ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

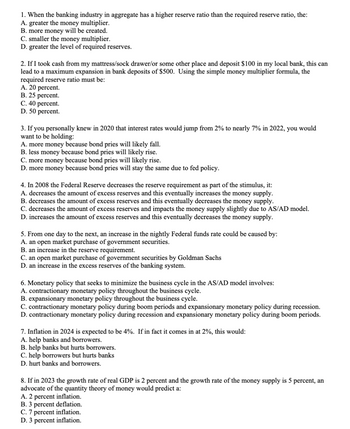

Transcribed Image Text:1. When the banking industry in aggregate has a higher reserve ratio than the required reserve ratio, the:

A. greater the money multiplier.

B. more money will be created.

C. smaller the money multiplier.

D. greater the level of required reserves.

2. If I took cash from my mattress/sock drawer/or some other place and deposit $100 in my local bank, this can

lead to a maximum expansion in bank deposits of $500. Using the simple money multiplier formula, the

required reserve ratio must be:

A. 20 percent.

B. 25 percent.

C. 40 percent.

D. 50 percent.

3. If you personally knew in 2020 that interest rates would jump from 2% to nearly 7% in 2022, you would

want to be holding:

A. more money because bond pries will likely fall.

B. less money because bond pries will likely rise.

C. more money because bond pries will likely rise.

D. more money because bond pries will stay the same due to fed policy.

4.In 2008 the Federal Reserve decreases the reserve requirement as part of the stimulus, it:

A. decreases the amount of excess reserves and this eventually increases the money supply.

B. decreases the amount of excess reserves and this eventually decreases the money supply.

C. decreases the amount of excess reserves and impacts the money supply slightly due to AS/AD model.

D. increases the amount of excess reserves and this eventually decreases the money supply.

5. From one day to the next, an increase in the nightly Federal funds rate could be caused by:

A. an open market purchase of government securities.

B. an increase in the reserve requirement.

C. an open market purchase of government securities by Goldman Sachs

D. an increase in the excess reserves of the banking system.

6. Monetary policy that seeks to minimize the business cycle in the AS/AD model involves:

A. contractionary monetary policy throughout the business cycle.

B. expansionary monetary policy throughout the business cycle.

C. contractionary monetary policy during boom periods and expansionary monetary policy during recession.

D. contractionary monetary policy during recession and expansionary monetary policy during boom periods.

7. Inflation in 2024 is expected to be 4%. If in fact it comes in at 2%, this would:

A. help banks and borrowers.

B. help banks but hurts borrowers.

C. help borrowers but hurts banks

D. hurt banks and borrowers.

8. If in 2023 the growth rate of real GDP is 2 percent and the growth rate of the money supply is 5 percent, an

advocate of the quantity theory of money would predict a:

A. 2 percent inflation.

B. 3 percent deflation.

C. 7 percent inflation.

D. 3 percent inflation.

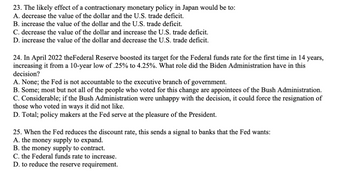

Transcribed Image Text:23. The likely effect of a contractionary monetary policy in Japan would be to:

A. decrease the value of the dollar and the U.S. trade deficit.

B. increase the value of the dollar and the U.S. trade deficit.

C. decrease the value of the dollar and increase the U.S. trade deficit.

D. increase the value of the dollar and decrease the U.S. trade deficit.

24. In April 2022 the Federal Reserve boosted its target for the Federal funds rate for the first time in 14 years,

increasing it from a 10-year low of .25% to 4.25%. What role did the Biden Administration have in this

decision?

A. None; the Fed is not accountable to the executive branch of government.

B. Some; most but not all of the people who voted for this change are appointees of the Bush Administration.

C. Considerable; if the Bush Administration were unhappy with the decision, it could force the resignation of

those who voted in ways it did not like.

D. Total; policy makers at the Fed serve at the pleasure of the President.

25. When the Fed reduces the discount rate, this sends a signal to banks that the Fed wants:

A. the money supply to expand.

B. the money supply to contract.

C. the Federal funds rate to increase.

D. to reduce the reserve requirement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The table below shows information for United Bank. Deposits Reserves Reserve Requirement $300 million $33 million 10% Which of the following statements is true concerning United Bank in the federal funds market? Multiple Choice C O United Bank will lend $33 million reserves in the federal funds market. O United Bank will borrow $30 million reserves in the federal funds market. United Bank will lend $3 million reserves in the federal funds market. United Bank will borrow $3 million reserves in the federal funds market. @ a $ % Λ &arrow_forwardHow do I do #4?arrow_forwardI'd like help on b,c,darrow_forward

- 1.What is the money multiplier if the target reserve ratio ofbanks is 4%? 2. If the target reserve ratio for a bank is 5%, deposits are $1billion, and loans are $800 million, what are the targetreserves?$50 million•80%$40 million$200 million3. Which measurement of the money in Canada will be the largest? 4. Is there more money or currency in Canada?5.arrow_forwardB. Consider the following data Currency Checkable deposits Savings deposits $1,200 billion $1,500 billion $2,500 billion Banking system's reserve-to-deposit ratio is 30%. Calculate (show your werk) 1. Bank reserves = 2. Monetary base = 3. M1 money supply = %3D 4. Realistic money multiplier =arrow_forwardIn a system of 100-percent-reserve banking, a. banks do not accept deposits. b. banks do not influence the supply of money. c. loans are the only asset item for banks. d. banks can increase the money supply.arrow_forward

- How does deposit insurance encourage banks to take on too much risk? 1. Banks can make riskier investments because the government has insured banks against losses on their investments 2. Banks can make riskier investments without worrying about deposit withdrawals because the government has insured depositors against losses 3. Deposit insurance encourages banks to increase investments in riskless assets 4. With deposit insurance, depositors have more incentive to withdraw their deposits if the managers make reckless investmentsarrow_forward6arrow_forwardBut which event will increase the quantity of deposits the banking system can create? A. An increase in the monetary base B. An increase in the currency drain C. An increase in the desired reserves by banksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education