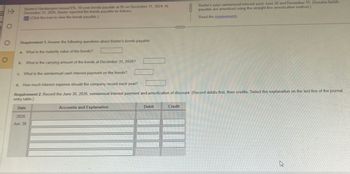

Baxter's Hamburgers issued 6%, 10-year bonds payable at 95 on December 31, 2024. At

December 31, 2026, Baxder reported the bonds payable as follows:

(Click the icon to view the bonds payable.)

Requirement 1. Answer the following questions about Baxter's bonds payable:

a. What is the maturity value of the bonds?

b. What is the carrying amount of the bonds at December 31, 2026?

c. What is the semiannual cash interest payment on the bonds?

d. How much interest expense should the company record each year?

Requirement 2. Record the June 30, 2026, semiannual interest payment and amortization of discount. (Record debits first, then credits. Select the explanation on the last line of the journal

entry table.)

Date

2026

Jun. 30

Accounts and Explanation

Debit

Baxter's pays semiannual interest each June 30 and December 31. (Assume bonds

payable are amortized using the straight-line amortization method.)

Read the requirements.

Credit

D

Transcribed Image Text:ent 1. Answer the following questions

is the maturity value of the bonds?

s the carrying amount of the bonds a

the semiannual cash interest payme

ch interest expense should the com

2. Record the June 30, 2026, sem

Accounts and Expl

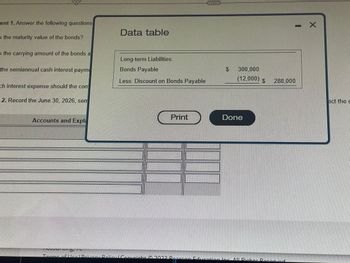

Data table

Long-term Liabilities:

Bonds Payable

Less: Discount on Bonds Payable

Print

$ 300,000

(12,000) $

Done

11

288,000

X

ect the e

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hawar Company issued $400,000 of bonds on January 1, 2020. Required: Prepare the journal entry to record the redemption of the bonds before maturity at 97. Assume the balance in Premium on Bonds Payable is $4,000. For the toolbar presS ALT+F10 (PC) or ALT+EN+F10 (Mac)arrow_forwardOn June 30, 2021, the market interest rate is 5%. Champs Corporation issues $600,000 of 10%, 30-year bonds payable. The bonds pay interest on June 30 and December 31. The company amortizes bond premium using the effective-interest method. Read the requirements. Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is Requirements 1. 2. 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare a bond amortization table for the first four semiannual interest periods. Record the issuance of bonds payable on June 30, 2021; the payment of interest on December 31, 2021; and the payment of interest on June 30, 2022. Print Done Xarrow_forwardOn August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forward

- Cullumber Company issued $650,000 of 5-year, 9% bonds at 96 on January 1, 2022. The bonds pay interest annually. (a1) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation eTextbook and Media List of Accounts Debit Creditarrow_forwardHow to calculate the issue price of the bonds with normal calculator?arrow_forwardOn January 1, 2025, Martinez Company issued $1,800,000 face value, 7%, 10-year bonds at $1,932,482. This price resulted in a 6% effective-interest rate on the bonds. Martinez uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest on each January 1. (a) Prepare the journal entries to record the following transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 125.) 1. 2. 3. 4. No. 1. 2. 3. 4. The issuance of the bonds on January 1, 2025. Accrual of interest and amortization of the premium on December 31, 2025. The payment of interest on January 1, 2026. Accrual of interest and amortization of the premium on December 31, 2026. Date Jan. 1, 2025 Dec. 31, 2025 Jan. 1, 2026 Dec. 31, 2026 Account Titles and…arrow_forward

- Blossom Company issued $510,000 of 5-year, 9% bonds at 96 on January 1, 2022. The bonds pay interest annually. (a1) Your answer is correct. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Cash Discount on Bonds Payable Bonds Payable Your answer is incorrect. Compute the total cost of borrowing for these bonds. Total cost of borrowing eTextbook and Media List of Accounts - Your answer is partially correct. Account Titles and Explanation Interest Expense (DZ). Premium on Bonds Payable $ Interest Payable Prepare the journal entry to record the issuance of the bonds, assuming the bonds were issued at 104. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Total cost of borrowing Debit eTextbook and Media $ 489600 Debit 20400 Compute the total cost of borrowing for these bonds, assuming the bonds were…arrow_forwardVirginia Vista Company has 4%, 10-year bonds payable that mature on June 30, 2028. The bonds are issued on June 30, 2018, and Virginia Vista pays interest each June 30 and December 31. Read the requirements. Requirement 1. Will the bonds be issued at face value, at a premium, or at a discount if the market interest rate on the date of issuance is 2%? If the market interest rate is 6%? If the market interest rate is 2%, the bonds will be issued at If the market interest rate is 6%, the bonds will be issued at Requirement 2. Virginia Vista issued $400,000 of the bonds at 89. Round all calculations to the nearest dollar. a. Record issuance of the bonds on June 30, 2018. (Record debits first, then credits. Select explanations on the last line of the journal entry. Round your answers to the nearest whole dollar.) Date Accounts and Explanation Debit Credit 2018 (a) Jun. 30 b. Record the payment of interest and amortization of the discount on December 31, 2018. Use the straight-line…arrow_forwardPharoah Electric sold $5,400,000, 10%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022, and paid interest annually on January 1. The bonds were sold at 98. (a) Prepare the journal entry to record the issuance of the bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 1, 2022 eTextbook and Media List of Accounts Debit Creditarrow_forward

- how to calculate this? thank youarrow_forwardSunland Company issues $220,000, 20-year, 8% bonds at 103. Prepare the journal entry to record the sale of these bonds on June 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation June 1 Debit Creditarrow_forwardThe balance sheet for Ivanhoe Consulting reports the following information on July 1, 2022. Long-term liabilities Bonds payable $4,500,000 Less: Discount on bonds payable 315,000 $4,185,000 Ivanhoe decides to redeem these bonds at 101 after paying annual interest.Prepare the journal entry to record the redemption on July 1, 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education