FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

During the first month of operations ended August 31, Kodiak Fridgeration Company manufactured 46,000 mini refrigerators, of which 42,000 were sold. Operating data for the month are summarized as follows:

|

1

|

Sales

|

|

$9,660,000.00

|

|

2

|

|

|

|

|

3

|

Direct materials

|

$3,220,000.00

|

|

|

4

|

Direct labor

|

1,380,000.00

|

|

|

5

|

Variable manufacturing cost

|

828,000.00

|

|

|

6

|

Fixed manufacturing cost

|

506,000.00

|

5,934,000.00

|

|

7

|

Selling and administrative expenses:

|

|

|

|

8

|

Variable

|

$756,000.00

|

|

|

9

|

Fixed

|

294,000.00

|

1,050,000.00

|

| Required: | |||

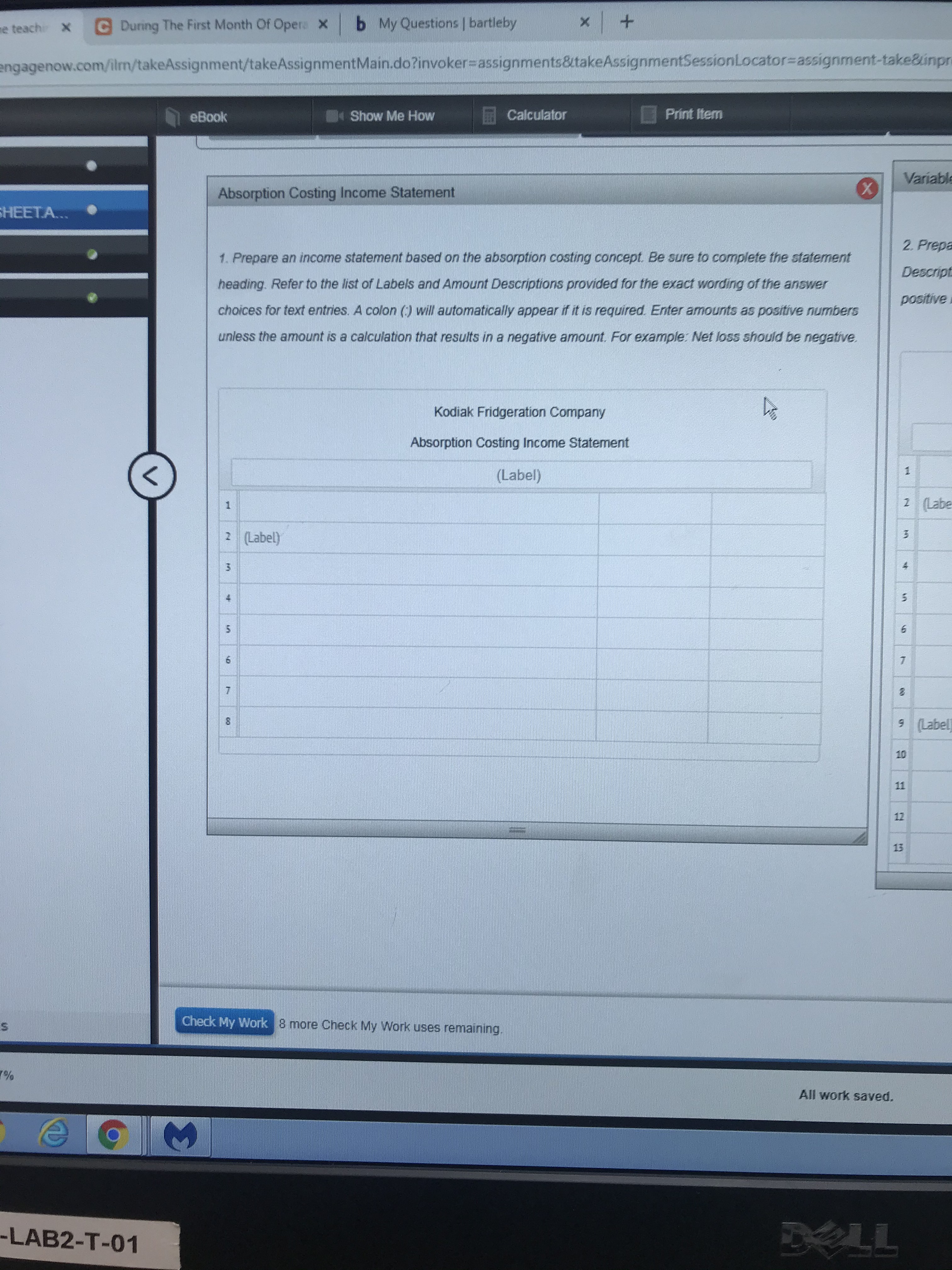

| 1. | Prepare an income statement based on the absorption costing concept.* | ||

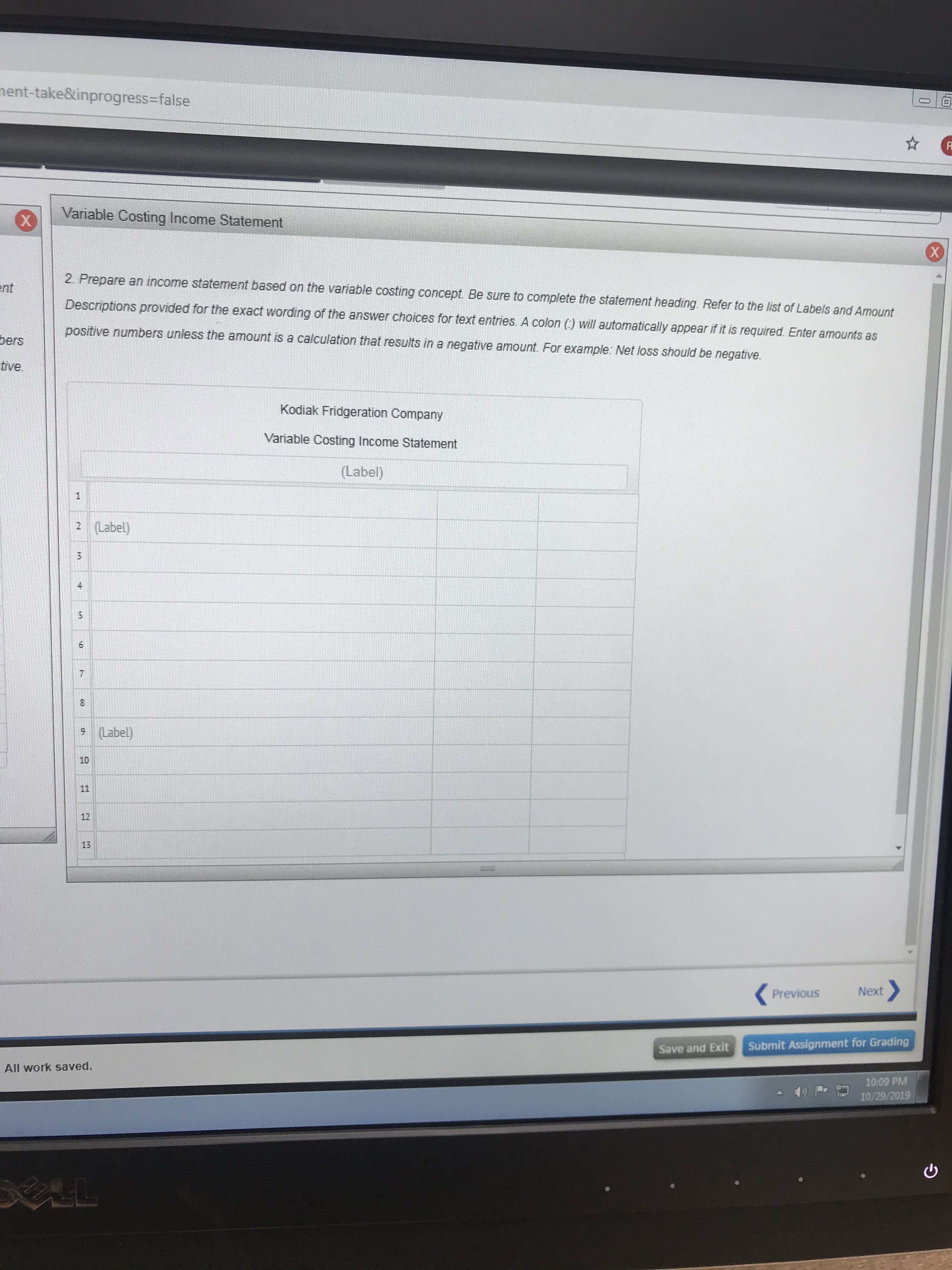

| 2. | Prepare an income statement based on the variable costing concept.* | ||

| 3. | Explain the reason for the difference in the amount of operating income reported in (1) and (2).

|

| Labels | |

| August 31 | |

| Cost of goods sold | |

| Fixed costs | |

| For the Month Ended August 31 | |

| Variable cost of goods sold | |

| Amount Descriptions | |

| Contribution margin | |

| Contribution margin ratio | |

| Cost of goods manufactured | |

| Fixed manufacturing costs | |

| Fixed selling and administrative expenses | |

| Gross profit | |

| Operating income | |

| Inventory, August 31 | |

| Loss from operations | |

| Manufacturing margin | |

| Planned contribution margin | |

| Sales | |

| Sales mix | |

| Selling and administrative expenses | |

| Total cost of goods sold | |

| Total fixed costs | |

| Total variable cost of goods sold | |

| Variable cost of goods manufactured | |

| Variable selling and administrative expenses |

Transcribed Image Text:b My Questions bartleby

X

C During The First Month Of Opera X

me teach X

engagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpr

Calculator

Print Item

Show Me How

eBook

Variable

Absorption Costing Income Statement

HEETA...

2. Prepa

1. Prepare an income statement based on the absorption costing concept. Be sure to complete the statement

Descript

heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer

positive.

choices for text entries. A colon () will automatically appear if it is required. Enter amounits as positive numbers

unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative

Kodiak Fridgeration Company

Absorption Costing Income Statement

1

(Label)

2 (Labe

2 (Label)

3

4

5

6

7

7

9 (Label

10

11

12

13

Check My Work

8 more Check My Work uses remaining.

All work saved.

LL

-LAB2-T-01

Transcribed Image Text:nent-take&inprogress-false

Fr

Variable Costing Income Statement

2. Prepare an income statement based on the variable costing concept. Be sure to complete the statement heading. Refer to the list of Labels and Amount

ent

Descriptions provided for the exact wording of the answer choices for text entries. A colon () will automatically appear if it is required. Enter amounts as

positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative.

bers

tive.

Kodiak Fridgeration Company

Variable Costing Income Statement

(Label)

2 (Label)

9 (Label)

10

11

12

13

Next

Previous

Submit Assignment for Grading

Save and Exit

All work saved.

10:09 PM

10/29/2019

LL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shawnee Motors Inc. assembles and sells snowmobile engines. The company began operations on August 1 and operated at 100% of capacity during the first month. The following data summarize the results for August: 1 Sales (32,000 units) $8,000,000.00 2 Production costs (41,000 units): 3 Direct materials $3,280,000.00 4 Direct labor 2,255,000.00 5 Variable factory overhead 1,025,000.00 6 Fixed factory overhead 615,000.00 7,175,000.00 7 Selling and administrative expenses: 8 Variable selling and administrative expenses $1,180,000.00 9 Fixed selling and administrative expenses 210,000.00 1,390,000.00 Required: a. Prepare an income statement according to the absorption costing concept.* b. Prepare an income statement according to the variable costing concept.* c. What is the reason for the difference in the amount of income from operations reported in…arrow_forwardO’Brien Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: Variable costs per unit: Manufacturing: Direct materials $ 26 Direct labor $ 15 Variable manufacturing overhead $ 5 Variable selling and administrative $ 2 Fixed costs per year: Fixed manufacturing overhead $ 570,000 Fixed selling and administrative expenses $ 140,000 During its first year of operations, O’Brien produced 96,000 units and sold 77,000 units. During its second year of operations, it produced 85,000 units and sold 99,000 units. In its third year, O’Brien produced 87,000 units and sold 82,000 units. The selling price of the company’s product is $79 per unit. 4. Assume the company uses absorption costing and a LIFO inventory flow assumption (LIFO means last-in first-out. In other words, it assumes that the newest units in inventory are sold first): Compute the unit product cost for Year 1, Year 2, and…arrow_forwardThe following information pertains to the first year of operation for Crystal Cold Coolers Incorporated: Number of units produced Number of units sold Unit sales price 3,000 2,400 $ 350 $70 $ 55 Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit $ 13 $65 $ 26,400 $ 63,000 Fixed manufacturing overhead per unit ($195,000+3,000 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. Complete this question by entering your answers in the tabs below. Full Absorption Costing Variable Costing. Prepare Crystal Cold's full absorption costing income statement for the year. Crystal Cold Coolers Incorporated Full Absorption Costing Income Statement Sales Less: Cost of goods sold Gross margin Less: Non-manufacturing expenses Variable selling expense Fixed general and administrative…arrow_forward

- The accounting records for Portland Products report the following manufacturing costs for the past year. Direct materials $ 390,000 Direct labor 262,000 Variable overhead 231,000 Production was 170,000 units. Fixed manufacturing overhead was $860,000. For the coming year, costs are expected to increase as follows: direct materials costs by 20 percent, excluding any effect of volume changes; direct labor by 4 percent; and fixed manufacturing overhead by 10 percent. Variable manufacturing overhead per unit is expected to remain the same. Required A: Prepare a cost estimate for a volume level of 136,000 units of product this year. (Do not round intermediate calculations.) Cost Item This Year’s cost Direct materials _______________ Direct labor…arrow_forwardPrior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: 1 Sales (28,800 × $75) $2,160,000.00 2 Manufacturing costs (28,800 units): 3 Direct materials 1,209,600.00 4 Direct labor 316,800.00 5 Variable factory overhead 115,200.00 6 Fixed factory overhead 221,760.00 7 Fixed selling and administrative expenses 28,400.00 8 Variable selling and administrative expenses 34,900.00 The company is evaluating a proposal to manufacture 36,000 units instead of 28,800 units, thus creating an ending inventory of 7,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. Required: a. Prepare an estimated income statement, comparing operating results if 28,800 and 36,000 units are manufactured in (1) the absorption costing…arrow_forwardThe following data pertain to the operations of Deci, Inc. in the most recent month for the production of its only product, which sells for $297: Beginning inventory: 4, 000 Units Produced: 46,000 Units Sold: 47,000 Variable Costs per unit: Direct materials: $84 Direct Labor: $93 Manufacturing Overhead: $18 Selling and Administrative: $30 Fixed Costs: Manufacturing overhead: $1,912, 680 Selling and administrative: $1,954, 260 What is the variable costing unit product cost?arrow_forward

- Mahoko PLC's planned production for the year just ended was 18,400 units. This production level was achieved, and 21,200 units were sold. Other data follow: Direct material used $ 552,000 Direct labor incurred 259,440 Fixed manufacturing overhead 390,080 Variable manufacturing overhead 198,720 Fixed selling and administrative expenses 329,360 Variable selling and administrative expenses 100,280 Finished-goods inventory, January 1 3,500 units The cost per unit remained the same in the current year as in the previous year. There were no work-in-process inventories at the beginning or end of the year. Required: 1. What would be Mahoko PLC’s finished-goods inventory cost on December 31 under the variable-costing method? Note: Do not round intermediate calculations. 2-a. Which costing method, absorption or variable costing, would show a higher operating income for the year? 2-b. By what amount?arrow_forwardDuring the first month of operations ended August 31, Kodiak Fridgeration Company manufactured 48,000 mini refrigerators, of which 44,000 were sold. Operating data for the month are summarized as follows: 1 Sales $8,800,000.00 2 Manufacturing costs: 3 Direct materials $3,360,000.00 4 Direct labor 1,344,000.00 5 Variable manufacturing cost 816,000.00 6 Fixed manufacturing cost 528,000.00 6,048,000.00 7 Selling and administrative expenses: 8 Variable $528,000.00 9 Fixed 352,000.00 880,000.00 Required: 1. Prepare an income statement based on the absorption costing concept.* 2. Prepare an income statement based on the variable costing concept.*arrow_forwardDenton Company manufactures and sells a single product. Cost data for the product are given: Variable costs per unit: Direct materials $ 5 Direct labor 10 Variable manufacturing overhead 3 Variable selling and administrative 1 Total variable cost per unit $ 19 Fixed costs per month: Fixed manufacturing overhead $ 108,000 Fixed selling and administrative 169,000 Total fixed cost per month $ 277,000 The product sells for $48 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced Units Sold July 27,000 23,000 August 27,000 31,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: July August Sales $ 1,104,000 $1,488,000 Cost of goods sold 506,000 682,000 Gross margin 598,000 806, 000 Selling and administrative expenses 192,000 200,000 Net operating income $ 406,000 $ 606,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education