FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

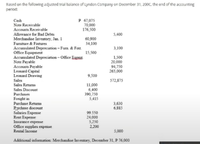

Transcribed Image Text:Based on the following adjusted trial balance of Lyndon Company on December 31, 200C, the end of the accounting

period:

Cash

Note Receivable

P 67,075

70,000

176,500

Accounts Receivable

Allowance for Bad Debts

Merchandise Inventory, Jan. 1

Furniture & Fixtures

5,400

60,900

34,100

Accumulated Depreciation - Furn. & Fixt

Office Equipment

Accumulated Depreciation - Office Eapmt

Note Payable

Accounts Payable

Leonard Capital

Leonard Drawing

Sales

Sales Returns

3,100

15,500

1,500

20,000

94,750

265,000

9,500

572,875

11,000

6,400

390,750

5,415

Sales Discount

Purchases

Freight in

Purchase Returns

Pychase discount

Salaries Expense

Rent Expense

Insurance expense

Office supplies expense

Rental Income

3,630

6,885

99.530

24,000

5,250

2,200

5,000

Additional information: Merchandise Inventory, December 31, P 76,000

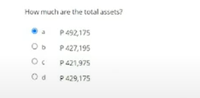

Transcribed Image Text:How much are the total assets?

P 492,175

P427,195

P 421,975

P 429,175

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardEntries for Bad Debt Expense under the Direct Write-Off and Allowance Methods The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31: Apr. 13. Wrote off account of Dean Sheppard, $6,720. May 15. Received $3,360 as partial payment on the $8,940 account of Dan Pyle. Wrote off the remaining balance as uncollectible. July 27. Received $6,720 from Dean Sheppard, whose account had been written off on April 13. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Paul Chapman $4,500 Duane DeRosa 3,360 Teresa Galloway 2,020 Ernie Klatt 2,820 Marty Richey 1,010 31. If necessary, record the year-end adjusting entry for the uncollectible accounts. If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.…arrow_forwardThe unadjusted trial balance of Fortune Company included the following accounts: Debit $ Sales (80% on credit) for the year ended 31 Dec 2023 Credit $ 900,500 Accounts Receivable 31 Dec 2023 209,070 Allowance for Impairment 1 Jan 2023 3,500 The aging of accounts receivable produced the following five groupings. Days Past Due Amount Estimated Uncollectible % of Not yet due 85,000 1% 1-30 days past due 56,000 3% 31-60 days past due 33,500 5% 61-90 days past due 18,570 10% Over 90 days past due 16,000 15% Required: Prepare the adjusting entries to record the impairment loss of receivable for the year 2023. If Fortune Company: (a) (b) uses the Statement of Financial Position Approach to estimate the uncollectible accounts. Show your workings. uses the Income Statement Approach to estimate the uncollectible accounts, and it is expected that 1% of the net credit sales for the year will be uncollectible.arrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $630,000; Allowance for Doubtful Accounts has a debit balance of $5,500; and sales for the year total $2,840,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $25,400. a. Determine the amount of the adjusting entry for uncollectible accounts. 22,900 X b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. 601,200 X Feedback 630,000 ✓ 28,400 X 22,900 X Check My Work The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding the less likely that it will be collected. The amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts.arrow_forwardThe unadjusted trial balance of ABC Company reports the following balances at the end of the year: Dr Cr Accounts receivable $50,000Allowance for doubtful accounts $ 2,000 Sales (all on credit) 100,000Sales returns and allowances 25,000Sales discounts 5,000Instructions:Prepare the journal entry to record bad debt expense assuming that bad receivables are estimated to be 5% of ending accounts receivable.arrow_forwardSelected data for the Erdin Corporation for the year ended Decmeber 31, 20x5 is provided below: Credit sales Accounts receivable written off Recoveries of previously written of accounts receivable Allowance for doubtful accounts balance, January 1, 20x5 Accounts receivable, December 31, 20x5 Erdin estimates that 0.8% of sales will be uncollectible. Required - $4,500,000 36,500 1,800 33,000 cr. 625,000 Write the journal entries to record the accounts receivable written off, the recoveries and the bad debt expense. Calculate the ending balance in the allowance for doubtful account at December 31, 20x5. Note that the accounts receivable and recoveries have been accounted for in the ending Accounts Receivable balance.arrow_forward

- nalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $565,000, Allowance for Doubtful Accounts has a credit balance of $5,000, and sales for the year total $2,540,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $26,000. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forwardBramble Company closes its books on its July 31 year-end. The company does not make entries to accrue for year-end. On June 30, the Notes Receivable account balance is $24,400. Notes Receivable include the following. Date April 21 May 25 June 30 July 5 14 20 Maker 24 Coote Inc. Brady Co. BMG Corp. Face Value $6,400 7,200 During July, the following transactions were completed. 10,800 Term 90 days 60 days 6 months Maturity Date July 20 July 24 December 31 Interest Rate Made sales of $4,300 on Bramble credit cards. Made sales of $600 on Visa credit cards. The credit card service charge is 2%. Received payment in full from Coote Inc. on the amount due. Received payment in full from Brady Co. on the amount due. 7% 9% 5%arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $440,000, Allowance for Doubtful Accounts has a debit balance of $4,000, and sales for the year total $1,980,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $18,400. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5 Answer with all workarrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $660,000, Allowance for Doubtful Accounts has a credit balance of $6,000, and sales for the year total $2,.970,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $25.200. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardEntries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $21,550 Lee Drake 33,925 Jenny Green 27,565 Mike Lamb 19,460 Total $102,500 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Numberof Days Past Due) Receivables Balanceon December 31 Estimated Percent ofUncollectible Accounts 0-30 days $715,000 1% 31-60 days 310,000 2 61-90 days 102,000 15 91-120 days 76,000 30 More than 120 days 97,000 60 Total receivables $1,300,000 a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. b. Journalize the write-offs and the year-end…arrow_forwardAt December 31 of the current year, a company reported the following: Total sales for the current year: $960,000 includes $610,000 in cash sales Accounts receivable balance at Dec. 31, end of current year: $64,000 Allowance for Doubtful Accounts balance at January 1, beginning of current year: $4,100 credit Bad debts written off during the current year: $6,200. Prepare the necessary adjusting journal entry to record bad debts expense assuming this company's bad debts are estimated to equal 8% of credit sales:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education