b. This 2-mile length of 4-lane divided roadway project is estimated to require 2 years to complete following planning & design. The roadway to be constructed is projected to cost $125,000 per lane mile. It will need to begin construction 12 months prior to the project’s estimated completion date. Your government controls the permitting process for the roadway and has already issued the necessary permits. The total roadway project will be paid for at its completion. Assuming a discount rate of 4.25% and monthly compounding, what amount will need to be funded today

b. This 2-mile length of 4-lane divided roadway project is estimated to require 2 years to complete following planning & design. The roadway to be constructed is projected to cost $125,000 per lane mile. It will need to begin construction 12 months prior to the project’s estimated completion date. Your government controls the permitting process for the roadway and has already issued the necessary permits. The total roadway project will be paid for at its completion. Assuming a discount rate of 4.25% and monthly compounding, what amount will need to be funded today

Cost of the project = $ 125,000 per lane mile

Nos. of lane = 4

Length = 2 mile

Hence, cost of project = $ 125,000 per lane mile x 4 x 2 = $ 1,000,0000

So, the future value of the payment, FV = $ 1,000,000

This payment will occur on completion of the project i.e. 2 years after planning phase is over. Effectively this payment occurs at 18 + 24 = 42 months from now. Hence, n = 42.

Interest rate = 4.25% per annum

Hence, discount rate = r= interest rate per month = 4.25% / 12 = 0.3542%

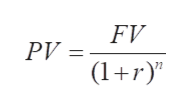

Present value (PV) of an future payment (FV) is given by the formula as shown on whiteboard

Step by step

Solved in 5 steps with 1 images