A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

You manage a spare parts warehouse for an Electric Car Company. Dealers come by the warehouse to purchase batteries and you replenish your inventory at the start of every month or when the inventory of batteries is exhausted. At the start of December, the warehouse contains 10 batteries, 3 of which are not fully charged. You must reimburse $50 to a dealer if they need to charge a battery at their facility.

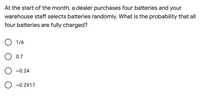

Transcribed Image Text:At the start of the month, a dealer purchases four batteries and your

warehouse staff selects batteries randomly. What is the probability that all

four batteries are fully charged?

O 1/6

0.7

~0.24

~0.2917

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Similar questions

- Richard invests $298.66 every month into an account. At the end of 30 years, he has a balance of $181,092.15. What interest did he make over 30 years?arrow_forwardYou are looking for a bank in which to open a checking account for your new part-time business. You estimate that in the first year, you will be writing 30 checks per month and will make three debit transactions per month. Your average daily balance is estimated to be $900 for the first six months and $2,400 for the next six months. Use the following information to solve the problem. Bank Monthly Fees and Conditions Bank 1 $17.00 with $1,000 min. daily balance-or-$25.00 under $1,000 min. daily balance Bank 2 $4.50 plus $0.40 per check over 10 checks monthly$1.00 per debit transaction Bank 3 $5 plus $0.25 per check$2.00 per debit transaction Bank 4 $7 plus $0.15 per check$1.50 per debit transaction (a) Calculate the cost (in $) of doing business with each bank for a year. Bank 1$ Bank 2$ Bank 3$ Bank 4$arrow_forwardWhile shopping for a car loan, you get the following offers: Solid Savings & Loan is willing to loan you $10,000 at 4% interest for 4 years. Fifth Federal Bank & Trust will loan you the $10,000 at 5% interest for 3 years. Both require monthly payments. You can afford to pay $250 per month. Which loan, if either, can you take?arrow_forward

- Dejah earned $100,000 last year at her startup and wants to prepare for potential lean times. She plans to take a 20%20% salary decrease next year and will then take a 20%20% increase in the second year. One of her friends says, "That's not bad, Dejah. You will be back to your original salary in two years." Help Dejah explain to her friend that she will not be making her original salary in two yearsarrow_forwardYou are thinking of making your home more energy efficient by replacing some of the light bulbs with compact fluorescent bulbs and insulating part or all of your exterior walls. Each compact fluorescent light bulb costs $4 and saves you an average of $2 per year in energy costs, and each square foot of wall insulation costs $1 and saves you an average of $0.20 per year in energy costs.† Your home has 60 light fittings and 1,200 square feet of uninsulated exterior wall. You can spend no more than $1,300 and would like to save as much per year in energy costs as possible. How many compact fluorescent light bulbs and how many square feet of insulation should you purchase? Please don't give handwritten answer..thankuarrow_forwardNathan's house is totally damaged by Hurricane Sandy. He has to rent an apartment, which costs him $1000/month. His normal expense for meal is $400/month, but now he spends $600/month for meal. His normal expense for laundry is $100/month, but now he spends $200/month for laundry. Assume his other expenses do not change. How much compensation can Nathan get from his HO-3 Policy, Coverage D (Additional living expenses) per month? O a. $1,800 O b. $1,500 O c. $1,300 O d. $300arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON