FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please make the adjustments for December 31,2020.

That is complete data.

Thanks

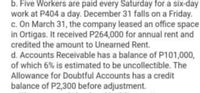

Transcribed Image Text:b. Five Workers are paid every Saturday for a six-day

work at P404 a day. December 31 falls on a Friday.

c. On March 31, the company leased an office space

in Ortigas. It received P264,000 for annual rent and

credited the amount to Unearned Rent.

d. Accounts Receivable has a balance of P101,000,

of which 6% is estimated to be uncollectible. The

Allowance for Doubtful Accounts has a credit

balance of P2,300 before adjustment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Based on the following information, determine the maximum loan amount available as of July 31, 2021. T The plan allows for two outstanding loans at a time. The participant took a loan of $45,000 on March 1, 2021. The participant's outstanding loan balance is $0 as of July 31, 2021. The participant's vested account balance is $150,000 . Answers: $0, $5,000, $50,000, or $75,000?arrow_forwardPrepare all necessary journal entries for 2024.arrow_forwardC&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28, 2021, to advance Jeff $35,000 on a one-year, 7 percent note, with interest to be paid at maturity on February 28, 2022. CSM prepares financial statements on June 30 and December 31. Required: Prepare the journal entries that CSM will make: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to whole dollar amount.) When the note is established To record the interest accruals at each quarter-end and interest payments at each payment date to record the principal payment at the maturity datearrow_forward

- Sheffield Marina has 300 available slips that rent for $900 per season. Payments must be made in full by the start of the boating season, April 1, 2021. The boating season ends October 31, and the marina has a December 31 year-end. Slips for future seasons may be reserved if paid for by December 31, 2021. Under a new policy, if payment for 2022 season slips is made by December 31, 2021, a 4% discount is allowed. If payment for 2023 season slips is made by December 31, 2021, renters get a 21% discount (this promotion hopefully will provide cash flow for major dock repairs).On December 31, 2020, all 300 slips for the 2021 season were rented at full price. On December 31, 2021, 213 slips were reserved and paid for the 2022 boating season, and 62 slips were reserved and paid for the 2023 boating season.(a) Prepare the appropriate journal entries for December 31, 2020, and December 31, 2021.arrow_forwardThe prepaid rent is P120,000 good for one year starting November 30, 2020. The balance sheet date is December 31, 2020. The prepayment was recorded under asset method. The correct rent expense for the given period would be:arrow_forwardThe answers were all incorrect for 2023, 2024, 2025, 2026, and 2027. Could you please recalculate them. Thank you.arrow_forward

- Explain clearlyarrow_forwardBlue Incorotation has a patent that will expire at the end of 2025. They spent $100,000 to successfully prosecute an infringement suit on July 1, 2018. The carrying value of this patent before the litigation is $300,000. Write journal entries to record for these activities.arrow_forwardFind the actual time and approximate time from October 5,2020 to June 30,2021.arrow_forward

- need help answering part D on total assets for 2022arrow_forwardWiam water supply services orders a water pump and expects the delivery in 30 days. The order was placed in 1st January, 2019 with an estimated cost of RO 8000. The water pump was delivered on time by the supplier on 30th January, 2019 with a voucher of RO 8,100. The voucher was approved on 6th February 2019 and the payment was settled on 7th February, 2019. Based on the above case, answer the following six questions (Questions 45-50) Question 45 Question text In the above case the disbursement is recorded on: a. 1st July, 2019 b. 30th January, 2019 c. 7th February, 2019 d. 6th February, 2019 Question 46 Question text Suppose the order made on 1st January is cancelled later on 10th January, which among the following will be the correct accounting treatment? a. A fresh encumbrance is made again on 10th January b. There will be no effect on the encumbrance control account c. The encumbrance made earlier is reversed. d. The available fund balance…arrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education