FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

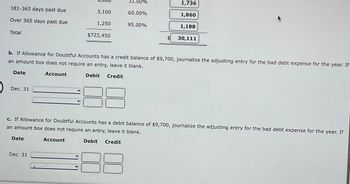

Transcribed Image Text:181-365 days past due

Over 365 days past due

Total

Date

Dec. 31

Date

3,100

1,250

b. If Allowance for Doubtful Accounts has a credit balance of $9,700, journalize the adjusting entry for the bad debt expense for the year. If

an amount box does not require an entry, leave it blank.

Account

Debit Credit

Dec. 31

$722,450

Account

60.00%

95.00%

1,736

1,860

1,188

30,111

c. If Allowance for Doubtful Accounts has a debit balance of $9,700, journalize the adjusting entry for the bad debt expense for the year. If

an amount box does not require an entry, leave it blank.

Debit Credit

↑

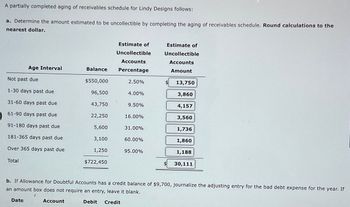

Transcribed Image Text:A partially completed aging of receivables schedule for Lindy Designs follows:

a. Determine the amount estimated to be uncollectible by completing the aging of receivables schedule. Round calculations to the

nearest dollar.

Age Interval

Not past due

1-30 days past due

31-60 days past due

61-90 days past due

91-180 days past due

181-365 days past due

Over 365 days past due

Total

Date

Balance

Account

$550,000

96,500

43,750

22,250

5,600

3,100

1,250

$722,450

Estimate of

Uncollectible

Accounts

Percentage

2.50%

4.00%

9.50%

16.00%

31.00%

60.00%

95.00%

Estimate of

Uncollectible

Accounts

Amount

$

13,750

3,860

4,157

3,560

1,736

1,860

1,188

b. If Allowance for Doubtful Accounts has a credit balance of $9,700, journalize the adjusting entry for the bad debt expense for the year. If

an amount box does not require an entry, leave it blank.

Debit Credit

30,111

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $622,324 and Allowance for Doubtful Accounts has a balance of $20,510. What is the net realizable value of the accounts receivable? a.$601,814 b.$642,834 c.$20,510 d.$622,324arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $410 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $7,470. Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $410 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $976,000 for the year. Amount added $fill in the blank 3 Ending balance $fill in the blank 4arrow_forwardPrepare the year-end adjusting entry for bad debts according to each of the following situations: Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10% of the year-end balance in accounts receivable. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is determined by an aging of accounts receivable.arrow_forward

- Under the allowance method, when $600 is authorised to be written off, the journal entry would be Select one: a. Debit Accounts Receivable $600, Credit Allowance for Doubtful Debts $200 b. Debit Bad Debts Expense $600, Credit Accounts Receivable $600 c. Debit Bad Debts Expense $600, Credit Allowance for Doubtful Debts $600 d. Debit Allowance for Doubtful Debts $600, Credit Accounts Receivable $600arrow_forwardUnder the direct write-off method of accounting for uncollectible accounts, Bad Debt Expense is recorded Oa. when a credit sale is past due O b. whenever a predetermined amount of credit sales has been made Oc. when an account is determined to be worthless O d. at the end of each accounting periodarrow_forwardjournalize the adjusting entry at December 31, assuming Macarty determines that Matisse's $900 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $1,100 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 10% of accounts receivable. veb-08.000.SI (c) If Allowance for Doubtful Accounts has a debit balance of $500 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. 33 E8-5 Godfreid Company has accounts receivebie of 395,400 at March 31, 2017. Credit terms are 2/10, n/30. At March 31, 2017, there is a $2,100 credit balance in Allowance for Doubtful Accounts prior to adjustment. The corpany uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Determin prepare t (LO 2), AF d ok) storyand p o teersl2la lgtantg boviooo Balance, March 31…arrow_forward

- At the beginning of the year, the balance in the Allowance for Doubtful Accounts is a credit of $743. During the year, $344 of previously written off accounts were reinstated and accounts totaling $756 are written off as uncollectible. The end-of-year balance (before adjustment) in the Allowance for Doubtful Accounts should be the one listed below. a.$331 b.$756 c.$344 d.$743arrow_forwardDd.22.arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $300 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $8,500. Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $500 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $1,000,000 for the year. Amount added $fill in the blank 3 Ending balancearrow_forward

- At the beginning of the year, the balance in Allowance for Doubtful Accounts is a credit of $752. During the year, previously written off accounts of $141 are reinstated and accounts totaling $710 are written off as uncollectible. The end-of-year balance (before adjustment) in Allowance for Doubtful Accounts should be a.$183 b.$710 c.$141 d.$752arrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forwardOn October 12 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the allowance method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets? Multiple Choice No effect on net income; no effect on total assets. Decrease in net income; no effect on total assets. Decrease in net income; decrease in total assets. No effect on net income; decrease in total assets.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education