Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

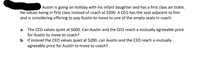

Transcribed Image Text:Austin is going on holiday with his infant daughter and has a first class air ticket.

He values being in first class instead of coach at $300. A CEO has the seat adjacent to him

and is considering offering to pay Austin to move to one of the empty seats in coach.

a. The CEO values quiet at $600. Can Austin and the CEO reach a mutually agreeable price

for Austin to move to coach?

b. If instead the CEO values quiet at $200, can Austin and the CEO reach a mutually

agreeable price for Austin to move to coach?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Roxy Theatre is a monopoly. Roxy discovers that at the price that maximizes its profit, seniors are not coming to the theatre. So Roxy conducts a survey. The table reveals the results of the survey. Roxy decides to price discriminate among patrons who attend on weekends and those who attend on weekdays. Price (dollars per ticket) Weekends Quantity demanded (tickets per week) Weekdays 18.00 0 15.00 100 0 12.00 200 0 If the marginal cost of a show is $6.00, what price does Roxy charge on weekdays and what price does Roxy change on weekends to maximize profit? 9.00 300 0 6.00 300 200 3.00 300 300 If the marginal cost of a show is $6.00, Roxy will maximize profit by charging on weekdays and charging. a ticket on the weekend. a ticketarrow_forwardAssume you wrote up a proposal requesting $5000 for charity. The money would be used to buy food that volunteers (employees from the company) would distribute to the homeless on Saturday. The proposal is approved and you receive the money. However, the CEO comes to you and asks, "What will be the return on the investment?" How would you reply?arrow_forwardKryptonite is a telecommunications provider located in Iowa with hundreds of thousands of employees. Their CEO, Clark Klein, is considering the replacement of their expensive Defined Benefit (DB) Pension Plan which requires large contributions every year with a 401(K) where the employees will bear the investment risk. The majority of the workforce is young, and the top executives are all in their 50s and 60s. An intern recommends utilizing a DB/K plan, which is a combination DB and 401(k) plan. What are the pros an cons of this plan in this case?arrow_forward

- T wins a door prize as the one-thousandth customer walking through the door of his favoritecoffee shop. He is given a choice of $1,000 in cash or a cappuccino machine(which cost the shop $1,000, but has a retail value of $1,500). T chooses the machine.a. T has realized at least $1,000 of income.b. T will recognize income only if and when he sells the machine.c. Both (a) and (b) are correct.d. None of the above. T bought an antique desk and chair from her employer for $50 in Year 1 when the firmbought all new office furniture. The desk and chair had a fair market value of $500.The property increases in value to $700 in Year 2, and T sells it for $900 in Year 3.a. T has realized income of $450 in Year 1 only if the difference between thevalue of the items and their price was intended as compensation.b. T will realize income of $450 in Year 1 regardless of her employer’s motive.c. T will realize income in Year 2 because the property has increased in value.d. None of the abovearrow_forwardreases Imagine yourself in the position of Thomas Pierce . president of Greymare Bus Lines. Your firm was established by your grandfather, who was quick to capitalize on the growing demand for transportation between Widdicombe and nearby townships. The company has owned all its vehicles from the time the company was formed: you are now reconsidering that policy. Your operating manager wants to buy a new bus costing $100,000. The bus will last only eight years before going to the scrap yard. You are convinced that investment In the additional equipment is worthwhile. However, the representative of the bus manufacturer has pointed out that her firm would also be willing to lease the bus to you for eight annual payments of $16,200 each. Greymare would remain responsible for all maintenance, Insurance, and operating expenses. If Greymare does not own the bus it cannot depreciate it and therefore, it gives up a valuable depreciation tax shield. We assume depreciation would be calculated…arrow_forwardYou own a restaurant and are considering additional waiters. Alfred’s pay scheme would be $120 per evening. Blanchard’s pay scheme would be $10 per table served. A. Which would be considered a variable coat and which a fixed cost? B. Charles, a third potential waiter, asks for $60 per evening plus $5/table. From the perspectives of Alfred, Blanchard an Charles, who is taking the most risk and who the least? Who has the most to gain and who the least? C. As you are about to choose, Dutch enters and offers the following: He will accept $7.50/table but wants a guaranteeof minimum $30 per evening. Comparing Charles’ and Dutch’s offers, where do they “break even” for you (i.e., at how many tables will you be paying them the same amount)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education