ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Economics

50

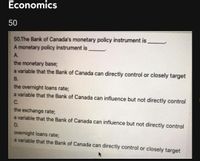

50.The Bank of Canada's monetary policy instrument is,

A monetary policy instrument is,

A.

the monetary base;

a variable that the Bank of Canada can directly control or closely target

В.

the overnight loans rate;

a variable that the Bank of Canada can influence but not directly control

C.

the exchange rate;

a variable that the Bank of Canada can influence but not directly control

D.

overnight loans rate;

a variable that the Bank of Canada can directly control or closely target

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The currency of the United States is: a. backed dollar for dollar by gold. b. backed by a gold cover of 50 percent. c. not backed by any precious metal. d. backed by the government's silver reserves. e. backed by the government's gold and silver reservesarrow_forward€ O } စ ၁ ] Homework (Ch 15) PRICE LEVEL (Price index) 200 180 160 140 120 100 80 60 40 20 0 0 25 50 75 100 125 150 175 REAL GDP (Millions of dollars) Q Search AS AD 200 225 250 ပုံပုံ AD AS 87 ? H a ၈)၊ 8 X 2:38 PM 12/9/2022 A-Z 20arrow_forwardIn Minland, the central bank lowers the interest rate from 5 per cent a year to 3 per cent a year. a.Describe in detail the steps that the Bank of Minland must follow to make the interest rate fall? b.Describe the effects of the lower interest rate on consumption expenditure and investment. c. Describe the effects of the lower interest rate on the exchange rate of the Minland dollar for the UK pound. d.Describe the effects of the change in the Minland dollar exchange rate on Minland’s net exports. e.Explain whether the change in the interest rate shifts or brings a movement along Minland’s interest-sensitive expenditure curve. f.Explain the full set of ripple effects of the interest rate cut ending with the changes in real GDP and the price level.arrow_forward

- Cover A strong dollar is normally expected to cause: O low unemployment and low inflation in the U.S. O high unemployment and high inflation in the U.S. O high unemployment and low inflation in the U.S. O low unemployment and high inflation in the U.S. Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accurate.arrow_forwardAccording to the Taylor rule, the Federal Reserve should lower the federal funds rate when the apply.) A exchange rate rises. B. Fed's inflation rate target rises. c. inflation rate falls. D. Fed's long-run target for the federal funds rate falls. DE output gap falls. (Check all thatarrow_forwardChina has a current trade surplus and considering only the direct effect on income, if the Chinese National bank used expansionary monetary policy, the policy would tend to: A. decrease the exchange rate and increase the trade surplus.B. increase the exchange rate and increase the trade surplus.C. decrease the exchange rate and decrease the trade surplus.D. increase the exchange rate and decrease the trade surplus. The recent increase in the Fed Funds rate at the direction of the Federal Reserve tends to: A. lower U.S. prices, make exports more expensive relative to imports, and lower the value of the dollar.B. lower U.S. prices, make exports cheaper relative to imports, and raise the value of the dollar.C. raise U.S. prices, make exports cheaper relative to imports, and raise the value of the dollar.D. raise U.S. prices, make exports more expensive relative to imports, and lower the value of the dollar. one Of the four choices below, which causes a shift in the Supply of dollars to…arrow_forward

- Suppose a country's central bank announces that it is decreasing the long-run money growth rate to tame inflation. The country's currency will suddenly and its rate of depreciation will then O appreciate; rise O appreciate; fall O depreciate; rise O depreciate; fallarrow_forwardExplanation it very good and clear. Not copy paste from anywhere.and give concept throughoutarrow_forwardWhat impact might a central bank's decision to raise interest rates have on the exchange rate of its currency in the short term? A. The exchange rate is likely to depreciate. B. The exchange rate is likely to appreciate. C. The exchange rate will remain unchanged. D. The exchange rate will become more volatile.arrow_forward

- while expansionary fiscal Expansionary monetary policy would likely cause increases in policy financed through increased borrowing would result in decreases in OC and I; (X-M) only OC and (X-M); C only OG only; C and I OC, I, and (X-M); C, I, and (X-M) Conly; I onlyarrow_forwardAnswer the question according to the graph below. Dollar/euro exchange rate, Ee Ese Dollar return Dollar return 2' 2' 4' Expected euro return Expected euro return Ege 3' 1' Ese Rates of return (in dollar terms) R R L(Rg. Yus) L(Rg. Yus) Mus Pis Mis Pis 4. U.S. real money supply Mus Mus Pus P1 US U.S. real money holdings U.S. real money holdings Assume that the U.S. money supply is initially given at M'us, the price level is initially given at PUs, and the equilibrium exchange rate is initially at E's/e. Which of the following is TRUE when the nominal money supply permanently increases from Mus to M²us? Lütfen birini seçin: O A. the money supply increase does not affect exchange rate expectations O B. the dollar depreciates against the euro in the long-run. O C. the real money supply rises from M'us / P'us to M²us / P²us in the short run O D. In the short-run, the dollar's depreciation is smaller than it would be if the money supply increase was temporary rather than permanent.arrow_forwardwould like some help on this questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education