Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

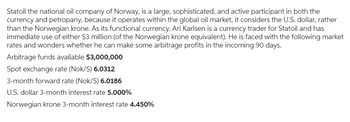

Transcribed Image Text:Statoil the national oil company of Norway, is a large, sophisticated, and active participant in both the

currency and petropany, because it operates within the global oil market, it considers the U.S. dollar, rather

than the Norwegian krone. As its functional currency. Ari Karlsen is a currency trader for Statoil and has

immediate use of either $3 million (of the Norwegian krone equivalent). He is faced with the following market

rates and wonders whether he can make some arbitrage profits in the incoming 90 days.

Arbitrage funds available $3,000,000

Spot exchange rate (Nok/S) 6.0312

3-month forward rate (Nok/S) 6.0186

U.S. dollar 3-month interest rate 5.000%

Norwegian krone 3-month interest rate 4.450%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are the manager of a U.S. company situated in Los Angeles and manages the import/export division of the company. The company distributes (resells) a variety of consumer products imported to the U.S.A from Europe and also exports goods manufactured in the U.S.A. to Canada. Therefore, your company is very much dependent an the impact of current and future exchange rates on the performance of the company. Scenario 1: You have to estimate the expected exchange rates between your home currency and the other currencies of the major other countries that you deal with in terms of bath imports and exparts. The reason is that increases in the values of other currencies compared to the U.S. Dollar may impact your imports negatively, whilst it may on the other hand, be good for exports. To do this estimate, you obtain the following spot exchange rate information: €/S CADS/S 0.87616 1.30779 You also obtain the following annual risk free rates applying in the countries: U.S.A. 2.660% France…arrow_forwardPulaski Inc. wants to establish a new subsidiary in Colombia that will sell cell phones to Colombian customers and remit earnings back to the U.S. parent. The value of this project will be favorably affected if the value of the peso ____ while it establishes the new subsidiary and ____ when the subsidiary starts operations. appreciates; appreciates depreciates; appreciates appreciates; depreciates depreciates; depreciatesarrow_forwardi need help with this problem i know the answer is 5.86 i just need help on how to do it step by steparrow_forward

- Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $946, and the exchange rate will be $1.34/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $768, and the exchange rate will be $1.39/£. You assess that the American economy will experience a boom with a 80 percent probability and a recession with the remaining probability. Estimate the expected value of the spot rate (in £ X.XXXX)arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,001,980, and the exchange rate will be $1.4/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $502, 240, and the exchange rate will be $1.6/£. You assess that the American economy will experience a boom with a 50 percent probability and a recession with a 50 percent probability. a. Estimate your exposure to the exchange risk. (Round final answer to nearest dollar.) b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty. (Round final answer to nearest dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education