Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

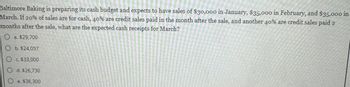

Transcribed Image Text:Baltimore Baking is preparing its cash budget and expects to have sales of $30,000 in January, $35,000 in February, and $35,000 in

March. If 20% of sales are for cash, 40% are credit sales paid in the month after the sale, and another 40% are credit sales paid 2

months after the sale, what are the expected cash receipts for March?

O a. $29,700

O b. $24,057

O c. $33,000

O d. $26,730

Oe. $36,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following sales are predicted for a company’s next four months.arrow_forwardAssume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $42,000 and $71,000, respectively. The company expects to collect 45% of its credit sales in the month of the sale, 50% in the following month, and 5% is deemed uncollectible. What amount of cash collections from credit sales would the company include in its cash budget for the second month? Multiple Choice $56,500 $31,950 $35,500 $52,950arrow_forwardi need the answer quicklyarrow_forward

- 7 Benton Company's sales budget shows the following expected total sales: Month Sales January $17,000 February $21,000 March April The company expects 80% of its sales to be on account (credit sales). Credit sales are collected as follows: 25% in the month of sale and 69% in the month following the sale, with the remainder being uncollectible and written off. The total cash receipts during April would be: Multiple Choice O $26,000 $49,000 O O $21,165. $35,200. $33,952. Check $25,725.arrow_forwardvnt.2 Matthew Company has a sales budget for last month of $400,000. Cost of goods sold is expected to be 40% of sales. All units are paid for in the month following purchase. The beginning inventory is $5,000 and an ending inventory of $12,000 is desired. Beginning accounts payable is $76,000. The costs of goods solf for the next month is a) $220,000 b) $160,000 c) $172,000 d) $140,000arrow_forwardPreparing a Production Budget Patrick Inc. makes industrial solvents. In the first 4 months of the coming year, Patrick expects the following unit sales: January 41,000 February 38,000 March 50,000 April 51,000 Patrick's policy is to have 24% of next month's sales in ending inventory. On January 1, it is expected that there will be 4,350 drums of solvent on hand. Required: Prepare a production budget for the first quarter of the year. Show the number of drums that should be produced each month as well as for the quarter in total. If required, round your answers to the nearest whole unit. Patrick Inc. Production Budget For the Coming Quarter January February March 1st Quarter Total Sales fill in the blank 1 fill in the blank 2 fill in the blank 3 fill in the blank 4 Desired ending inventory fill in the blank 5 fill in the blank 6 fill in the blank 7 fill in the blank 8 Total needs fill in the blank 9 fill in the blank 10 fill in the blank 11 fill in the…arrow_forward

- Browning Company's sales budget shows the following expected total sales: Month Sales $23,000 $27,000 $32,000 $43,000 January February March April The company expects 70% of its sales to be on account (credit sales). Credit sales are collected as follows: 25% in the month of sale, 69% in the month following the sale with the remainder being uncollectible and written off. The total cash inflows from sales in April would be: Multiple Choice $22,575 $25,005. $35,881 $23,200arrow_forwardAssume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $40,000 and $61,000, respectively. The company expects to collect 30% of its credit sales in the month of the sale and the remaining 70% in the following month. What amount of cash collections from credit sales would the company include in its cash budget for the second month? Multiple Choice $42,700 $18,300 О $46,300 C $30,300arrow_forwardNeed help with thisarrow_forward

- COVID 19 Co has forecast purchases on account to be $318,000 in March, $370,000 in April, $421,000 in May, and $493.000 in June. Sixty five percent of purchases are paid for in the month of purchase, the remaining 35% are paid in the following month, What is the budgeted Accounts Payable balance for June 30? Select one a. $172.550 b. $320,450 C $147.350 d. $273.650arrow_forwardon 4 obinson Corp., which operates on a calendar year, expects to sell 1380 units in October, and expects sales to increase 130 units each month thereafter. Sales price expected to stay constant at $7 per unit. What are budgeted sales revenue for the fourth quarter? << < Question 4 of 5arrow_forwardActivity No. 13: Budgeting Callgate Company has forecast credit sales for the fourth quarter of the year: September (actual) Fourth Quarter: October November December P 100,000 80,000 70,000 120,000 Based on the past experience, 20% of sales are collected in the month of sales, 70% in the following month and 10% are never collected. Prepare a schedule of cash receipts for the company covering the last quarter of the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education