FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

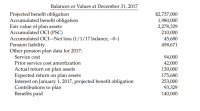

(Disclosures: Pension Expense and Other Comprehensive Income) Taveras Enterprises provides the following information relative to its defined benefit pension plan.

Check the below image for the information.

Instructions

(a) Prepare the note disclosing the components of pension expense for the year 2017.

(b) Determine the amounts of other comprehensive income and comprehensive income for 2017. Net income for 2017 is $35,000.

(c) Compute the amount of accumulated other comprehensive income reported at December 31, 2017.

Transcribed Image Text:Balances or Values at December 31, 2017

Projected benefit obligation

Accumulated benefit obligation

Fair value of plan assets

Accumulated OCI (PSC)

Accumulated OCI–Net loss (1/1/17 balance, –0–)

Pension liability

Other pension plan data for 2017:

Service cost

$2,737,000

1,980,000

2,278,329

210,000

45,680

458,671

94,000

42,000

130,000

175,680

253,000

93,329

140,000

Prior service cost amortization

Actual return on plan assets

Expected return on plan assets

Interest on January 1, 2017, projected benefit obligation

Contributions to plan

Benefits paid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Pension Expense in a pension plan for the year were recorded at $856,800. In addition, an amount of $161,400 had been debited to the Other Comprehensive Income account to record all actuarial losses for the year. In addition, the company had contributed a cash amount of $350,000 to the Plan Assets. What would have been the amount recorded as Pension expenses for 2019 if the company were reporting under ASPE? Select one: a. $856,800. b. $757,200. c. $161,400. d. $350,000. e. None of the above.arrow_forwardplease answer with full working thanksarrow_forwardElectronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: PBO balance, January 1 Plan assets balance, January 1 Service cost Interest cost Gain from change in actuarial assumption Benefits paid Actual return on plan assets Contributions 2024 ($ millions) $600 300 85 65 28 (60) 13 75 The expected long-term rate of return on plan assets was 6%. There were no AOCI balances related to pensions on January 1, 2024, but at the end of 2024, the company amended the pension formula, creating a prior service cost of $16 million. Required: 1. Calculate the pension expense for 2024. 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. Required 1…arrow_forward

- Blossom Corp. sponsors a defined benefit pension plan for its employees. On January I, 2025, the following balances relate to this plan. Plan assets: $460,000 Projected benefit obligation: $606,500 Pension asset/liability: $146,500 Accumulated OCI (PSC): 104,200 Dr. As a result of the operation of the plan during 2025, the following additional data are provided by the actuary. Service cost: $93,500 Settlement rate, 10% Actual return on plan assets: $54,600 Amortization of prior service cost: $18,100 Expected return on plan assets: $51,600 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions: $76,600 Contributions: $100,500 Benefits paid retirees: $84,300 Using the data above, compute pension expense for Blossom for the year 2025 by preparing a pension worksheet. (Enter all amounts as positive.)arrow_forwardSubject: acountingarrow_forwardPrepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2020. ( Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) The following information is available for the pension plan of Sandhill Company for the year 2020.arrow_forward

- The Kollar Company has a defined benefit pension plan. Pension Information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $3,200. b. Prior service cost from plan amendment on January 2, 2024 = $600 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $640. d. Service cost for 2025 = $690. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10% f. Payments to retirees in 2024 = $500. g. Payments to retirees in 2025 = $570. h. No changes in actuarial assumptions or estimates. 1. Net gain-AOCI on January 1, 2024 = $370. J. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $2,300. b. 2024 contributions = $660. c. 2025 contributions = $710. d. Expected…arrow_forwardPlease provide proper tables for each requirement. For the spreadhseet as well as the journal entries so it is easy to understand. Tables with titles and calculations and accounts etc.arrow_forwardCullumber Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2025 in which no benefits were paid. 1. 2. 3. 4. The actuarial present value of future benefits earned by employees for services rendered in 2025 amounted to $55,700. The company's funding policy requires a contribution to the pension trustee amounting to $144,323 for 2025. As of January 1, 2025, the company had a projected benefit obligation of $894,700, an accumulated benefit obligation of $792,500, and a debit balance of $402,000 in accumulated OCI (PSC). The fair value of pension plan assets amounted to $601,400 at the beginning of the year. The actual and expected return on plan assets was $54,300. The settlement rate was 9%. No gains or losses occurred in 2025 and no benefits were paid. Amortization of prior service cost was $49,800 in 2025. Amortization of net gain or loss was not required in 2025.arrow_forward

- Presented below is pension information for A Company for the year 2016: Interest on plan assets P24,000 Interest on vested benefits 10,000 Service cost 35,000 Interest on defined benefit obligation 21,000 Past service cost due to increase in benefits 18,000 The amount of pension expense to be reported for 2016 isarrow_forwardThe following Incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions) Debit (Credit) Beginning balance Service cost Interest cost Expected return on assets Gain/loss on assets Amortization of: Prior service cost Net gain/loss Loss on PBO Contributions to fund Retiree benefits paid Ending balance What was the actuary's Interest (discount) rate? Multiple Choice O 17% PBO (300) (12) Prior Plan Service Net Pension Net Pension Assets Cost (Gain)/Loss Expense Cash (Liability)/Asset 43 (185) 83 (88) 866 (11) (5) 6 (96) 77 51 (60)arrow_forwardBased upon this information, how would I make the following journal entries? Record annual pension expense. Record the change in plan assets. Record the change in the PBO. Record the cash contribution to plan assets. Record the retiree benefits paid.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education