FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

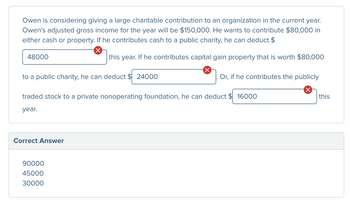

Transcribed Image Text:Owen is considering giving a large charitable contribution to an organization in the current year.

Owen's adjusted gross income for the year will be $150,000. He wants to contribute $80,000 in

either cash or property. If he contributes cash to a public charity, he can deduct $

48000

this year. If he contributes capital gain property that is worth $80,000

to a public charity, he can deduct $24000

Or, if he contributes the publicly

traded stock to a private nonoperating foundation, he can deduct $ 16000

year.

Correct Answer

90000

45000

30000

this

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ms. Prince wants to create a scholarship in honor of her parents at the law school from which she received her degree. She could endow the scholarship with $500,000 cash or with $500,000 worth of marketable securities with a cost basis of $318,000. Assume the taxable year is 2023. Required: If her AGI is $3.8 million, compute the after-tax cost of the two endowment options. Use Individual Tax Rate Schedules and Tax rates for capital gains and qualified dividends. Note: Enter your answers in dollars not in millions of dollars. After-tax cost Cash Securitiesarrow_forwardRight before his death from a terminal illness, Shing makes a gift of $705,000 cash to his churcha gift that he had planned to bequeath to the church anyway. Presuming Shing had a marginal Federal income tax rate of 35% and his Federal estate tax bracket is 40%, what is the tax effect of his lifetime transfer. Ignore the 20 % / 30 % /50 % / 60% contribution limitations. If an amount is zero, enter "0". f gifted during his lifetime, Shing will save $ in income taxes. If made as a bequest from his estate, the estate will save$ in estate taxes.arrow_forwardMario had AGI of $90,000 and will itemize for 2021. He had significant damage to an antique plane as a result of a hurricane in 2021. The hurricane was a federally declared disaster. • The plane had a value of $240,000 before the hurricane. The value of the plane after the hurricane was estimated to be $125,000. • He estimates that his insurance will cover $75,000 of the repairs. • He wants to amend his 2020 return for the loss. His 2020 AGI was $80,000. • In 2022, he received $68,000 of proceeds from the insurance His 2022 AGI was $65,000. What is his casualty loss deduction for 2020, 2021, and 20227 (530,900) for 2020; s0 for 2021; (5400) for 2022 s0 for 2020; ($31,900) for 2021: (S500) for 2022 s0 for 2020: ($30,900) for 2021: (S500) for 2022 O (531,900) for 2020; $0 for 2021: (5500) for 2022arrow_forward

- Right before his death from a terminal illness, Shing makes a gift of $890,000 cash that he had planned to bequeath to the church anyway. Presuming Shing had a marginal Federal income tax rate of 35% and his Federal estate tax bracket is 40%, what is the tax effect of his lifetime transfer. Ignore the 20%/30%/50%/60% contribution limitations. If an amount is zero, enter "0", If gifted during his lifetime, Shing will save $ in income taxes. If made as a bequest from his estate, the estate will save in estate taxes.arrow_forwardPhilip just won $100,000 in the lottery! With this money he would like to invest it wisely and put as much as he can in a Tax-Free Savings Account (TFSA). Calculate Philip’s maximum amount that he can contribute to his TFSA assuming the following: We are December 17, 2021 Philip is 60 years old and just retired Philip contributed $4,000 to his TFSA in 2019 Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009 - 2012 $5,000/year 2016 - 2018 $5,500/year 2013 - 2014 $5,500/year 2019 - 2020 $6,000/year 2015 $10,000/year 2021 $6,000/year a. $75,500 b. $60,000 c. $71,500 d. $15,500 e. Philip can no longer contribute to his TFSA as he is retired.arrow_forwardMadeline made a stock gift of $40,000 to the American Cancer Society, a qualified public charity. Madeline itemizes her deductions and has an adjusted gross income of $120,000. What is the maximum income tax deduction allowable to Madeline in the current year for her charitable contribution? A) $40,000 B) $72,000 C) $36,000 D) $60,000arrow_forward

- Colby has decided to make charitable contributions of property this year. He donates a painting (adjusted basis $900, fair market value $40,000) that he previously created to a local art museum (a public charity under section 501(c)(3)). The painting will be exhibited in the museum's modern art collection. His adjusted gross income is $90,000. What is his charitable deduction for this year? Select one: a. $0 b. $900 c. $45,000 d. $40,000arrow_forwardMorrissey donated stock (a capital asset) to a public charity. He purchased the stock three years ago for $100,000. On the date of the gift, the stock had a fair market value of $200,000. What is Morrissey's maximum charitable contribution deduction for the year related to this stock if his AGI is $500,000? Select one: O A $250,000 OB. $150,000 OC. $100,000 OD. $200,000arrow_forwardjohn's employer gave him gifts during 2020 and he's wondering what the tax impactwill be to him. He received $300 in gift cards and a watch worth $400 for hisarrow_forward

- John and Charlotte are considering contributing $1,000 to their church. This contribution will bring their total itemized deductions to $2,000. Assuming the standard deduction is $10.000 per person and they are in the 15% marginal tax bracket, how much will they save in taxes by contributing this $1,000 to their church? Type your answer herearrow_forwardUse Patty's charitable contribution information from the above question to answer the following question: Now Assume that Patty's AGI for 2023 is $125,000. Calculate Patty's itemized deduction for charitable contributions for 2023 based on the above information, considering all relevant AGI limitations.arrow_forwardLast year, Dani maximized her TFSA contribution limit by contributing $30,000 to her TFSA. This year, her contribution limit is $7,000. The $30,000 that Dani contributed last year has grown to $32,000. She contributed nothing this year but withdrew the entire amount of $32,000. Assuming next year's limit is also $7,000 how much can Dani contribute to her TFSA next year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education