ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

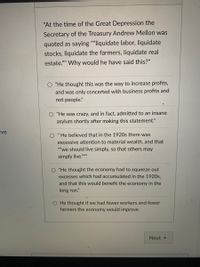

Transcribed Image Text:"At the time of the Great Depression the

Secretary of the Treasury Andrew Mellon was

quoted as saying ""liquidate labor, liquidate

stocks, liquidate the farmers, liquidate real

estate."" Why would he have said this?"

"He thought this was the way to increase profits,

and was only concerted with business profits and

not people."

O "He was crazy, and in fact, admitted to an insane

asylum shortly after making this statement."

ive

He believed that in the 1920s there was

%3D

excessive attention to material wealth, and that

""we should live simply, so that others may

simply live."

"He thought the economy had to squeeze out

excesses which had accumulated in the 1920s,

and that this would benefit the economy in the

long run."

He thought if we had fewer workers and fewer

farmers the economy would improve.

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- With the use of an example, briefly explain the main difference between the ex-ante and the ex-post opportunity cost of capital. Why does this matter for the evaluation of an investment decision? In what ways can managers utilise the distinction between ex-ante and ex-post opportunity cost of capital when deciding on the firm’s strategy?arrow_forwardWhat is the difference between short-run and long-run in economics?arrow_forwardwhat is the company business model o What is the revenue model? Give a general idea of how the business generates revenues use Ounass website to answer this questionarrow_forward

- what is the meaning behind Frederic Bastiat's Negative Railroad? Be thorough and prove your understanding.arrow_forwardPlease answer both questions. Has the credit card industry become more or less competitive? Does it still fit the characteristics of perfect competition or is it moving away from being perfectly competitive? Does the fact that the credit card issuing industry meets some criteria of perfect competition benefit society? Why or Why not?arrow_forwardPLEASE TYPE Suppose an industry that has 10 firms. Below are the market shares for 2008 and 2013 of the 10 firms. Market Share Firms 2008 2013 A B C D E F G H I G 26% 21% 16% 10% 9% 7% 4% 3% 2% 2% 22% 23% 19% 9% 8% 7% 6% 4% 1% 1% Using the CR4, CR8, and HHI, analyze the evolution of the potential market power of firms in the industry.arrow_forward

- 5.4 Food service firms buy meat, vegetables, and other foods and resell them to restaurants, schools, and hospitals. US Foods and Sysco are by far the largest firms in the indus- try. In 2015, these firms were attempting to combine or merge to form a single firm. A news story quoted one res- taurant owner as saying: "There was definite panic in the restaurant industry... when the merger was announced. They know they're going to get squeezed." a. Analyze the effect on the food service market of US Foods and Sysco combining. Draw a graph to illustrate your answer. For simplicity, assume that the market was perfectly competitive before the firms combined and would be a monopoly afterward. Be sure your graph shows changes in the equilibrium price, the equilibrium quantity, consumer surplus, producer surplus, and deadweight loss. b. Why would restaurant owners believe they would be "squeezed" by this development?arrow_forwardOn the graph below, shift the demand curve, the supply curve, or both on the following diagram to illustrate both the short-1 report and the new long-run equilibrium after firms and consumers finish adjusting to the news. PRICE (Dollars per kilogram) 10 6 Supply Demand 8 7 2 1 Demand 0 0 30 60 90 120 150 180 210 240 270 300 QUANTITY (Millions of kilograms) Supply The new equilibrium price and quantity suggest that the shape of the long-run supply curve in this industry is run.arrow_forwardUnlike the Suez Canal, the Panama Canal is highly relevant for the US economy. A blockage of the Panama Canal could produce severe supply disruptions for the US economy. Suppose there is a severe blockage of the Panama Canal that last for six weeks. The following questions consider how such a blockage of the Panama Canal would affect the US economy in the short-run. Once Panama Canal officials are able to unblock the canal and get traffic flowing again, the US economy will begin to recover from the supply disruptions. Which of the following statements describes the US economy after the Panama Canal has become unblocked? A) The price level will increase back to its initial level of P*, and real GDP will decrease back to its natural level. B) The price level will decrease back to its initial level of P*, and real GDP will increase to its natural level. C) The price level will increase to its original level of P*,…arrow_forward

- What type of tax increases could increase the savings rate and therefore promote long-run growth? sales tax income tax capital gain tax excise taxarrow_forwarda. Define the terms “Short Run” and “Long Run”. b. Would the short run be longer for Tonino’s Pizza Restaurant or for NASA? Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education