Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

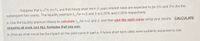

Transcribed Image Text:Suppose that =7% (na1), and that future short term (1 year) interest rates are expected to be 5% and 3% (for the

subsequent two years). The liquidity premium for n2 and 3 is 0.25% and 0.35% respectively.

a. Use the liquidity premium theory to calculate for ne2 and 3, and then plot the yield curve using your results. CALCULATE

showing all work and ALL formulas that you use,

b. Discuss what would be the impact on the yield curve in part a. if future short term rates were suddenly expected to rise.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- DONE IN EXCEL especify how to donthe graph step by step okease 5. (a) Use rate of return analysis to decide which one will you select if your MARR is 14% per year? (b) Graph interest rate vs. present value for both option 1 and 2. (c) Discuss how your selection between option 1 and 2 will change when MARR is changed and at which interest rate the two options are the same economically. The following two alternatives are mutually exclusive. Annual Benefit Salvage Value Alternative Initial Life, Cost years 4. Option 1 Option 2 $42,000 $45,000 $10,000 $11,500 $4,000 $4,200 6.arrow_forwardConsider an investment where the cash flows are: – $946.21 at time t = 0 (negative since this is your initial investment) $377 at time t = 1 in years $204 at time t = 2 in years $499 at time t = 3 in years (a) Use Excel's "Solver" to find the internal rate of return (IRR) of this investment. Take a screen shot showing Solver open with your entries for the function clearly visible. Paste the screen shot into an application (like Paint), and save it as a (.png) file. Upload your screenshot below. (b) What is the value of IRR found by Solver?arrow_forwardSuppose that we make contributions to a fund of $125 today and $750 in twoyears for a return of $1000 in one year. First write the Net Present Value as a function of the discount factor ν. Secondly, use the NPV to calculate the yield rate of this investment (select the larger value for i. Finally, explain whether or not this is a good investment for us. Please show all workarrow_forward

- The present value represents the amount of money you would have to deposit today in order to match what you would get from the income stream at the future date. The formula is Time = M = i Future value represents the total amount of money you would have if you deposit the income stream until a future date. The formula is To start our problem we need to identify the variables. Rate =r= i Income Stream S(t) = i Present Value = years % M 1. 0 S (t) et dt. Future Value = Present Value* erM dollars/yeararrow_forwardGive typing answer with explanation and conclusionarrow_forwardPlease fast help me please with this one, in text fastarrow_forward

- Profitability index. Given the discount rate and the future cash flow of each project listed in the following table, , use the PI to determine which projects the company should accept. ..... What is the Pl of project A? (Round to two decimal places.)arrow_forwardSuppose you have a project that has a 0.4 chance of tripling your investment in a year and a 0.6 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) What is the standard deviation?arrow_forward6-1 YIELD CURVES Assume that yields on U.S. Treasury securities were as follows: Term Rate 6 months 4.69% 1 year 5.49 2 years 5.66 З years 5.71 4 years 5.89 5 years 6.05 10 years 6.12 20 years 6.64 30 years 6.76arrow_forward

- Consider the following cash flows. The interest rate is 10%. What is the duration (hint: you need PV)? Year 0 1 2 3 4 Cash flow 100 200 300 400arrow_forward(Present value of an uneven stream of payments) You are given three investment alternatives to analyze. The cash flows from these three investments are shown in the popup window: Assuming a discount rate of 16 percent, find the present value of each investment. a. What is the present value of investment A at 16 percent annual, discount rate? S (Round to the nearest cènt.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) INVESTMENT B END OF YEAR 1 23456TBLG 7 8 9 10 A $18,000 18,000 18,000 18,000 18,000 $18,000 18,000 18,000 18,000 18,000 18,000 C $18,000 90,000 18,000 -arrow_forwardState the return rate (in %) for your optimal portfolio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education