A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

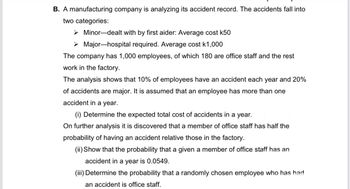

Transcribed Image Text:B. A manufacturing company is analyzing its accident record. The accidents fall into

two categories:

➤Minor-dealt with by first aider: Average cost k50

➤ Major-hospital required. Average cost k1,000

The company has 1,000 employees, of which 180 are office staff and the rest

work in the factory.

The analysis shows that 10% of employees have an accident each year and 20%

of accidents are major. It is assumed that an employee has more than one

accident in a year.

(i) Determine the expected total cost of accidents in a year.

On further analysis it is discovered that a member of office staff | half the

probability of having an accident relative those in the factory.

(ii) Show that the probability that a given a member of office staff has an

accident in a year is 0.0549.

(iii) Determine the probability that a randomly chosen employee who has had

an accident is office staff.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Burning fuels in power plants and motor vehicles emits carbon dioxide (CO2), which contributes to global warming. The CO2 emissions (metric tons per capita) for countries varies from 0.02 in Burundi to 44.02 in Qatar. Although the data set includes 214 countries, the CO2 emissions of 15 countries are not available on the World Bank database. The data set is too large to display but the data for the first five countries is given. Use the full data set with data on the 214 countries to answer the questions. To access the complete data set, click the link for your preferred software format: Excel Minitab JMP SPSS TI R Mac-TXT PC-TXT CSV Crunchlt! Country CO2 Emissions (Metric Tons per Capita) Aruba 23.92 Andorra 5.97 Afghanistan 0.43 Angola 1.35 Albania 1.61 Find the mean and the median for the full data set. Round your answers to three decimal places. The mean for these data is tons per person The median for these data is tons per personarrow_forwardProfitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 73 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy. Use the accompanying multiple linear regression results to complete parts (a) and (b) below. Variable Coefficient Standard Error 0.30408 0.00539 -0.24116 0.01953 0.04922 0.01517 Intercept Efficiency Ratio, X₁ Risk-Based Capital, X₂ t Statistic - 0.79 3.62 3.24 (Round to four decimal places as needed.) p-value 0.4304 0.0005 0.0018 C a. Construct a 95% confidence interval estimate of the population slope between ROA and efficiency ratio.arrow_forwardProfitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 20 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy. Complete parts (a) through (g) below. Click the icon to view the data table. a. State the multiple regression equation. Let X₁, represent the efficiency ratio (%) and let X₂; represent the total risk-based capital (%). Ý TO DX DX = + + (Round the constant to two decimal places as needed. Round the coefficients to four decimal places as needed.) Distribution Costs ROA (%) 1.13 1.22 0.82 1.15 0.81 1.23 0.67 1.35 0.95 0.71 0.69 1.10 0.87 1.02 0.86 1.74 1.02 1.76 0.90 0.68 Efficiency…arrow_forward

- 5. The electric power consumed each month by a chemical plant to thought to be related to the average ambient temperature x₁, the number of days in the month X2, the average product purity x3, and the tons of product produced x4. The past year's historical data are available and are presented in the following table. y 240 236 270 274 301 316 300 296 267 276 288 261 X₁ 25 31 45 60 65 72 80 84 75 60 50 38 X₂ 24 21 24 25 25 26 25 25 24 25 25 23 X3 91 90 88 87 91 94 87 86 88 91 90 89 X4 100 95 110 88 94 99 97 96 110 105 100 98arrow_forwardMorning House is a mail-order firm which carries a wide range of rather expensive art objects for homes and offices. It operate problems would be greatly reduced. Since it takes approximately six weeks to receive 90% of the response to a given campaign, an accurate prediction of total sales made as late as the end of the first week of receiving orders would be useful. The first week’s sales and total sales of the last 12 campaigns of the firm are shown below. Can the first week’s sales be used to predict total sales? First week’s Total Campaign Sales Sales 1 32 167 2 20 91 3 114 560 4 66 335 5 18 70 6 125 650 7 83 401 8 65 320 9 94 470 10 5 15 11 39 210 12 50 265 --------------------------------------------arrow_forward2.arrow_forward

- The table to the right represents the annual percentage of smartphones sold in a certain region in 2011, 2012, and 2013 (projected). a. What conclusions can you reach about the market for smartphones in 2011, 2012, and 2013? b. What differences are there in the market for smartphones in 2011, 2012, and 2013? a. Select all that apply. A. Type 6 had the smallest or close to the smallest percentage of smartphones sold in all three years. B. Type 3 had the second largest percentage of smartphones sold in all three years. C. Type 1 had the largest percentage of smartphones sold in all three years. D. Type 5 had the smallest or close to the smallest percentage of smartphones sold in all three years. E. Type 2 had the second largest percentage of smartphones sold in all three years. Туре Type 1 Type 2 Type 3 Type 4 Type 5 Type 6 2011 44% 21% 21% 10% 1% 3% 2012 69% 16% 4% 6% 3% 2% 2013 63% 17% 1% 3% 13% 3%arrow_forwardProfitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 20 community banks include the ROA (%), the efficiency ratio (%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (%), as a measure of capital adequacy. Complete parts (a) through (g) below. Click the icon to view the data table. a. State the multiple regression equation. Let X₁¡ represent the efficiency ratio (%) and let X₂¡ represent the total risk-based capital (%). Ŷ₁=+X₁₁+Xzi (Round the constant to two decimal places as needed. Round the coefficients to four decimal places as needed.) Distribution Costs ROA (%) 1.04 0.77 0.14 1.44 0.90 1.16 1.07 1.58 1.45 1.15 1.17 3.40 0.86 0.66 0.81 1.14 0.83 0.86 1.14 1.04 TOlal Efficiency…arrow_forwardC8. According to the Pew Research Center (2015), recent immigrants are better educated than earlier immigrants to the United States. The change was attributed to the availability of better education in each region or country of origin. The percentage of immigrants 25 years of age and older who completed at least high school is reported in this table for 1970 to 2013. Write a statement describing the change over time in the percentage who completed at least a high school degree. 1970 1980 1990 2000 2013 Mexico 14 17 26 30 48 Other Central/South America 57 53 60 66 Asia 75 72 75 82 84 48 68 81 87 95 Europe 36 48 52 58 72 Caribbean 81 91 88 85 85 Africa Source: Pew Research Center, Modern Immigration Wave Brings 59 Million to U.S., Driving Population Growth and Change Through 2065, 2015. Retrieved from https://www.pewresearch.org/hispanic/2015/09/28/modern- immigration-wave-brings-59-million-to-u-s-driving-population-growth-and-change-through-2065/ 52arrow_forward

- A researcher thinks some social media sites are more prone to narcissistic behavior (excessive posting) than others. To examine the relationship between narcissism and social media, she recruits users of three different social media sites (Facebook, Twitter and Instagram), follows them for 24 hours and records the number of posts made by each user. The number of posts is given in the table below. Twitter Facebook Instagram 10 7 14 10 8. 10 10 10 11 9. www. 12 wwww. 11 13 12 8. 7 8. 11 8 10 12 11 11 a. Perform a complete hypothesis test to determine whether there are any significant differences among the three groups. Test at the .05 level of significance. SHOW ALL YOUR WORK b. Do you need to perform post hocs? Explain but do not compute the post hocs. C. Compute effect size. d. Summarize your findings in a source table. e. Write an interpretation of our results in APA-format (include means and SDs in your interpretation)arrow_forwardI have collected real data on the sale of a microwavable cup of soup across 20 different cities for the same time period (a month). The variables in the dataset are: Quantity sold in the city for that month: Measured in thousands of units Price: measured in dollars Average Income in the city: Measured in thousands of dollars Ads: Average number of ads run in stores for that city during that month. Price of a substitute product: measured in dollars Population of the city: measured in thousands of people The dataset is on Canvas and, using Excel or any other statistical software, please answer the following questions: 1. Describe the patterns in quantity sold and own and rival prices during this time period using basic descriptive statistics. Graphs are welcome as well. 2. Take the logs of the variables, and estimate the demand function. a. Interpret the R-square. b. Interpret the coefficients for logP and logPsub c. Interpret the p-values associated with each independent…arrow_forward6. Accidents on highways are one of the main causes of death or injury in developing countries and the weather conditions have an impact on the rates of death and injury. In foggy, rainy, and sunny conditions, 1/4, 1/8, and 1/21 of the accidents result in death, respectively. Sunny conditions occur 60% of the time, while rainy and foggy conditions each occur 20% of the time. Given that an accident without deaths occurred, what is the conditional probability that it was foggy at the time?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON