FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H & H Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the

| H & H Tool Trial Balance on January 1, 2023 (dollars in millions, except par value) |

||

| Debit | Credit | |

|---|---|---|

| Cash | 9 | |

| 8 | ||

| Supplies | 31 | |

| Land | ||

| Equipment | 98 | |

| 17 | ||

| Other noncurrent assets (not detailed to simplify) | 12 | |

| Accounts payable | ||

| Wages payable | ||

| Interest payable | ||

| Dividends payable | ||

| Income taxes payable | ||

| Long-term notes payable | ||

| Common stock (8 million shares, $0.50 par value) | 5 | |

| Additional paid-in capital | 100 | |

| 36 | ||

| Service revenue | ||

| Depreciation expense | ||

| Supplies expense | ||

| Wages expense | ||

| Interest expense | ||

| Income tax expense | ||

| Miscellaneous expenses (not detailed to simplify) | ||

| Totals | 158 | 158 |

Transactions during 2023 follow. All dollars are in millions, except per share amounts:

- Borrowed $24 cash on a 5-year, 10 percent note payable, dated March 1, 2023.

- Sold 6 million additional shares of common stock for cash at $1 market value per share on January 1, 2023.

- Purchased land for a future building site; paid cash, $23.

- Earned $339 in revenues for 2023, including $69 on credit and the rest in cash.

- Incurred $109 in wages expense and $45 in miscellaneous expenses for 2023, with $40 on credit and the rest paid in cash.

- Collected accounts receivable, $44.

- Purchased other noncurrent assets, $18 cash.

- Purchased supplies on account for future use, $43.

- Paid accounts payable, $42.

- Declared cash dividends on December 1, $24.

- Signed a three-year $49 service contract to start February 1, 2024.

- Paid the dividends in (j) on December 31.

Data for

- Supplies counted on December 31, 2023, $34.

- Depreciation for the year on the equipment, $19.

- Interest accrued on notes payable (to be computed).

- Wages earned by employees since the December 24 payroll but not yet paid, $21.

- Income tax expense, $18, payable in 2024

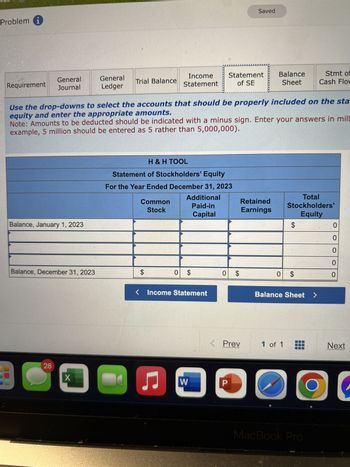

Transcribed Image Text:Problem i

Requirement

General

Journal

Balance, January 1, 2023

Balance, December 31, 2023

28

General

Ledger

X

Trial Balance

Use the drop-downs to select the accounts that should be properly included on the sta

equity and enter the appropriate amounts.

Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in mill

example, 5 million should be entered as 5 rather than 5,000,000).

Common

Stock

Income

Statement

H & H TOOL

Statement of Stockholders' Equity

For the Year Ended December 31, 2023

Additional

Paid-in

Capital

$

- ♫

0 $

Income Statement

Statement

of SE

W

0 $

Saved

Retained

Earnings

Prev

P

D

Balance

Sheet

Total

Stockholders'

Equity

$

0 $

1 of 1

Balance Sheet

Stmt of

Cash Flow

MacBook Pro

O

0

O

0

0

0

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 31 December, a finishing machine was sold. Accumulated depreciation to 30 June was $10,000. The depreciation for 6 months ended 31 December was $3,000. Its capital cost was $25,000 and accumulated depreciation was $13,000 at date of sale. The machine was sold for cash to jake strong for $14300 (including GST) Balance date is 30 June Complete the following table in image 2 based off the general ledger in image 1. All of the table must be complete including balance column.arrow_forwardUse the information at the top of this screen (next to Instructions) to complete the general ledger of Foster Incorporated:arrow_forwardYour staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forward

- On February 25, 2014, Holden Corp. purchased automobiles and trucks for a total price of $530,000, by borrowing the full balance from the bank to be repaid within 8 years. The bank appraised the automobiles at S196,000 and the trucks at $294,000. Enter an appropriate description, and enter the date in the format dd/mmm (i.e., 15/Jan). General Journal Page GJ2 F Debit Credit Date Account/Explanationarrow_forwardDuring Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $24,000. On the date of delivery. January 2, the company paid $8,000 on the machine, with the balance on credit at 11 percent interest due in six months. On January 3, it paid $800 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,200. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $3,800. 3. Compute the depreciation expense to be reported for Year 1. Depreciation expensearrow_forwardDengararrow_forward

- Read the description of the following adjustments that are required at the end of the accounting period for Paulo Consulting Services. Record the necessary journal entries required at the end of January. (Round your answers to the nearest whole dollar.) Equipment was purchased on January 1, 20X1, for $45,000 and has an estimated useful life of 8 years with a salvage value of 3,720. Depreciation is computed using the straight-line method. Signed a 5-month contract for $6,210 of prepaid advertising on January 1, 20X1. Prepaid rent for the year on January 1, 20X1, in the amount of 26,950. Purchased supplies for $7,000 on January 1, 20X1. Inventory of supplies was $5,650 on January 31, 20X1. Do not give answer in imagearrow_forwardQuality Move Company made the following expenditures on one of its delivery trucks: Mar. 20 Replaced the transmission at a cost of $1,990. June 11 Paid $1,455 for installation of a hydraulic lift. Nov. 30 Paid $57 to change the oil and air filter. Prepare journal entries for each expenditure. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTSQuality Move CompanyGeneral Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation-Delivery Truck 125 Equipment 126 Accumulated Depreciation-Equipment 130 Mineral Rights 131 Accumulated Depletion 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner's…arrow_forwardThe following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29 Received 40% of the $17,000 balance owed by Jankovich Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18 Reinstated the account of Vince Karm, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,560 cash in full payment of Karm’s account. Aug. 9 Wrote off the $22,380 balance owed by Golden Stallion Co., which has no assets. Nov. 7 Reinstated the account of Wiley Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $13,220 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncollectible (one entry): Claire Moon Inc., $22,860; Jet Set Co., $15,320; Randall Distributors, $41,460; Harmonic Audio, $18,890. 31 Based on an analysis of the $2,740,000 of accounts receivable, it was estimated that $113,330 will…arrow_forward

- During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $24,000. On the date of delivery, January 2, the company paid $6,000 on the machine, with the balance on credit at 12 percent interest due in six months. On January 3, it paid $1,400 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,600. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $3,300. E8-4 Part 1 Required: 1. Indicate the effects of each transaction on the accounting equation. (Enter decreases to account categories as negative amounts. If the transaction does not impact the accounting equation choose "No effect" in the first column under "Assets".) Date January 1 No effect January 2 Equipment Cash January…arrow_forwardPlease prepare the following joiurnal entries: Show all calcualtions Bought a van, paying $10500 cash as a down payment and signed a 10 month $32000, 9% note payable for the balanceThe company paid 750 to have its company logo printed on the side of the van. The residual value is $7500. The old van was sold for $7500; it cost $32000 and acculumated depreciation up to the date of disposal was $30000arrow_forward! Required information [The following information applies to the questions displayed below.] During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $28,000. On the date of delivery, January 2, the company paid $7,000 on the machine, with the balance on credit at 9 percent interest due in six months. On January 3, it paid $1,500 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,700. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $3,400. Required: 1. Indicate the effects of each transaction on the accounting equation. Note: Enter decreases to account categories as negative amounts. If the transaction does not impact the accounting equation choose "No effect" in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education