FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Differential Analysis Involving Opportunity Costs

On August 1, Rantoul Stores Inc. is considering leasing a building and purchasing the necessary equipment to operate a retail store. Alternatively, the company could use the funds to invest in $1,000,000 of 4% U.S. Treasury bonds that mature in 15 years. The bonds could be purchased at face value. The following data have been assembled:

| Cost of store equipment | $1,000,000 | |

| Life of store equipment | 15 years | |

| Estimated residual value of store equipment | $50,000 | |

| Yearly costs to operate the store, excluding | ||

| $200,000 | ||

| Yearly expected revenues—years 1–6 | $300,000 | |

| Yearly expected revenues—years 7–15 | $400,000 |

Transcribed Image Text:3. If the proposal is accepted, what would be the total estimated operating income of the store for the 15 years?

4,950,000 X

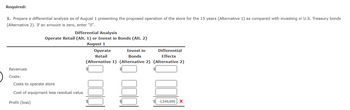

Transcribed Image Text:Required:

1. Prepare a differential analysis as of August 1 presenting the proposed operation of the store for the 15 years (Alternative 1) as compared with investing in U.S. Treasury bonds

(Alternative 2). If an amount is zero, enter "0".

Revenues

Costs:

Differential Analysis

Operate Retail (Alt. 1) or Invest in Bonds (Alt. 2)

August 1

Costs to operate store

Cost of equipment less residual value

Profit (loss)

Operate

Invest in

Differential

Effects

Retail

Bonds

(Alternative 1) (Alternative 2) (Alternative 2)

000

0001

-1,540,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress Novak Company is considering investing in a new dock that will cost $670,000. The company expects to use the dock for 5 years, after which it will be sold for $410,000. Novak anticipates annual cash flows of $220,000 resulting from the new dock. The company's borrowing rate is 8%, while its cost of capital is 11% Click here to view PV tables. Calculate the net present value of the dock (Use the above table) (Round factor values to 5 decimal places, eg. 1.25124 and final answer to O decimal places, eg 5,275) Net present value Indicate whether Novak should make the investment. Novak Save for Later the project Attempts: 0 of 1 used Submit Answerarrow_forwardAverage Rate of Return The following data are accumulated by McDermott Motors Inc. evaluating two competing capital investment proposals: Testing Equipment Diagnostic Software Amount of investment $44,000 $40,000 Useful life 4 years 9 years Estimated residual value $0 $0 Estimated total income over the useful life $6,600 $22,500 Determine the expected average rate of return for each proposal. If required, round to one decimal place. Testing Equipment 3.75 Х % Diagnostic Software 6.25 X % Feedback Check My Work Divide the estimated average annual income by the average investment. Initialcost plus residual value divided by two equals average inve Sign outarrow_forward不 NPV for varying costs of capital LePew Cosmetics is evaluating a new fragrance-mixing machine. The machine requires an initial investment of $320,000 and will generate cash inflows of $61,850 per year for 8 years. If the cost of capital is 13%, calculate the net present value (NPV) and indicate whether to accept or reject the machine. The NPV of the project is $ (Round to the nearest cent.) Should this project be accepted? (Select the best answer below.) No ○ Yesarrow_forward

- Cash flows estimation and capital budgeting:You are the head of finance department in XYZ Company. You are considering adding a new machine to your production facility. The new machine’s base price is $10,800.00, and it would cost another $2,760.00 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after three years for $2,350.00. The machine would require an increase in net working capital (inventory) of $800.00. The new machine would not change revenues, but it is expected to save the firm $23,845.00 per year in before-tax operating costs, mainly labor. XYZ's marginal tax rate is 35.00%. a. What is the initial cash outlay? b. What is the free cash flow for year 1? c. What is the additional Year-3 cash flow (i.e, the after-tax salvage and the return of working capital – also called terminal value)? (please show your work in details and highlight your answers)arrow_forwardTerminal cash flow: Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $207,000 and will require $29,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages). A $26,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,000 before taxes; the new machine at the end of 4 years will be worth $73,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 21% tax rate. The terminal cash flow for the replacement decision is shown below: (Round to the nearest…arrow_forwardCash Payback Period for a Service Companyarrow_forward

- Example: Evaluating a business investment opportunity • A low-risk, 4-year investment opportunity promises to pay $3,000, $6,000, and $5,000 at the end of the first, second and fourth year, respectively. A cash injection of $1,000 is required at the end of the third year. The investment may be purchased for $10,000, which would have to be borrowed at an effective interest rate of 10%. Use Economic Value Added principle to determine whether the investment should be undertaken.arrow_forwardCash payback period for a service company Haukea Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of $140,000 and each with an eight-year life and expected total net cash flows of $280,000. Location 1 is expected to provide equal annual net cash flows of $35,000, and Location 2 is expected to have the following unequal annual net cash flows: Year Amount Year Amount Year 1 $63,000 Year 5 $34,000 Year 2 48,000 Year 6 25,000 Year 3 29,000 Year 7 20,000 Year 4 45,000 Year 8 16,000 Determine the cash payback period for both location proposals. Location Year Location 1 years Location 2 yearsarrow_forwardRevenues generated by a new fad product are forecast as follows: Year Revenues 1 $50,000 2 35,000 3 30,000 4 20,000 Thereafter 0 Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment. a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm’s tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is the project IRR?arrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease Correct answer and Do not allow Image formatarrow_forwardCash Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $72,000. The manager believes that the new investment will result in direct labor savings of $18,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project?fill in the blank 1 years b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education