Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

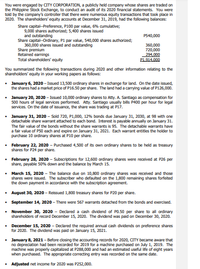

Transcribed Image Text:You were engaged by CITY CORPORATION, a publicdy held company whose shares are traded on

the Philippine Stock Exchange, to conduct an audit of its 2020 financial statements. You were

told by the company's controller that there were numerous equity transactions that took place in

2020. The shareholders' equity accounts at December 31, 2019, had the following balances:

Share capital--Preference, P100 par value, 6% cumulative;

9,000 shares authorized; 5,400 shares issued

and outstanding

Share capital-Ordinary, P1 par value, 540,000 shares authorized;

360,000 shares issued and outstanding

Share premium

Retained earnings

Total shareholders' equity

P540,000

360,000

720,000

294,000

P1.914.000

You summarized the following transactions during 2020 and other information relating to the

shareholders' equity in your working papers as follows:

January 6, 2020- Issued 13,500 ordinary shares in exchange for land. On the date issued,

the shares had a market price of P16.50 per share. The land had a carrying value of P126,000.

• January 20, 2020 - Issued 10,000 ordinary shares to Atty. A. Santiago as compensation for

500 hours of legal services performed. Atty. Santiago usually bills P400 per hour for legal

services. On the date of issuance, the share was trading at P17.

• January 31, 2020 - Sold 720, P1,000, 12% bonds due January 31, 2030, at 98 with one

detachable share warrant attached to each bond. Interest is payable annually on January 31.

The fair value of the bonds without the share warrants is 95. The detachable warrants have

a fair value of P50 each and expire on January 31, 2021. Each warrant entitles the holder to

purchase 10 ordinary shares at P10 per share.

• February 22, 2020 - Purchased 4,500 of its own ordinary shares to be held as treasury

shares for P24 per share.

• February 28, 2020 - Subscriptions for 12,600 ordinary shares were received at P26 per

share, payable 50% down and the balance by March 15.

• March 15, 2020 - The balance due on 10,800 ordinary shares was received and those

shares were issued. The subscriber who defaulted on the 1,800 remaining shares forfeited

the down payment in accordance with the subscription agreement.

• August 30, 2020 - Reissued 1,800 treasury shares for P20 per share.

• September 14, 2020 - There were 567 warrants detached from the bonds and exercised.

• November 3o, 2020 - Declared a cash dividend of PO.50 per share to all ordinary

shareholders of record December 15, 2020. The dividend was paid on December 30, 2020.

• December 15, 2020 - Declared the required annual cash dividends on preference shares

for 2020. The dividend was paid on January 15, 2021.

January 8, 2021 - Before closing the accounting records for 2020, CITY became aware that

no depreciation had been recorded for 2019 for a machine purchased on July 1, 2019. The

machine was properly capitalized at P288,000 and had an estimated useful life of eight years

when purchased. The appropriate correcting entry was recorded on the same date.

• Adjusted net income for 2020 was P252,000.

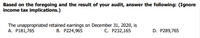

Transcribed Image Text:Based on the foregoing and the result of your audit, answer the following: (Ignore

income tax implications.)

The unappropriated retained earnings on December 31, 2020, is

B. P224,965

A. P181,765

C. P232,165

D. P289,765

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3 00 Which of the following is/are fully exempt from Capital Gains Tax? Select one: O a. A family home which was owned for 15 years by the taxpayer and has been rented out for the last 7 years as the taxpayer relocated to the UK for work purposes. The owner, upon returning to Australia, has lived in the property for 2 months prior to selling the house (to fund the purchase of a new family home). There have been no other claims of main residence by the taxpayer. O b. A motor vehicle purchased by the taxpayer, held for 24 months then disposed of for a value above the cost base. c. O d. O e. A lottery win by a Uber driver. Two of the specific events are fully exempted from CGT. All of the specific events are fully exempted from CGT.arrow_forwardA private offering is a sale of securities in which: X investors may resell their stock within 3 months of acquisition. the security can only be sold within the home state of the offeror. the security is exempt from registration. the issuer provides less disclosures in return to selling less stock to fewer investors.arrow_forwardThe interest rate for the first five years of a $34,000 mortgage loan was 3.95% compounded semiannually. The monthly payments computed for a 10-year amortization were rounded to the next higher $10. (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. Calculate the principal balance at the end of the first term. Principal balance $ b. Upon renewal at 6.45% compounded semiannually, monthly payments were calculated for a five-year amortization and again rounded up to the next $10. What will be the amount of the last payment? Final payment $arrow_forward

- Suppose you own a mutual fund which has 17,000,000 shares outstanding. If its total assets are $38,000,000 and its liabilities are $7,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. $arrow_forwardIf Jensen obtains the job based on a bid of $14,300, what is the probability that he will lose money on the job?Note: Use Appendix B (link to appendix b https://cxp-cdn.cengage.info/protected/prod/assets/b6/2/b62d7c39-0b28-4359-ade6-4e056146f23e.pdf?__gda__=st=1671734492~exp=1672339292~acl=%2fprotected%2fprod%2fassets%2fb6%2f2%2fb62d7c39-0b28-4359-ade6-4e056146f23e.pdf*~hmac=6aa777d3df8bd33ffb3bbf0e849b197e2f0e6fb7a521cce4eb085aa7faf52b03) to identify the areas for the standard normal distribution. If required, round your answer to four decimal places.arrow_forwardI need answer typing clear urjent no chatgpt Which of the following is NOT an alternative to foreclosure? A) Restructuring the mortgage loan B) Transfer of the mortgage to a new owner C) Redemption D) Prepackaged bankruptcyarrow_forward

- Jack, a stockbroker, was an inexperienced in tax. He has sought the advice of an independent designated tax professional to advise him on tax planning and tax shelter that he needs. Simon, who is a designated accountant who specialized in those areas, advised Jack to invest in a number of multiple unit residential building (MURBs), a real estate investment project as tax shelter, by the conventional wisdom, were safe and conservative. When the value of MURBs fell during a decline in the real estate market, Jack lost heavily in his investment. Though the advice was perfectly sound at the time it was given, but unknown to Jack, Simon was also acting as adviser for developers in restructuring the MURBs and did not disclose that fact to Jack. In the context of breach of contract, is Jack liable for the loss of investment? In the context of breach of fiduciary duty, is Jack liable as well? Does ethics issue involve? Please state your reasons. Mr. Hunt, who has just retired, set up an…arrow_forwardWhich of the following steps can help a business avoid embezzlement? Group of answer choices Use independent auditors. Investigate promptly any employee whose lifestyle suddenly changes. Require co-signing of checks. All of the above.arrow_forwardMishap has a gross income of $43,360. She owns a condominium and donates to charity, but there's no way her tax deductible expenses come close to the standard deduction of $12,000. During a cold snap in the winter she donates an extra $500 to the local homeless shelter, a registered charity. How much will this donation save her on her taxes?arrow_forward

- Expenses on a statement of income are listed in no particular order under ASPE. from smallest to largest under IFRS. in alphabetical order under IFRS. by their nature or function under ASPE.arrow_forwardMr. and Mrs. Trump have applied to the Trustworthy Insurance Co. for insurance on Mrs. Trump's diamond tiara. The tiara is valued at $97,000. Trustworthy estimates that the jewelry has a 2.8% chance of being stolen in any one year. Use expected values to determine the annual insurance premium p. (Round your answer to two decimal places.) p ≥ $arrow_forwardA company declared a $ 10.00 per share cash dividend. The company had 100,000 shares authorized, 75,000 shares issued, and 10,000 shares of Treasury Stock. What is the journal entry to record the declaration of this cash dividend?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON