FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

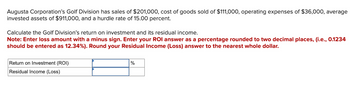

Transcribed Image Text:Augusta Corporation's Golf Division has sales of $201,000, cost of goods sold of $111,000, operating expenses of $36,000, average

invested assets of $911,000, and a hurdle rate of 15.00 percent.

Calculate the Golf Division's return on investment and its residual income.

Note: Enter loss amount with a minus sign. Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234

should be entered as 12.34%). Round your Residual Income (Loss) answer to the nearest whole dollar.

Return on Investment (ROI)

%

Residual Income (Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Briggs Company has operating income of $45,760, invested assets of $143,000, and sales of $457,600. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardBustamante Company has income from operations of $24,480, invested assets of $85,000, and sales of $204,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forwardMyrtle Company has sales of $128,000, cost of goods sold of $58,000, operating expenses of $12,000, average invested assets of $400,000, and a hurdle rate of 7.75 percent. Calculate Myrtle's return on investment and its residual income. Note: Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answer to the nearest whole dollar. Return on Investment (ROI) Residual Income (Loss) %arrow_forward

- Violet Company has sales of $463,000, net operating income of $248,000, average invested assets of $794,000, and a hurdle rate of 8.50 percent. Calculate Violet's return on investment and its residual income. Note: Enter your ROI answer as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answer to the nearest whole dollar. Return on Investment (ROI) Residual Income (Loss) 31.23%arrow_forwardMargin, Turnover, Return on Investment Pelak Company had sales of $5,003,000, expenses of $4,607,000, and average operating assets of $4,840,000. Required: 1. Compute the operating income.$ 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin % Turnover 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.%arrow_forwardBottlebrush Company has income from operations of $66,410, invested assets of $229,000, and sales of $664,100. Use the DuPont formula to calculate the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit Margin fill in the blank 1 % b. Investment Turnover fill in the blank 2 c. Return on Investment fill in the blank 3 %arrow_forward

- Bottlebrush Company has operating income of $58,328, invested assets of $317,000, and sales of $729,100. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit margin b. Investment turnover c. Return on investment % %arrow_forwardKeller Cosmetics maintains an operating profit margin of 8.15% and a sales-to-assets ratio of 3.20. It has assets of $530,000 and equity of $330,000. Assume that interest payments are $33,000 and the tax rate is 30%. a. What is the return on assets? b. What is the return on equity? Note: For all requirement, enter your answers as a percent rounded to 2 decimal places. a. Return on assets b. Return on equity % %arrow_forward(This is what is in between the 1st and 2nd screenshot) Using these data, determine the following: Earnings per share. Round your answer to two decimal places. Price-to-earnings ratio. Round your answer to two decimal places. Book value per share. Round your answer to two decimal places. Market-to-book ratio. Round your answer to two decimal places. EV-EBITDA multiple. Assume the cost of sales includes $14 million in depreciation expenses. Assume there are no amortization expenses. Round your answer to two decimal places. How much of the retained earnings total was added during Year 1? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places.$ million Show Eastland’s new balance sheet after the company sells 1 million new common shares in early Year 2 to net $28 a share. Part of the proceeds, $12 million, is used to reduce current liabilities, and the remainder is temporarily…arrow_forward

- Profit Margin, Investment Turnover, and ROI Briggs Company has operating income of $13,824, invested assets of $96,000, and sales of $230,400. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ? b. Investment turnover ? c. Return on investment ?arrow_forwardThe Bottlebrush Company has income from operations of $69,768, invested assets of $204,000, and sales of $775,200. Round answers to one decimal place. (a) Determine the profit margin. % (b) Determine investment turnover. (c) Use the DuPont formula to determined the rate of return on investment. %arrow_forwardBottlebrush Company has operating income of $150,720, invested assets of $314,000, and sales of $1,004,800. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education