FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

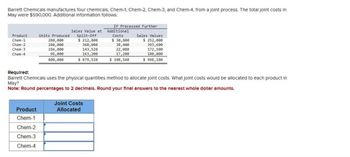

Transcribed Image Text:Barrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in

May were $590,000. Additional Information follows:

Sales Value at

Split-Off

$ 212,800

If Processed Further

Additional

Costs

393,600

172,500

Product

Chem-1

Units Produced

Sales Values

280,000

$ 30,800

$ 252,000

Chem-2

240,000

38,400

Chem-3

184,000

22,080

Chem-4

96,000

800,000

17,280

180,000

$ 879,520

$ 108,560

$ 998,100

360,000

143,520

163,200

Required:

Barrett Chemicals uses the physical quantities method to allocate joint costs. What joint costs would be allocated to each product in

May?

Note: Round percentages to 2 decimals. Round your final answers to the nearest whole dollar amounts.

Joint Costs

Allocated

Product

Chem-1

Chem-2

Chem-3

Chem-4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Deming & Sons manufactures four grades of lubricant, W-10, W-20, W-30, and W-40, from a joint process. Additional information follows. Units Product Produced 54,600 39,000 W-10 W-20 W-30 W-40 Product 31, 200 31, 200 156,000 W-10 W-20 W-30 W-40 Sales Value at Split-Off $324,000 279,000 189,000 144,000 $936,000 Required: Assuming that total joint costs of $327,600 were allocated using the physical quantities method, what joint costs were allocated to each product? (Do not round intermediate calculations.) Joint Costs Allocated If Processed Further S 114,300 $ 91,800 $ 73,800 $ 73,800 Additional Costs $ 35,000 27,900 18,900 11,700 $ 93,500 Sales Values $ 355,000 324,000 234,000 156,000 $1,069,000arrow_forwardBarrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in May were $564,000. Additional information follows: 281,000 If Processed Further Additional Costs $ 34,400 31,100 Sales Values $ 277,000 307,000 Product Chem-1 Units Produced 305,000 Sales Value at Split-Off $ 237,000 Chem-2 193,000 Chem-3 209,000 Chem-4 161,000 166,600 263,400 26,600 28,000 197,000 287,000 868,000 $ 948,000 $ 120,100 $ 1,068,000 Required: Barrett Chemicals uses the net realizable value method to allocate joint costs. What joint costs would be allocated to each product in May? Note: Round percentages to 2 decimals. Round your final answers to the nearest whole dollar amounts. Product NRV at Split- Off Joint Costs Allocated Chem-1 Chem-2 Chem-3 Chem-4arrow_forwardAtkinson, Inc., manufactures products A, B, and C from a common process. Joint costs were $154,680. Additional information is as follows: If Processed Further Product UnitsProduced Sales Value at Split-Off Sales Value Additional Costs A 7,110 $ 46,660 $ 64,435 $ 4,740 B 8,150 70,905 91,280 12,225 C 4,075 48,900 61,125 16,300 19,335 $ 166,465 $ 216,840 $ 33,265 Assuming that joint product costs are allocated using the net realizable value method, what were the total costs assigned to Product B? Multiple Choice $78,110. $77,906. $77,110. $79,396.arrow_forward

- company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $75,000 per quarter. The company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product Selling Price Quarterly Output 10,000 pounds A 4 per pound B 7 per pound 22,000 pounds 5,000 gallons 12 per gallon Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Costs Product Selling Price A $ $ 53,000 38,000 B $ $ с $ 18,000 $ Which products should be processed further? 7 per pound 11 per pound 18 per gallonarrow_forwardTango Company produces joint products M, N, and T from a joint process. This information concerns a batch produced in April at a joint cost of $190,000: Product Units Produced and Sold After Split-Off Total Separable Costs Total Final Sales Value M 17,000 $ 18,800 $ 230,000 N 11,000 16,400 210,000 T 12,000 3,800 39,000 Required: How much of the joint cost should be allocated to each joint product using the net realizable value method?arrow_forwardBarrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in May were $594,000. Additional information follows: Product Units Produced Sales Value at Split-Off If Processed Further Additional Costs Sales Values Chem-1 264,000 $ 200,640 $ 29,040 $ 237,600 Chem-2 176,000 264,000 28,160 288,640 Chem-3 200,000 156,000 24,000 187,500 Chem-4 160,000 272,000 28,800 300,000 800,000 $ 892,640 $ 110,000 $ 1,013,740 Required: Barrett Chemicals uses the physical quantities method to allocate joint costs. What joint costs would be allocated to each product in May?arrow_forward

- Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $90,000 per quarter. The company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product Selling Price Quarterly Output A $3 per pound 17,000 pounds B $4 per pound 22,000 pounds C $12 per gallon 5,000 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Product Additional Processing Costs Selling Price A S 36,000 $5 per pounds B S 35,000 $7 per pounds C S 11,000 $ 16 per gallons Required: Compute the incremental profit (loss) for each product. Product Product Product A B C Selling price after further processing Selling…arrow_forwardBarrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in May were $564,000. Additional information follows: Product Chem-1 Chem-2 Chem-3 Chem-4 Units Produced 288,000 176,000 192,000 144,000 800,000 Chem-1 Chem-2 Chem-3 If Processed Further Required: Which, if any, of the four products would you recommend Barrett Chemicals sell at split-off (and not process further)? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Chem-4 Sales Value at Additional Split-Off Costs $ 220,000 264,000 149,600 246,400 $ 880,000 $ 32,700 29,400 24,900 26,300 $ 113,300 Sales Values $ 260,000 290,000 180,000 270,000 $ 1,000,000 harrow_forwardChem Manufacturing Company processes direct materials up to the splitoff point where two products (X and Y) are obtained and sold. The following information was collected for the month of November: Production: X 3000 gallons, Y 2000 gallons . Sales: X 2600 at $15 per gallon ,Y 1700 at $10 per gallon. The joint cost was $20000. No beginning inventories of X and Y. --- Using the physical-volume method, joint cost allocated for X : Select one: O a. $20000 O b. $8000 c. $12000 O d. $10000arrow_forward

- Forest Products, Incorporated manufactures three products (FP-10, FP-20, and FP-40) from a single, joint input. None of the products can be sold without further processing. In November, joint product costs were $241,300. Additional information follows: Product FP-10 FP-20 FP-40 Units Produced 105,000 157,500 87,500 Product FP-10 FP-20 FP-40 Sales Values $ 177,750 311,250 85,300 Required: Forest Products uses the physical quantities (units produced) method to allocate joint costs. What joint costs would be allocated to each of the three products in November? Joint Costs Allocated Processing Costs (After Split-Off) $ 29,300 109,300 25,300arrow_forwardPT Y manufactures three products using the same production process. The costs incurred up to the split-off point are $200,000. The company decided to further process the three products before they were sold. The number of units produced (based on regular sales), the selling prices per unit of the three products at the split-off point and after further processing, and the additional processing costs are as follows. Product D E F Number of Units Produced 4,000 6,000 2,000 Selling Price at Split-Off Additional Processing Costs Selling Price after Processing $25.00 $26.60 $34.40 $14,000 $20,000 $9,000 $30.00 $31.20 $37.60 Instructions 1) Allocate the $200,000 joint cost to product D, E, and F using these methods: a. Physical-measure method (2%) b. NRV method (5%) 2) Which information is relevant to the decision on whether or not to process the products further? (2%). Explain why this information is relevant (2%). 3) Which product(s) should be processed further and which should be sold at…arrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $385,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product Selling Price Quarterly Output A $ 27.00 per pound 14,400 pounds B $ 21.00 per pound 22,400 pounds C $ 33.00 per gallon 5,600 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Product Additional Processing Costs Selling Price A $ 89,220 $ 32.80 per pound B $ 129,170 $ 27.80 per pound C $ 60,160 $ 41.80 per gallon Required: 1. What is the financial advantage…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education