FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

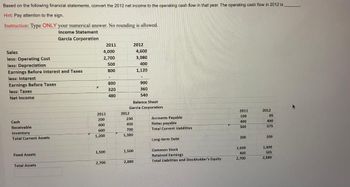

Transcribed Image Text:Based on the following financial statements, convert the 2012 net income to the operating cash flow in that year. The operating cash flow in 2012 is

Hint: Pay attention to the sign.

Instruction: Type ONLY your numerical answer. No rounding is allowed.

Income Statement

Garcia Corporation

Sales

less: Operating Cost

less: Depreciation

Earnings Before Interest and Taxes

less: Interest

Earnings Before Taxes

less: Taxes:

Net Income

Cash

Receivable

Inventory

Total Current Assets

Fixed Assets

Total Assets

4,000

2,700

500

800

2011

200

400

600

1,200

1,500

2011

2,700

-

800

320

480

2012

230

450

700

1,380

Balance Sheet

Garcia Corporation

1,500

2012

2,880

4,600

3,080

400

1,120

900

360

540

Accounts Payable.

Notes payable

Total Current Liabilities.

Long-term Debt

Common Stock

Retained Earnings

Total Liabilities and Stockholder's Equity

2011

100

400

500

200

1,600

400

2,700

2012

85

490

575

200

1,600

505

2,880

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sheridan Company completed its first year of operations on December 31. 2022. It initial income statement showed that Sheridan had sales revenue of $190,900 and operating expenses of $73,200. Accounts receivable and accounts payable at year-end were $63,900 and $31,600 respectively. Assume that accounts payable related to operating expenses. Inore income taxes. Compute net cash provided by operating activities using the direct method. (Show amo wnts that decrease cosh fow with either a sign eg 1s oog orinparenthesises (15,000) Net cash provided by operating activitiesarrow_forwardences Hampton Company reports the following information for its recent calendar year. Income Statement Data Sales Expenses: Cost of goods sold Salaries expense Depreciation expense Net income $ 160,000 Accounts receivable increase Inventory decrease Salaries payable increase 100,000 24,000 12,000 $ 24,000 Selected Year-End Balance Sheet Data Required: Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities-indirect method Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 10,000 16,000 1,000arrow_forwardThe balance sheets of Xenon Company reports total assets of $888,000 and $949,000 at the beginning and end of the year, respectively. Sales revenues are $1.8 million, net income is $194,000, and net cash flows from operating activities are $162,000. Required: Calculate the cash return on assets, cash flow to sales, and asset turnover. (Do not round intermediate calculations. Round your final answers to 1 decimal place.) Cash return on assets Cash flow to sales Asset turnover % % timesarrow_forward

- savitaarrow_forwardFinancial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Assets Cash Accounts receivable Inventory: Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped). Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 122,000 208,000 $3,885,000 3,341,100 543,900 330,000 $ 213,900 Beginning Balance Ending Balance $ 134,000 $ 137,000 472,000 337,000 571,000 480,000 788,000 781,000 402,000 432,000 248,000 253,000 $2,480,000 $2,555,000 $ 379,000 $ 336,000 987,000 987,000 1,114,000 1,232,000 $2,480,000 $2,555,000 The company paid dividends of $95,900 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an Investment in the stock of another company. The company's minimum required rate of…arrow_forwardThe following Information is available from the accounting records of Manahan Co. for the year ended December 31, 2019: Net cash provided by financing activities Dividends paid Loss from discontinued operations, net of tax savings of $39,700 Income tax expense Other selling expenses Net sales Advertising expense Accounts receivable Cost of goods sold General and administrative expenses Net sales Cost of goods sold Gross profit Expenses: Required: a. Calculate the operating Income for Manahan Co. for the year ended December 31, 2019. Advertising expense General and administrative expenses Operating income MANAHAN CO. Operating Income Statement For the year ended December 31, 2019 b. Calculate the company's net Income for 2019. Net income $ $119,000 18, 200 119,100 $ 27,288 11,500 646,600 47,000 59,300 368,562 141,800 0 0 0arrow_forward

- Alanta Corporation reported the following information for Year 7 and Year 6. December 31 Year 7 Year 6 Operating assets $147,691 $137,890 Operating liabilities 108,707 103,352 Net cash flow from operations 42,038 35,586 Net operating profit after tax (NOPAT) 30,034 28,568 Discount factor 6% 6% What are the company’s free cash flows to the firm (FCFF) for Year 7? Select one: a. $37,592 b. $34,480 c. None of these are correct d. $23,582 e. $25,588arrow_forwardThe table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ending in either 2021 or 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes Accounts payable Accounts receivable 2021 $ 4.500 1,900 600 290 540 130 420 280 440 Price 5,300 1.800 856 440 850 per share 2022 $ 4.600 2,000 620 350 590 Net fixed assets Long-tern debt Notes payable Dividends paid Cash and marketable securities *Taxes are paid in their entirety in the year that the tax obligation is incurred. 130 440 320 510 6. 190 *Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2022 is $6,500 and that the value of its long-term debt is only…arrow_forwardUsing the information below, complete the operating cash flow section of the Statement of Cash Flows for Peter Ltd using direct method. Your presentation must be consistent with the requirements of AASB107. Ignore tax. Reporting date is 30 June. The balances of selected accounts of Peter Ltd at 30 June 2021 and 30 June 2022 were ($000): 2021 2022 Cash 3850 1200 Inventory 3750 4250 Accounts receivable 2800 3500 Allowance for doubtful debts 320 260 Land 5000 5000 Plant 2750 2800 Accumulated depreciation 490 450 Accounts payable 3200 3500 Rent payable 100 130 Salaries payable 120 190 Share capital 1000 1000 Sales (on credit) 7750 6550 Cost of goods sold 1250 1100 Doubtful debts expense 280 300 Rent expense 540 450 Salaries expense 800 750 Depreciation expense 260 180 Required: Peter Ltd’s operating cash flow section extracted from the Statement of Cash Flows for year ended 30 June 2022 (Direct Method)arrow_forward

- Crane Company completed its first year of operations on December 31, 2022. Its initial income statement showed that Crane had sales revenue of $197,500 and operating expenses of $71,300. Accounts receivable and accounts payable at year-end were $62,400 and $18,300, respectively. Assume that accounts payable related to operating expenses. Ignore income taxes. Compute net cash provided by operating activities using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash provided by operating activities GA $ 84,162arrow_forwardCreate a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Income Statement: Current Year Revenue 4,742.00 Cost of Goods Sold 2,323.58 Gross Margin 2,418.42 SG&A 524.00 EBITDA 1,894.42 Depreciation Expense 504.00 EBIT 1,390.42 Interest Expense 164.20 EBT 1,226 Taxes 429.18 Net Income 797.04 Dividends 410 Addition to Retained Earnings 387.04 Balance Sheet: Assets Prior Year Current Year Cash 800 ???? Accounts Receivables 400 452.00 Inventory 300 358.00 Total Current Assets 1,500 ???? Net Fixed Assets 5,000 5,211.00 Total Asset 6,500 ???? Liabilities and Equity Prior Year Current Year Accounts Payable 300 320.00 Notes Payable 1,000 919.00 Total Current Liabilities 1,300 1,239.00 Long-Term Debt 2,000 2,365.00 Total Liabilities 3,300 ???? Common Stock and Paid-in Capital 2,200 2,200…arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education