FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:### Educational Website Content

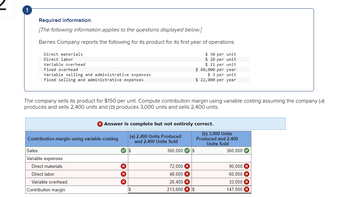

#### Contribution Margin Analysis for Barnes Company

**Required Information:**

*The following information applies to the questions displayed below:*

Barnes Company reports the following for its product for its first year of operations:

- **Direct Materials:** $30 per unit

- **Direct Labor:** $20 per unit

- **Variable Overhead:** $11 per unit

- **Fixed Overhead:** $60,000 per year

- **Variable Selling and Administrative Expenses:** $3 per unit

- **Fixed Selling and Administrative Expenses:** $22,000 per year

The company sells its product for $150 per unit. Compute the contribution margin using variable costing assuming the company (a) produces and sells 2,400 units, and (b) produces 3,000 units and sells 2,400 units.

---

### Computation of Contribution Margin Using Variable Costing

#### Scenario A: 2,400 Units Produced and 2,400 Units Sold

- **Sales:** $360,000

- **Variable Expenses:**

- **Direct Materials:** $72,000

- **Direct Labor:** $48,000

- **Variable Overhead:** $26,400

- **Variable Selling and Administrative Expenses:** Not listed in the table

- **Total Variable Expenses:** (These should be summed but figures for Variable Selling and Administrative Expenses are missing)

- **Contribution Margin:** $213,600

#### Scenario B: 3,000 Units Produced and 2,400 Units Sold

- **Sales:** $360,000

- **Variable Expenses:**

- **Direct Materials:** $90,000

- **Direct Labor:** $60,000

- **Variable Overhead:** $33,000

- **Variable Selling and Administrative Expenses:** Not listed in the table

- **Total Variable Expenses:** (These should be summed but figures for Variable Selling and Administrative Expenses are missing)

- **Contribution Margin:** $147,000

**Note:** The answer is complete but not entirely correct because the given values do not account for all variable expenses such as variable selling and administrative expenses, as indicated by the discrepancy in the contribution margin calculation for both scenarios.

### Analysis of Diagrams

- **Table Headings:** The table contains two primary scenarios for analysis—Scenario (a) and Scenario (b).

- **Sales Row:** Indicates the total revenue generated from

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,150 rackets and sold 4,980. Each racket was sold at a price of $90. Fixed overhead costs are $79,950 per year, and fixed selling and administrative costs are $65,600 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Prepare an income statement under variable costing. Contribution margin Less: Fixed expenses Income X Answer is not complete. Sales Less: Variable expenses Variable selling and administrative expenses Variable cost of goods sold ACES INCORPORATED Income Statement (Variable Costing) Fixed overhead Fixed selling and administrative expenses $ 448,200 2852 $12arrow_forwardFarrow Company reports the following annual results. Contribution Margin Income Statement Sales (420, 00 units) Variable costs Direct materials Direct labor Overhead Per Unit $ 15.00 Annual Total $ 6, 300, 000 2.00 4.00 2.50 840, 000 1,680, 000 1,050, 000 2,730, 000 Contribution margin Fixed costs Fixed overhead 6.50 2.00 840, 000 630, 000 Fixed general and administrative 1.50 Incone $ 3.00 $ 1, 260, 000 The company receives a special offer for 42,000 units at $12 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremental fixed overhead of $168,000 and incremental fixed general and administrative costs of $181,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? ces Complete this question by entering your answers in the tabs below. Required A Required B Compute the income or…arrow_forward

- Sims Company began operations on January 1. Its cost and sales information for this year follow. Direct materials $ 30 per unit Direct labor $ 50 per unit Variable overhead $ 40 per unit Fixed overhead $ 6,600,000 per year Variable selling and administrative expenses $ 11 per unit Fixed selling and administrative expenses $ 4,250,000 per year Units produced 110,000 units Units sold 80,000 units Sales price $ 360 per unit 1. Prepare an income statement for the year using variable costing.2. Prepare an income statement for the year using absorption costing.arrow_forwardWalsh Company manufactures and sells one product. The following information pertains to each of the company's first two years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative. Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ 30 $ 14 $ 3 $ 2 $ 320,000 $ 80,000 During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the company's product is $57 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 3. Reconcile the difference…arrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative $ 11 $ 4 $ 1 $ 1 $ 308,000 $ 218,000 During the year, the company produced 28,000 units and sold 24,000 units. The selling price of the company's product is $41 per unit. Required: 1. Assume the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year.arrow_forward

- Assume the following information for a company that produced and sold 10,000 units during its first year of operations: Per Unit Per Year $ 200 $ 75 $ 50 $ 10 Selling price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $ 300,000 Using absorption costing, what is the company's gross margin per unit?arrow_forwardYancey, Inc reports the following information Units produced Units sold Sales poce Direct materials Direct labor 520 units 520 units $150 per unit $40 per unit $30 per unit Variable manufacturing overhead Fixed manufacturing overhead $20 per unit $24,000 per year $15 per unit Variable selling and administrative costs Fixed selling and administrative costs $25,000 per year What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent) OA. $76 15 OB 5136 15 OC. $116 15 OD $80.00arrow_forwardAces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 5,800 rackets and sold 4,700. Each racket was sold at a price of $88. Fixed overhead costs are $74,240 for the year, and fixed selling and administrative costs are $65,000 for the year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses Required: Prepare an income statement under variable costing. $ 11.94 7.94 4.92 1.80arrow_forward

- Swisher, Incorporated reports the following annual cost data for its single product: Normal production level 30,000 units Direct materials $6.40 per unit Direct labor $3.93 per unit Variable overhead $5.80 per unit Fixed overhead $150,000 in total This product is normally sold for $48 per unit. If Swisher increases its production to 50,000 units, while sales remain at the current 30,000 unit level, by how much would the company's income increase or decrease under variable costing? $60,000 decrease. b. $90,000 decrease. c.There is no change in gross margin. d. $90,000 increase. e. $60,000 increase.arrow_forwardYancey, Inc. reports the following information: Units produced Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 580 units 580 units $130 per unit $10 per unit $25 per unit - $30 per unit $22,000 per year Variable selling and administrative costs Fixed selling and administrative costs $20 per unit $15,000 per year What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent.) OA. $95.00 OB. $72.93 OC. $102.93 OD. $62.93arrow_forwardIsaac Company has estimated the following costs for this year for 240,000 units: Manufacturing Selling & Administrative Variable $150,000 $65,000 Fixed 350,000 135,000 Total $200,000 $500,000 Calculate the manufacturing cost markup needed to obtain a target profit of $100,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education