FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Subject: acounting

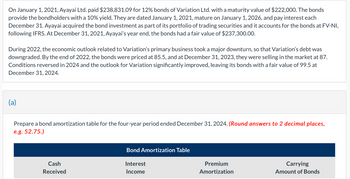

Transcribed Image Text:On January 1, 2021, Ayayai Ltd. paid $238,831.09 for 12% bonds of Variation Ltd. with a maturity value of $222,000. The bonds

provide the bondholders with a 10% yield. They are dated January 1, 2021, mature on January 1, 2026, and pay interest each

December 31. Ayayai acquired the bond investment as part of its portfolio of trading securities and it accounts for the bonds at FV-NI,

following IFRS. At December 31, 2021, Ayayai's year end, the bonds had a fair value of $237,300.00.

During 2022, the economic outlook related to Variation's primary business took a major downturn, so that Variation's debt was

downgraded. By the end of 2022, the bonds were priced at 85.5, and at December 31, 2023, they were selling in the market at 87.

Conditions reversed in 2024 and the outlook for Variation significantly improved, leaving its bonds with a fair value of 99.5 at

December 31, 2024.

(a)

Prepare a bond amortization table for the four-year period ended December 31, 2024. (Round answers to 2 decimal places,

e.g. 52.75.)

Cash

Received

Bond Amortization Table

Interest

Income

Premium

Amortization

Carrying

Amount of Bonds

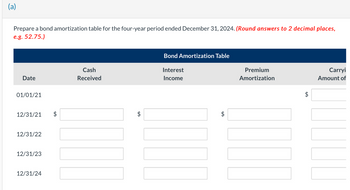

Transcribed Image Text:(a)

Prepare a bond amortization table for the four-year period ended December 31, 2024. (Round answers to 2 decimal places,

e.g. 52.75.)

Date

01/01/21

12/31/21

12/31/22

12/31/23

12/31/24

Cash

Received

$

Bond Amortization Table

Interest

Income

LA

Premium

Amortization

LA

Carryi

Amount of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education