FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

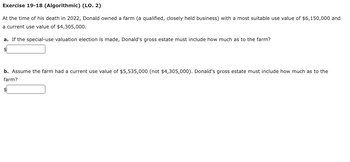

Transcribed Image Text:Exercise 19-18 (Algorithmic) (LO. 2)

At the time of his death in 2022, Donald owned a farm (a qualified, closely held business) with a most suitable use value of $6,150,000 and

a current use value of $4,305,000.

a. If the special-use valuation election is made, Donald's gross estate must include how much as to the farm?

$

b. Assume the farm had a current use value of $5,535,000 (not $4,305,000). Donald's gross estate must include how much as to the

farm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larry is the sole proprietor of a trampoline shop. During 2020, the following transactions occurred. For each transaction, what are the amount and nature of recognized gain or loss? Larry sold an apartment building for $300,000 on September 1. The rental property was purchased on September 1, 2017, for $150,000 and was being depreciated over a 27.5-year life using the straight-line method. At the date of sale, the adjusted basis was $124,783. There is an overall § 1231 gain of $__________ How much § 1250 recapture is recognized? $__________ What is the amount of unrecaptured § 1250? $__________ Larry's personal yacht was stolen on September 5. The yacht had been purchased in August at a cost of $25,000. The fair market value immediately preceding the theft was $19,600. Larry was insured for 50% of the original cost, and he received $12,500 on December 1. There is a tax loss (before AGI limitations) of $__________ that is treated as nondeductable personal casualty loss. Larry sold a…arrow_forwardCallie Cooper purchased two pieces of property in 1990: Property Q cost $15,000 and Property R cost $30,000. In 2020, when Callie died, she left the property to her daughter, Christy. At that time, Property Q had appreciated in value to $80,000 while Property R had declined in value, now worth only $10,000. What is Christy’s basis in each piece of property? What are the tax consequences of the changes in value of the properties from the time of original purchase to the death of Callie?arrow_forwardLars acquired a new network system on June 5, 2023 (five-year class property), for $69,000. She expects taxable income from the business will always be about $215,000 without regard to the §179 election. Lars will elect §179 expensing. She also acquired seven-year property in July 2023 for $430,000. (Use Table 6A-1) Required: Determine Lars’s maximum cost recovery deduction with respect to her purchases in 2023. TABLE 6A-1 General Depreciation System: 200% or 150% Declining Balance Switching to Straight-Line* Half-Year Convention Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13…arrow_forward

- 13. B purchased two parcels of land in 2016 for $50,000 each. Parcel 1 was purchased to hold until its value increased and then offered for sale. Parcel 2 was purchased to build a rental property and collect rents over time. In 2022 parcel 1 was sold for $40,000 and parcel 2 was sold for $100,000 as part of the rental property sale. Determine the amount that B’s net income for tax purposes will increase in 2022.arrow_forwardNonearrow_forwardPlease help with solutionarrow_forward

- On January 1, 2019, Ted purchased a small software company for $200,000. He paid $120,000 for the fixed assets of the company and $80,000 for goodwill. How much amortization may Ted deduct on his 2019 tax return for the purchased goodwill?arrow_forwardOn July 1, 2019, Ted, age 73 and single, sells his personal residence of the last 30 years for $368,000. Ted's basis in his residence is $48,776. The expenses associated with the sale of his home total $22,080. On December 15, 2019, Ted purchases and occupies a new residence at a cost of $175,000. Calculate Ted's realized gain, recognized gain, and the adjusted basis of his new residence. Realized gain $ Recognized gain $ Adjusted basis of the new residence $arrow_forwardVinubhaiarrow_forward

- lly Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2022, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 235,000 85,000 Cost $ 205,000 153,000 Accumulated Depreciation $ 57,000 28,000 lly's taxable income before these transactions is $195,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount. Description Taxable income Tax liability Amount $ 242,500arrow_forwardShun Li sold a capital property on July 31, 2019 for $400,000. She received $100,000 at the time of sale with the balance of $300,000 payable on July 31, 2021. The adjusted cost base of the property was $160,000. The minimum taxable capital gain that Shun Li can report in the 2019 taxation year is: $30,000. $60,000. $120,000. $180,000.arrow_forwardIn January of 2020, Joseph converted a building from a personal use asset to a business use asset. At the time of the conversion, Joseph's adjusted basis in the building was $75,000 and the building had a fair market value of value of $60,000. In June of 2020, Joseph sold the building to another individual taxpayer for $55,000. What is the amount of taxable income (or tax deduction) that Joseph must include on his 2019 tax return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education