FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

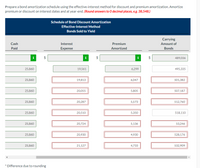

Transcribed Image Text:Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize

premium or discount on interest dates and at year-end. (Round answers to O decimal places, e.g. 38,548.)

Schedule of Bond Discount Amortization

Effective-Interest Method

Bonds Sold to Yield

Carrying

Cash

Interest

Premium

Amount of

Paid

Expense

Amortized

Bonds

i

$

2$

489,036

25,860

19,561

6,299

495,335

25,860

19,813

6,047

501,382

25,860

20,055

5,805

507,187

25,860

20,287

5,573

512,760

25,860

20,510

5,350

518,110

25,860

20,724

5,136

53.246

25,860

20,930

4,930

528,176

25,860

21,127

4,733

532,909

* Difference due to rounding

Transcribed Image Text:(b)

Bonita Co. sells $431,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the

bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Bonita buys back $137,920 worth of bonds for

$144,920 (includes accrued interest). Give entries through December 1, 2022.

Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize

premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ee 148.arrow_forwardBonita Co. sells $399,000 of 12% bonds on June 1, 2025. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2029. The bonds yield 8%. On October 1, 2026, Bonita buys back $119,700 worth of bonds for $126,700 (includes accrued interest). Give entries through December 1, 2027. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to O decimal places, e.g. 38,548.) Date 6/1/25 12/1/25 6/1/26 12/1/26 6/1/27 12/1/27 6/1/28 Cash Paid $ Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yield Interest Expense tA Premium Amortized A Carryin Value o Bondsarrow_forwardEllis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments.arrow_forward

- Lok issued 8%, 80, 000 bonds on February 1, 2024. The bonds pay interest each July 31 and January 31 and were issued to yield 7% to investors. The bonds mature on January 31, 2034. Compute the amount of cash Lok will receive when it issues these bonds. Prepare an amortization schedule that shows how the discount or premium on the bonds will be amortized over their term. Prepare journal entries required on the following dates: February 1, 2024 issuance of the bonds. July 31, 2024 date of the first interest payment. December 31, 2024 accrual of interest through the end of the fiscal year. January 31, 2025 - date of the second interest payment. January 31, 2034 the date the principal is repaid. What would be the entry to record the issuance of the bonds if they are not issued until March 1 (that is, between interest dates)? Under the original assumption that the bonds are issued February 1, 2024 How much would it cost Lok to pay off the bonds early (by repurchasing them from the open…arrow_forwardOn January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forwardOn July 1, 2019, Cyclic Inc issued $1,000,000 in principal of 6% bonds due in July 2024. The bond pays interest quarterly on January 2, April 1, July 1, and October 1. On July 1, 2020, immediately following an interest payment. Epimetheus Bank purchased $5000 in face value of these bonds for $4501. Epimetheus Bank intends to trade this bond as part of its business operations. When Epimetheus Bank purchased the bond, it calculated that the historical market rate was 9%. When Epimetheus Bank received the interest payment on October 1,2020, what were the journal entries? Select all that apply. Cr. Interest revenue $75 Dr. Amortization of discount on trading debt $26 Cr. Interest revenue $101 Dr Cash $75 Dr Cash $101 Cr. Trading debt receivable $26arrow_forward

- Roarie LLC issued 10,000, $1,000 bonds on January 1, 2020. The bonds have a 10-year term and pay interest semiannually. This is a partial bond amortization schedule for the bonds: Cash Payment Interest A. $4,261,329 B. $7,738,658 C. $4,000,000 D. $3,738,658 Effective Decrease in Interest Balance Disct Cash 1 200,000 313,067 113,067 2 200,000 318,720 118,720 3 200,000 324,657 124,657 4 200,000 330,889 130,889 What would be the total interest cost of the bonds over their full term? Outstanding Balance 10,000,000 (6,261,343) 3,738,658 4,000,000 7,738,658 6,261,343 6,374,410 6,493,130 6,617,787 6,748,676arrow_forwardSpurrier Corp. has 10-year bonds with a face value of $400,000 and a carrying value of $420,345 as of 12/31/19. On June 30, 2020, they pay their bondholders $12,000 and recognize $10,509 in interest expense. Please provide the June 30, 2019 carrying value of the bonds after the interest payment.arrow_forwardOn May 1, 2018, Green Corporation issued $1,100,000 of 12% bonds, dated January 1, 2018, for $1,074,000 plus accrued interest. The bonds mature on December 31, 2032, and pay interest semiannually on June 30 and December 31. Green's fiscal year ends on December 31 each year. Required: 1. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. 2. Prepare the journal entry for the issuance of the bonds. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the amount of accrued interest that was included in the proceeds received from the bond sale. Accrued interestarrow_forward

- Sheridan Inc. issues $5,000,000, 5-year, 10% bonds at 101, with interest payable annually on January 1. The straight-line method is used to amortize bond premium. a) Prepare the journal entry to record the sale of these bonds on January 1, 2022 b)arrow_forwardOn January 1, 2021, Shay Company issues $300,000 of 10%, 15-year bonds. The bonds sell for $293,250. Six years later, on January 1, 2027, Shay retires these bonds by buying them on the open market for $315,750. All interest is accounted for and paid through December 31, 2026, the day before the purchase. The straight-line method is used to amortize any bond discount. 1. What is the amount of the discount on the bonds at issuance?2. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2021, through December 31, 2026?3. What is the carrying (book) value of the bonds as of the close of business on December 31, 2026?4. Prepare the journal entry to record the bond retirement.arrow_forwardGreat Lake Glassware Company issues $1,050,000 of its 16%, 10-year bonds at 94 on February 28, 2024. The bonds pay interest on February 28 and August 31. Assume that Great Lake uses the straight-line method for amortization The journal entry to record the first interest payment on August 31, 2024 includes a OA. debit to Interest Expense for $87,150. OB. debit to Cash for $84,000. OC. debit to Discount on Bonds Payable for $3,150 OD. debit to Interest Expense for $80,850arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education