FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

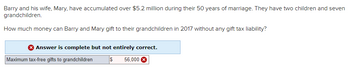

Transcribed Image Text:Barry and his wife, Mary, have accumulated over $5.2 million during their 50 years of marriage. They have two children and seven

grandchildren.

How much money can Barry and Mary gift to their grandchildren in 2017 without any gift tax liability?

Answer is complete but not entirely correct.

$ 56,000 X

Maximum tax-free gifts to grandchildren

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alan inherited $100,000 with the stipulation that he"invest it to financially benefit his family." Alan and his wife Alice decided they would invest the inheritance to help them accomplish two financial goals: purchasing a Park City vacation home and saving for their son Cooper's education. INVESTMENT: Initial Investment; Investment horizon VACATION HOME: $50,000; 5 years COOPER'S EDUCATION: $50,000; 18 years. Alan and Alice have a marginal income tax rate of 32 percent (capital gains rate of 15 percent) and have decided to investigate the following investment opportunities. Growth Stock: 5 years, Future Value = $$65,000: What is the Annual After-Tax Rate of Return: _____________% : 18 years, Future Value = $140,000: What is the Annual After-Tax Rate of Return: _____________%arrow_forwardOwen is considering giving a large charitable contribution to an organization in the current year. Owen's adjusted gross income for the year will be $150,000. He wants to contribute $80,000 in either cash or property. If he contributes cash to a public charity, he can deduct $ 48000 this year. If he contributes capital gain property that is worth $80,000 to a public charity, he can deduct $24000 Or, if he contributes the publicly traded stock to a private nonoperating foundation, he can deduct $ 16000 year. Correct Answer 90000 45000 30000 thisarrow_forwardLast year Robert transferred a life insurance policy worth $470,000 to an irrevocable trust with directions to distribute the corpus of the trust to a grandson, Danny, upon graduation from college, or to Danny's estate upon death. Robert paid $41,000 of gift tax on the transfer of the policy. Early this year, Robert died, and the insurance company paid $4.2 million to the trust. What amount, if any, is included in Robert's gross estate? Note: Enter your answers in dollars, not millions of dollars. Amount to be included in Robert's gross estatearrow_forward

- Norma, a widow, has made lifetime gifts to her two grandchildren in an effort to reduce the size of her gross estate. In 2012, Norma made a $100,000 taxable gift. She made another $150,000 taxable gift in 2014. She used her gift tax applicable credit amount to offset any gift tax liability for all gifts. What amount of gift tax applicable credit remains available to Norma in 2022? A)$4,641,000 B)$70,800 C)$4,656,000 D)$4,699,000arrow_forwardJoyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a. $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the homearrow_forwardThis year Carla received corporate stock worth $35,000 as a gift from her grandfather. Her grandfather originally had purchased the stock in 2012 at a cost of $20,000. No gift taxes were paid on the transfer. Three months after receiving the stock. Carla sold it for $32,000. What are the amount and character of gain or loss recognized by Carla on this transaction?arrow_forward

- Your 80-year-old uncle has an estate valued at over $10 million and asked for your advice regarding how to make sure that each of his heirs receive certain assets and that estate taxes are minimized. What steps would you recommend? Be sure to address such issues as wills, trusts, gifting, and probate.arrow_forwardIn 2019, Joshua gave $12,500 worth of Microsoft stock to his son. In 2020, the Microsoft shares were worth $22,500. What was the gift tax in 2019? The gift tax exemption in 2019 was the same as in 2020. Gift taxarrow_forwardShemar and Jordan are cousins who were both born on the same day, and both turned 25 today. Their grandfather began putting $2,900 per year into a trust fund for Shemar on his 20th birthday, and he just made a 6th payment into the fund. The grandfather (or his estate's trustee) will make 40 more $2,900 payments until a 46th and final payment is made on Shemar's 65th birthday. The grandfather set things up this way because he wants Shemar to work, not be a "trust fund baby," but he also wants to ensure that Shemar is provided for in his old age. Until now, the grandfather has been disappointed with Jordan, hence has not given him anything. However, they recently reconciled, and the grandfather decided to make an equivalent provision for Jordan. He will make the first payment to a trust for Jordan today, and he has instructed his trustee to make 40 additional equal annual payments until Jordan turns 65, when the 41st and final payment will be made. If both trusts earn an annual return of…arrow_forward

- In 2020, Emily and Mark are married. Emily earns $150,000 from her job as a finance executive. Mark earns $25,000 per year as a part-time florist. They have two children, Peter and Sam, ages 2 and 5. Emily’s great aunt Joan gave her a check for $17,000 during the year because she is her favorite niece. Also, Emily’s job reimbursed him $5,000 for childcare for his two sons.Mark owns a 20% interest in Flowers to Go (a partnership). The partnership earned $75,000 in operating income during the year, it also paid a cash distribution of $15,000 to Mark during the year.Emily and Mark have a joint checking account that earned interest of $165 for the year. Emily also own City of Scranton bonds which paid interest of $1,000.They also have the following expenses during the year:· Medical Expenses: $22,000· State & Local Taxes: $11,500· Federal Income Tax Payments: $10,000· Cash Charitable Contributions: $3,000The standard deduction amounts for 2021 are listed below:· Single: $12,550· Head…arrow_forwardMunabhaiarrow_forwardjohn's employer gave him gifts during 2020 and he's wondering what the tax impactwill be to him. He received $300 in gift cards and a watch worth $400 for hisarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education