FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please Introduction and showing work and please no plagiarism please i humble request plz sir don't copy pest please

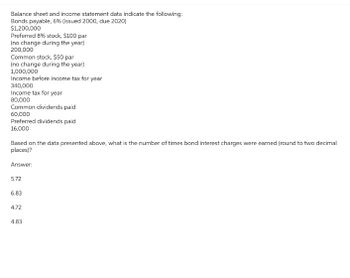

Transcribed Image Text:Balance sheet and income statement data indicate the following:

Bonds payable, 6% (issued 2000, due 2020)

$1,200,000

Preferred 8% stock, $100 par

(no change during the year)

200,000

Common stock, $50 par

(no change during the year)

1,000,000

Income before income tax for year

340,000

Income tax for year

80,000

Common dividends paid

60,000

Preferred dividends paid

16,000

Based on the data presented above, what is the number of times bond interest charges were earned (round to two decimal

places)?

Answer:

5.72

6.83

4.72

4.83

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- AutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardAccounting Questionarrow_forward

- 合日 Document1 Q. Search in Document Home Insert Draw Design Layout References Mailings Review View + Share a A. A- E -E - E , E E Times New R... - AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe AaBbCcDdEe AaBbCcDdEe AgBbCcDdEe AgBbCcDdEe Paste в I U - abe X, x2 Normal Heading 1 Subtle Emph.. Emphasis Styles Pane No Spacing Heading 2 Title Subtitle You are considering opening your own restaurant. To do so, you will have to quit your current job, which pays $46k per year, and cash in your life savings of $200k, which have been in a certificate of deposit paying 6% per year. You will need this $200k to purchase equipment for your restaurant operations. You estimate that you will have to spend $4k during the year to maintain the equipment so as to preserve its market value at $200k. Fortunately, you own a building suitable for the restaurant. You currently rent out this building on a month-by-month basis for $2,500 per month. You anticipate that you will spend $50k for food, $40k for extra help, and…arrow_forward* CengageNOWv2 | Online teachin X b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * D 9 : M Gmail O YouTube Maps Blackboard HW #9 - Chpt 21 O eBook Show Me How E Print Item 1. TMM.21.01 Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): 2. TMM.21.02 Sales $14,100 3. TMM.21.03 Food and packaging $5,994 Рayroll 3,600 4. TMM.21.04 Occupancy (rent, depreciation, etc.) 1,986 5. EX.21,01 General, selling, and administrative expenses 2,100 $13,680 6. EX.21.02 Income from operations $420 7. EX.21.03 Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. 8. EX.21.06.ALGO a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million 9. EX.21.09.ALGO b. What is Wicker…arrow_forwardungageNOWv2 | Online teachin x takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * O H. C20-128PR01-2016. O Final Exam Review -. G Professional Certific. Cancel Your. F Startup Opportuniti. V How brands are co. A Assignment Practic. A COVID-19 Student. Extreme Sports sells logo sports merchandise. The company is contemplating whether or not to continue its custom embroidery service. All of the company's direct fixed costs can be avoided if a segment is dropped. The information is available for the segments. Custom Logo Embroidery Apparel Sales $61,000 $249,000 Variable costs 31,000 110,000 Contribution margin $30,000 $139,000 Direct fixed costs 22,000 40,000 Allocated common fixed costs 13,000 50,000 Net income $(5,000) $49,000 A. What will be the impact on net income if the embroidery segment is dropped? Net income $ B. Assume that if the embroidery segment is dropped, apparel sales will increase 10%. What is the impact on the contribution…arrow_forward

- File Edit View History Bookmarks Profiles estion 4 - Proctoring Enable X getproctorio.com/secured #lockdown ctoring Enabled: Chapter 6 Homework Assignm... i 4 kipped ic raw 511 F CUNY Login 2 Req 1 Req 2 to 4 #3 Complete this question by entering your answers in the tabs below. с Tab How many performance obligations are in this contract? Number of performance obligations $ Window Help st X 4 Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada. On March 1, 2024, Barrick Gold receives $150,000 from Citizen Bank and promises to deliver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Barrick Gold delivers the products to Brink's, a third-party carrier. In addition, Barrick Gold has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold…arrow_forwardNot a previously submitted question. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education