Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

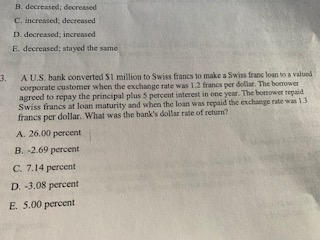

Transcribed Image Text:B. decreased; decreased.

C. increased; decreased

D. decreased; increased

E. decreased; stayed the same

A U.S. bank converted S1 million to Swiss francs to make a Swiss franc loan to a valued

3.

corporate customer when the exchange rate was 1.2 francs per dollar. The borower

agreed to repay the principal plus 5 percent interest in one year. The bomower repaid

Swiss francs at loan maturity and when the loan was repaid the exchange rate was 1.3.

francs per dollar. What was the bank's dollar rate of return?

A. 26.00 percent

B. -2.69 percent

C. 7.14 percent

D. -3.08 percent

E. 5.00 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US$. Information for Forward Contract: Forward exchange rate (one yr): 1.54 $/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50 $/BP Investment return at Aerion Fund Management (in UK): 4% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015 $/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54 $/BP What are the costs of MMI? (Answer in US$ of course. You are US company!) Group of answer choices None of the above $789,343 $735,504 $770,082 $783,452arrow_forwardAt the beginning of year 1 the Terranian central bank conducted TEK100 million of dollar selling/terranian kwacha buying intervention. The intervention was undertaken at the rate of 1 dollar per kwacha and immediately afterwards the currency strengthened to 11 dollars per kwacha and stayed there. At the end of year 5 the exchange rate is still at 1.1 whilst kwacha 1 year interest rates are (and have always been) 4% whilst dollar 1 year interest rates are (and have always) been 0.25%. What is the profit/loss of the intervention at the end of year 5 in million Kwacha? Quote you answer to 1 decimal place and express a loss by putting a'in front of your answer (if a profit do not put a '+ Answer: Next piarrow_forwardklp.4arrow_forward

- Nonearrow_forward. AU.S. bank can earn 6% on dollar loans or 8% on pound denominated loans to British concerns. The bank currently has $500 million in dollar loans and British pound loans equivalent to $400 million. The loans are funded by dollar denominated CDs paying 4%. All loans and CDs are on single payment terms. The current spot rate for pounds is S1.8604 and the one year forward rate is $1.8405.TWhat is the bank's spread if they fully hedge their exposure to pounds?arrow_forwardCompany A (a U.S. MNC) wants to borrow £10,000,000 at a fixed rate for five year. Company B (a U.K. MNC) wants to borrow $16,000,000 at a fixed rate for five year. Today's exchange rate is £1- $1.6. The information below summarizes what each company can do without using swaps. Company A Company B $ Loans 8 10.6 £ Loans 11.6 12.4 If Company A wants to save 0.3% of the £10,000,000 loan through a Swap Bank, and If Company B wants to save 0.2% of the $16,000,000 loan through a Swap Bank. How much can the Swap bank earn on pound (£) loans (in terms of %) after meeting Company A and Company B's demand? (if your answer is 1.34%, just enter "1.34". If your answer is -1.34%, just enter"-1.34").arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education