FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

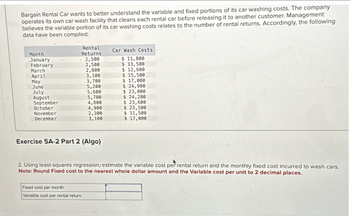

Transcribed Image Text:Bargain Rental Car wants to better understand the variable and fixed portions of its car washing costs. The company

operates its own car wash facility that cleans each rental car before releasing it to another customer. Management

believes the variable portion of its car washing costs relates to the number of rental returns. Accordingly, the following

data have been compiled:

Month

January

February

March

April

May

June

July

August

September

October

November

December

Rental

Returns

2,500

2,500

2,800

3,100

3,700

5,200

5,600

5,700

4,800

4,900

Fixed cost per month

Variable cost per rental return

2,300

3,100

Exercise 5A-2 Part 2 (Algo)

Car Wash Costs

$ 11,800

$ 13,500

$ 12,600

$ 15,500

$ 17,000

$ 24,900

$ 23,000

$ 24,200

$ 23,600

$ 23,500

$ 11,500

$ 17,000

2. Using least-squares regression; estimate the variable cost per rental return and the monthly fixed cost incurred to wash cars.

Note: Round Fixed cost to the nearest whole dollar amount and the Variable cost per unit to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Annie B's Homemade Ice Cream is an ice cream shop in Asheville, NC. Its owners would like your assistance in classifying some of its costs as direct or indirect depending on the specified cost object. Required: 1. Which of the following costs could be directly traced to specific flavors of ice cream? 2. Which of the following costs could be directly traced to specific mobile sales events, such as selling pre-packaged servings of ice cream at the Cold Mountain Music Festival? 3. Which of the following costs could be directly traced to "mobile sales" as opposed to "in-store sales? Complete this question by entering your answers in the tabs below. Requirement 1 Requirement 2 Requirement 3 Which of the following costs could be directly traced to specific flavors of ice cream? 1. Walk-in freezer depreciation 2 Wages paid to employees scooping ice cream in the store 3. Cost of ingredients used to make ice cream 4. Cost of electricity used to run the batch freezer that makes ice cream 5.…arrow_forwardPlease do not give solution in image format thankuarrow_forwardA junk yard pulls parts off of wrecked vehicles and sells them to a wholesaler. If its total revenue function is TR = 28z and the total cost function is TC 168 +20z. The number of parts that the junk yard must sell to breakeven is S parts.arrow_forward

- Required information In October, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could manage a single product line, Nicole agreed. Nicole's Getaway Spa (NGS) would make monthly purchases from the supplier at a cost that included production costs and a transportation charge. NGS would keep track of its new inventory using a perpetual inventory system. On December 31 of last year, NGS had 10 units at a total cost of $6.90 per unit. Nicole purchased 30 more units at $8.50 in February. In March, Nicole purchased 10 units at $10.50 per unit. In May, 50 units were purchased at $10.30 per unit. In June, NGS sold 50 units at a selling price of $12.50 per unit and 30 units at $10.50 per unit. 2. Compute the Cost of Goods Available for Sale, Cost of Goods Sold, and Cost of Ending Inventory using the first-in, first-out…arrow_forwardhelp mearrow_forwardMarigold, Ltd. manufactures shirts, which it sells to customers for embroidering with various slogans and emblems. The standard cost card for the shirts is as follows. Direct materials Direct labor Variable overhead Fixed overhead Indirect material Indirect labor Equipment repair Equipment power Total Supervisory salaries Insurance Property taxes Depreciation Standard Price $3 per yard $14 per DLH $3.20 per DLH $3 per DLH Utilities Quality inspection Total Sandy Robison, operations manager, was reviewing the results for November when he became upset by the unfavorable variances he was seeing. In an attempt to understand what had happened, Sandy asked CFO Suzy Summers for more information. She provided the following overhead budgets, along with the actual results for November. Annual Budget $449,000 The company purchased 82,000 yards of fabric and used 93,600 yards of fabric during the month. Fabric purchases during the month were made at $2.80 per yard. The direct labor payroll ran…arrow_forward

- Please don't provide answer in image format thank you.arrow_forwardCost Behavior Analysis in a Restaurant: High-Low Cost Estimation Assume a Papa John's restaurant has the following information available regarding costs at representative levels of monthly sales: Cost of food sold Wages and fringe benefits Fees paid delivery help Rent on building Depreciation on equipment Utilities Supplies (soap, floor wax, etc.) Administrative costs Total Monthly sales in units 5,000 8,000 10,000 $15,000 $24,000 $30,000 4,350 4,560 4,700 1,300 2,080 2,600 1.300 1,300 1,300 400 400 400 750 840 900 150 180 200 1.500 1.500 1,500 $24.750 $34,860 $41,600 (a) Identify each cost as being variable, fixed, or mixed. Cost of food sold Wages and fringe benefits Fees paid delivery help Rent on building Depreciation on equipment Variable # Mixed ● Variable ÷ Fixed Fixedarrow_forwardHow do I determine the company's total contribution margin, contribution margin per service call, and contribution margin ratio when 50 service calls are made in the month of June? Problem E21-23arrow_forward

- Allocation of Administrative Costs Wical Rental Management Services manages four apartment buildings, each with a different owner. Wical’s CEO has observed that the apartment buildingswith more expensive rental rates tend to require more of her time and also the time of her staff. Thefour apartment buildings incur a total annual operating expense of $7,345,733, and these operatingexpenses are traced directly to the apartment buildings for the purpose of determining the profitearned by the building owners. The annual management fee that Wical earns is based on a percentageof total annual operating expenses and is negotiated each year. For the current year, the fee rate is 6%,and Wical has the following information for current-year average rental rates and occupancy rates:[LO 18-3]Apartment Complex Number of Units Average Occupancy Average RentCape Point 100 88.0% $1,895Whispering Woods 250 77.0 1,295Hanging Rock 200 72.0 995College Manor 350 82.0 895Total 900For the current year, Wical…arrow_forwardActivity-Based Supplier Costing Ventana Company is a car window repair and replacement company operating in the after-sales market. Ventana’s purchasing manager uses two suppliers (Jones Glass and Claro Glass) for the source of its passenger car windows. Data relating to side windows (Side) and windshields (WS) are given below. I. Activity costs Activity Adverse buying* 696,000 Supplier returns** 79,800 * Extra cost of purchasing from local car dealer because of insufficient delivery of supplier.** Windows returned because they were not ordered or because they were defective. II. Supplier Data Jones Glass Claro Glass Side WS Side WS Unit purchase price $60 $145 $57 $142 Units purchased 15,000 15,000 30,000 30,000 Insufficient units 750 750 3,600 3,600 Returned units 425 425 1,000 1,000 Required: 1. Calculate the activity rates for assigning costs to suppliers. Adverse buying…arrow_forwardRequired information In October, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could. manage a single product line, Nicole agreed. Nicole's Getaway Spa (NGS) would make monthly purchases from the supplier at a cost that included production costs and a transportation charge. NGS would keep track of its new inventory using a perpetual inventory system. On December 31 of last year, NGS had 20 units at a total cost of $5.40 per unit. Nicole purchased 30 more units at $7.40 in February. In March, Nicole purchased 20 units at $9.40 per unit. In May, 60 units were purchased at $9.20 per unit. In June. NGS sold 60 units at a selling price of $11.40 per unit and 50 units at $11.60 per unit. 2. Compute the Cost of Goods Available for Sale, Cost of Goods Sold, and Cost of Ending Inventory using the first-in, first-out…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education