FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:(a) Calculate the direct materials price and quantity variances for November. (If variance is zero, select "Not Applicable and enter O for the

amounts)

Direct material price variance

Direct material quantity variance

$

Direct labor rate variance

$

(b) Calculate the direct labor rate and efficiency variances for November. (Round answers to 0 decimal places, e.g. 125. If variance is zero,

select "Not Applicable and enter O for the amounts.)

$

Direct labor efficiency variance $

(c) Calculate the variable overhead spending and efficiency variances for November. (Round answers to 0 decimal places, eg. 125. If

variance is zero, select "Not Applicable and enter O for the amounts.)

Variable overhead spending variance

Variable overhead efficiency variance

Fixed overhead spending variance

$

(d) Calculate the fixed overhead spending variance for November. (Round answer to 0 decimal places, eg. 125. If variance is zero, select

"Not Applicable" and enter 0 for the amounts)

$

$

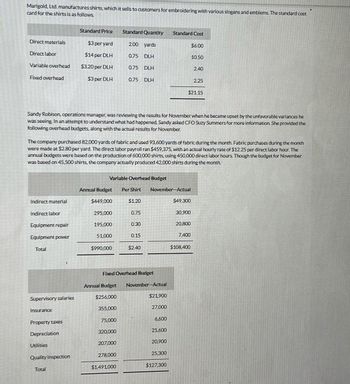

Transcribed Image Text:Marigold, Ltd. manufactures shirts, which it sells to customers for embroidering with various slogans and emblems. The standard cost

card for the shirts is as follows.

Direct materials

Direct labor

Variable overhead

Fixed overhead

Indirect material

Indirect labor

Equipment repair

Equipment power

Total

Supervisory salaries

Insurance

Property taxes

Depreciation

Standard Price

$3 per yard

$14 per DLH

$3.20 per DLH

$3 per DLH

Utilities

Quality inspection

Total

Sandy Robison, operations manager, was reviewing the results for November when he became upset by the unfavorable variances he

was seeing. In an attempt to understand what had happened, Sandy asked CFO Suzy Summers for more information. She provided the

following overhead budgets, along with the actual results for November.

Annual Budget

$449,000

The company purchased 82,000 yards of fabric and used 93,600 yards of fabric during the month. Fabric purchases during the month

were made at $2.80 per yard. The direct labor payroll ran $459,375, with an actual hourly rate of $12.25 per direct labor hour. The

annual budgets were based on the production of 600,000 shirts, using 450,000 direct labor hours. Though the budget for November

was based on 45.500 shirts, the company actually produced 42,000 shirts during the month.

Variable Overhead Budget

295,000

195,000

51,000

Standard Quantity

200 yards

0.75 DLH

0.75 DLH

$990,000

0.75 DLH

75,000

320,000

207,000

278,000

$1,491,000

$1.20

0.75

0.30

0.15

Fixed Overhead Budget

Annual Budget November-Actual

$256,000

355,000

Per Shirt November-Actual

$2.40

$21,900

27,000

Standard Cost

6,600

25,600

20,900

25,300

$127,300

$6.00

$21.15

$49,300

10.50

30,900

20,800

7,400

2.40

$108,400

2.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction

VIEW Step 2: Calculate the material price and quantity variance

VIEW Step 3: Calculate the direct labor rate and efficiency variance

VIEW Step 4: Calculate the variable overhead spending and efficiency variance

VIEW Step 5: Calculate the fixed overhead spending variance

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please do not Give image formatarrow_forwardRequired information [The following information applies to the questions displayed below.] A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Actual Cost Compute the (1) direct materials price variance and (2) direct materials quantity variance. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Cost per unit" answers to 2 decimal places. $ GA Standard Quantity and Cost 6 pounds @ $8 per pound 3 DLH @ $17 per DLH 3 DLH @ $12 per DLH 0 $ Actual Results 47,400 pounds @ $8.10 per pound 23,100 hours @ $17.50 per hour $ 286,100 0 0 7,800 units S $ 0 Standard Costarrow_forwardFor each of the following independent cases, fill in the missing amounts: Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your per unit rates to 2 decimal places. Round your other final answers to the nearest whole numbers. Units produced Standard hours per unit Standard hours Standard rate per hour Actual hours worked Actual labor cost Direct labor rate variance Direct labor efficiency variance Casey Company 2,800 5.10 $ $ 31.70 13,500 5,200 F Kevin, Incorporated $ $ 1.70 2,890 3,005 2,900 F 1,518 U $ $ $ Jess Company 200 660 10.00 6,500 200 U Valerie, Incorporated $ 1,000 10.00 15,200 $ 140,000 $ 5,800 Uarrow_forward

- Aaha Inc. produces premium protective automotive covers. The direct materials and direct labour standards for one car cover are as follows: Standard Quantity or Hours Direct materials Direct labour 7.00 metres of cloth 0.30 hours Standard Price or Rate $8 per metre $ 16 per hour Standard Cost $56.00 $4.80 In September, the following activity was recorded: 17,500 metres of cloth were purchased at a cost of $7.50 per metre All of the purchased material was used to produce 2,500 car covers. 520 direct labour-hours were recorded at a total labour cost of $8,320. Required: 1. Compute all direct materials variances for September (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (ie., zero variance).) Answer is complete and correct. Direct materials price variance Direct materials quantity variance Total direct material cost variance $ 8,750 F $ $ 8,750 ( 0 None F 000arrow_forwardPlease provide answer in text (Without image)arrow_forwardFix the red pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education