Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

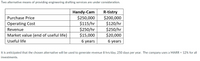

Transcribed Image Text:Two alternative means of providing engineering drafting services are under consideration.

Handy-Cam

$250,000

$115/hr

$250/hr

$15,000

R-tistry

$200,000

$120/hr

$250/hr

$20,000

Purchase Price

Operating Cost

Revenue

Market value (end of useful life)

Useful life

б years

б years

It is anticipated that the chosen alternative will be used to generate revenue 8 hrs/day, 250 days per year. The company uses a MARR = 12% for all

investments.

Transcribed Image Text:At what usage of the drafting services (hours/year) would you be indifferent between the two alternatives? Remember to show your calculations in your

supporting work.

Round your answer to the neares whole hour.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Which one of the following would be recognised as an expense in the current financial period? A. A payment made in the current financial period to hire a machine that will be used at the beginning of the next financial period B. A cash payment made during the current financial period, but relating to the first three months' rent due for the next financial period C. An invoice received for gas used in the last quarter of the current financial period, but which is not paid until the next financial period D. An invoice for printing, owing at the end of the previous financial period, but paid in the current financial periodarrow_forwardAs the controller of Chardon Consulting, you have hired a new employee, whom you must train. She objects to making an adjusting entry for accrued salaries at the end of the period. She reasons, "We will pay the salaries soon. Why not wait until payment to record the expense? In the end, the result will be the same." Write a reply to explain to the employee why the adjusting entry is needed for accrued salary expense. At the end of the period we must make an adjusting entry for accrued salary expense to (balance the adjusted trial balance, make sure we don't spend the cash owed to employees, reconcile the cash account, report all our, salary expense of the period). The unpaid salary expense is our (assent owed from employees, expenses in the future, liability to employees).If we fail to make this adjustment, we (overstate both expenses and liabilities, overstate expenses, overstate liabilities, understate both expenses and liabilities, understate expenses, understate…arrow_forwardIdentify the letter for the principle or assumption from A through F in the blank space next to situation that it best explains or justifies: _________In December of this year, Chavez Landscaping received a customer’s order and cash prepayment to install sod at a house that would not be ready for installation until March of next year. Chavez should record the revenue from the customer order in March of next year, not in December of this year.arrow_forward

- Please Correct answerarrow_forwardSuppose a customer rents a vehicle for three months from Commodores Rental on November 1, paying $5,250 ($1,750/month). 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of the Deferred Revenue and Service Revenue accounts (assuming the balance of Deferred Revenue at the beginning of the year is $0). Deferred revenue ending balance:____________ Service revenue ending balance: _____________arrow_forwardSelect all that apply Vance Co. allows employees to take a two week vacation each year. To account for the two weeks off each year, Dante will record an adjusting entry to which of the following accounts? Multiple select question. Credit to Salaries and Wages Payable. Credit to Cash. Debit to Cash. Credit to Vacation Benefits Payable. Debit to Vacation Benefits Expense. Debit to Salaries and Wages Expense.arrow_forward

- Please see the picture below. This question utilizes excel. Please help with this.arrow_forwardAccording to your studying of the Conceptual Framework, Discuss the following: 1. Selane Eatery operates a catering service specializing in business luncheons for large companies. Selane requires customers to place their orders 2 weeks in advance of the scheduled events. Selane bills its customers on the tenth day of the month following the date of service and requires that payment be made within 30 days of the billing date. Conceptually, when should Selane recognize revenue related to its catering service? 2. Mogilny Company paid $135,000 for a machine. The Accumulated Depreciation account has a balance of $46,500 at the present time. The company could sell the machine today for $150,000. The company president believes that the company has a “right to this gain.” What does the president mean by this statement? Do you agree? 3. Three expense recognition methods (associating cause and effect, systematic and rational allocation, and immediate recognition) were discussed in the chapter…arrow_forwardA roofing company collects payment when jobs are complete. The work for one customer, whose job was bid at $3,900, has been completed as of December 31, but the customer has not yet been billed. Assuming adjustments are only made at year-end, what is the adjusting entry the company would need to make on December 31, the calendar year-end? Multiple Choice Debit Roofing Revenue, $3,900; credit Cash, $3,900. Debit Roofing Revenue, $3,900; credit Accounts Receivable, $3,900. No adjustment is required. Debit Cash, $3,900; credit Roofing Revenue, $3,900. Debit Accounts Receivable, $3,900; credit Roofing Revenue, $3,900.arrow_forward

- Simple for most..confusing to mearrow_forwardI see the end portion. But it doesn't provide how they came up with that answer. Like the journal entries for each year showing all the purchases, adjustments, end of year, etc. Could you break it down by year showing how each one was obtained?arrow_forwardAt the end of the current month, Gil Frank prepared a trial balance for College App Services. The credit side of the trial balance exceeds the debit side by a significant amount. Gil has decided to add the difference to the balance of the miscellaneous expense account in order to complete the preparation of the current month's financial statements by a 5 o'clock deadline. Gil will look for the difference next week when he has more time. Discuss whether Gil is behaving in a professional manner in your opinion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education