Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

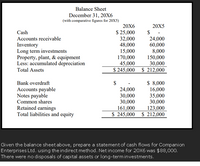

Transcribed Image Text:Balance Sheet

December 31, 20X6

(with comparative figures for 20X5)

20X6

$ 25,000

32,000

48,000

15,000

20X5

$ -

24,000

60,000

8,000

150,000

30,000

$ 245,000 $ 212,000

Cash

Accounts receivable

Inventory

Long term investments

Property, plant, & equipment

Less: accumulated depreciation

170,000

45,000

Total Assets

$ 8,000

16,000

35,000

30,000

123,000

$ 245,000 $ 212,000

Bank overdraft

$

24,000

Accounts payable

Notes payable

Common shares

30,000

30,000

161,000

Retained earnings

Total liabilities and equity

Given the balance sheet above, prepare a statement of cash flows for Companion

Enterprises Ltd. using the indirect method. Net income for 20X6 was $88,000.

There were no disposals of capital assets or long-terminvestments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Instructions This assignment is designed for practicing both the retailer/merchandiser accounting cycle and your basic excel skills. Below are select sales transactions for two companies. You will need to enter the missing pieces of each transaction on the journal entry tab. Each missing piece of information is highlighted in yellow. The only cell where an actual number is to be input is on the journal entries worksheet. Please note: not every yellow cell requires input (it could be left blank if appropriate). After completing the journal entries, you must then complete the missing pieces of the T accounts, trial balance, and statements highlighted in yellow. Only excel functions may be used to calculate the appropriate cell value on these pages. DO NOT INPUT THE ACTUAL NUMBER INTO THE T ACCOUNTS, TRIAL BALANCE, OR STATEMENTS. Use excel functions (such as making a cell equal another from the journal entry page, summing numbers together, or using the plus or minus symbols to help you…arrow_forwardplease answer without image WITH DETAILED WORKINGarrow_forwardBauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.3% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars): 1. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would…arrow_forward

- Extract from the statement of P&L and OCI of Don Ltd for year ended 30 June 20X8 and the Balance Sheet at 30 June 20X7 and 20X8 are given below. 20X7 20X8 Sales $2,120,000 Interest revenue $3,000 Loss on sale of plant and equipment ($25,000) Current Assets Interest receivable $1,500 $3,000 Non-current assets Plant and equipment (at cost) $410,000 $425,000 (-) Accumulated depreciation ($85,000) ($102,000) Loan to CEO $60,000 $45,000 Current liabilities Trade Payables $14,200 $34,250 Additional information: On 1 January 20X8 Don Ltd sold plant and equipment with a carrying amount of $75,000 (cost $100,000) and received $50,000 cash. An item of plant and equipment was purchased on 29 June 20X8. Not all of this was paid for with cash. $30,000 of this amount was purchased on credit and is in the trade payables balance at 30 June 20X8. Don Ltd…arrow_forwardNet Present Value Method The following data are accumulated by Geddes Company in evaluating the purchase of $158,800 of equipment, having a four-year useful life: Net Income Net Cash FlowYear 1 $44,000 $75,000 Year 2 27,000 58,000 Year 3 13,000 44,000 Year 4 (1,000) 29,000 Present Value of $1 at Compound InterestYear 6% 10% 12% 15% 20%1 0.943 0.909 0.893 0.870 0.8332 0.890 0.826 0.797 0.756 0.6943 0.840 0.751 0.712 0.658 0.5794 0.792 0.683 0.636 0.572 0.4825 0.747 0.621 0.567 0.497 0.4026 0.705 0.564 0.507 0.432 0.3357 0.665 0.513 0.452 0.376 0.2798 0.627 0.467 0.404 0.327 0.2339 0.592 0.424 0.361 0.284 0.19410 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 10%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. Present value of net cash flow $fill in the blank 1Amount to be invested $fill in the blank 2Net present value $fill in the blank 3b. Would…arrow_forwardI. Operating ActivitiesNet income $ 50,000II. Long-Term Investing ActivitiesAdditions to property, plant, and equipment $ (250,000)III. Financing ActivitiesNet cash provided by financing activities $ 170,000IV. SummaryNet decrease in cash (30,000)Cash and equivalents at beginning of the year 55,000Cash and equivalents at the end of the year $ 25,000If accruals increased by $25,000, receivables and inventories increased by $100,000, and depreciation and amortization totaled $10,000, what was the firm’s net income?arrow_forward

- Net Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of $161,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $35,000 $59,000 Year 2 21,000 45,000 Year 3 10,000 34,000 Year 4 (1,000) 23,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 6%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value.…arrow_forwardNet Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of $82,600 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $31,000 $53,000 Year 2 19,000 41,000 Year 3 9,000 31,000 Year 4 (1,000) 21,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 20%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value.…arrow_forwardAsaparrow_forward

- Assets Buildings and equipment Accumulated depreciation- buildings and equipment 144,000 Patents Accounts receivable Cash €1,200,000 288,000 320,000 €1,552.000 Cash flows from operating activities Net income Equities (400,000) Accounts payable Net cash used by investing activities Cash flows from financing activities Payment of cash dividend Share capital For the Year Ended December 31, 2022 Increase (Decrease) in Cash €400,000 Adjustments to reconcile net income to net cash provided by operating activities: Amortization of patents Net cash provided by operating activities Cash flows from investing activities Sale of equipment 96,000 Purchase of land (200,000) Purchase of buildings and equipment Kiner Company Statement of Cash Flows Sale of ordinary shares. Net cash provided by financing activities Net increase in cash 136,000 €1,552,000 Increase in accounts receivable Increase in accounts payable 64,000 Depreciation buildings and equipment 120,000 Gain on sale of equipment (48,000)…arrow_forwardNet Present Value Method The following data are accumulated by Paxton Company in evaluating the purchase of $98,400 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $37,000 $63,000 Year 2 23,000 49,000 Year 3 11,000 37,000 Year 4 (1,000) 25,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 20%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value.…arrow_forwardHasbro, Inc. Consolidated Statements of Operations - USD ($) $ in Thousands 12 Months Ended Dec. 31, 2018 Consolidated Statements of Operations [Abstract] Net revenues, external $ 4,579,646 Costs and expenses Cost of sales 1,850,678 Royalties 351,660 Product development 246,165 Advertising 439,922 Amortization of intangibles 28,703 Program production cost amortization 43,906 Selling, distribution and administration 1,287,560 Total expenses 4,248,594 Operating profit 331,052 Non-operating (income) expense Interest Expense 90,826 Interest income (22,357) Other (income) expense, net (7,819) Total non-operating expense, net 60,650 Earnings before income taxes 270,402 Income taxes 49,968 Net earnings 220,434 Net Loss Attributable to Noncontrolling Interests 0 Net Earnings Attributable to Hasbro, Inc. $ 220,434 Net earnings attributable to Hasbro, Inc. per common share: Basic (in dollars per share) $ 1.75 Diluted (in dollars per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education