Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

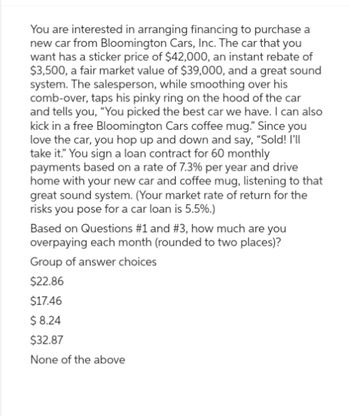

Transcribed Image Text:You are interested in arranging financing to purchase a

new car from Bloomington Cars, Inc. The car that you

want has a sticker price of $42,000, an instant rebate of

$3,500, a fair market value of $39,000, and a great sound

system. The salesperson, while smoothing over his

comb-over, taps his pinky ring on the hood of the car

and tells you, "You picked the best car we have. I can also

kick in a free Bloomington Cars coffee mug." Since you

love the car, you hop up and down and say, "Sold! I'll

take it." You sign a loan contract for 60 monthly

payments based on a rate of 7.3% per year and drive

home with your new car and coffee mug, listening to that

great sound system. (Your market rate of return for the

risks you pose for a car loan is 5.5%.)

Based on Questions #1 and #3 , how much are you

overpaying each month (rounded to two places)?

Group of answer choices

$22.86

$17.46

$ 8.24

$32.87

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give only typing answer with explanation and conclusionarrow_forwardPo.10.arrow_forwardPaul just graduated from college and landed his first "real" job, which pays $26 comma 40026,400 a year. In 66 years, what will he need to earn to maintain the same purchasing power if inflation averages 55 percent? Question content area bottom Part 1 Click on the table icon to view the FVIF table LOADING... . The future value, FV, Paul will need to earn if inflation averages 55 percent is $enter your response here. (Round to the nearest cent.)arrow_forward

- Problem C-1A (Algo) Calculate the future value of a single amount (LO C-2) Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 70 and puts $9,200 into an account earning 9% compounded annually. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) Required: Calculate how much each person will have accumulated by the age of 70. Answer is complete but not entirely correct. Current Person Age Initial Investment Accumulated Investment by Retirement (age 70) Alec 60 $ 9,200 $ 21,804.00 Daniel 50 9,200 51,520.00 William 40 9,200 122,084.00 Stephen 30 9,200 288,972.00arrow_forwardVery ungent Please answer asap You are considering purchasing a new car that will cost you $32,000. The dealer offers you 4.9% APR financing for 60 months (with payments made at the end of the month). Assuming you finance the entire $32,000 and finance through the dealer, your monthly payments will be (round to the nearest dollar): a. $1,171 b. $602 c. $1,086 d. $974arrow_forwardhello, I need helparrow_forward

- For doing a certain job, you are offered 1¢ the first day, 3¢ the second day, 9¢ the third day, and so on. In dollars and cents, how much will you earn in total for the first 15 days? $71,744.53 $42,314.56 $70,158.56 $45,624.49arrow_forwardwhats the Annual payment at the beginning of each year its a practice quiz im struggling witharrow_forwardDo not give answer in image and hand writingarrow_forward

- You want to have $10,500 saved 8 years from now. How much less can you deposit today to reach this goal if you can earn 7 percent rather than 5 percent on your savings? Multiple Choice $1,007.94 $995.72 $1,023.90 $1,036.34arrow_forwardHi, how do i solve this corp fi problem without using excel? Retirement options: Option 1: Make $1364.6 per month if you start your CPP at age 65. Option 2: Delay taking your CPP benefits until after 65, your monthly income will increase by0.7% for each month that you delay, up until age 70. Discount rate is .04 per month Question: What is present value at age 65 of your CPP payments if you begin taking them at 65? what is the present value at age 70 of your CPP payments if you begin taking them at 70?arrow_forward(Please type answer no write by hend)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education