Calculus: Early Transcendentals

8th Edition

ISBN: 9781285741550

Author: James Stewart

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1 102 F

Partly sunny

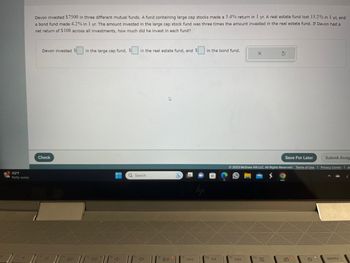

Devon invested $7500 in three different mutual funds. A fund containing large cap stocks made a 5.4% return in 1 yr. A real estate fund lost 13.2% in 1 yr, and

a bond fund made 4.2% in 1 yr. The amount invested in the large cap stock fund was three times the amount invested in the real estate fund. If Devon had a

net return of $108 across all investments, how much did he invest in each fund?

Devon invested S in the large cap fund, S

Check

14

f5

16

4-

in the real estate fund, and S

Q Search

f7

♫+

fa

00

s

b

fg

144

liji

in the bond fund.

f10

DII

fi

Save For Later

Submit Assig

© 2023 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | A

DDI

X

112

5

delete

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- At the beginning of the year Anna invested a portion of her $90, 000revenue from the sale of her house in an account that earns 8% annualsimple interest, and the remainder in an account that earns 9% annualsimple interest. If at the end of the year, she earned total interest of$7760, how much did she invest in each account?arrow_forwardIn February, Apple stock rose from $120.69 to $164.85, while Tesla stock increased from $675.50 a share to $809.87. You've invested $1500 in Feb 2021 and sold them for $2802.83 in Feb 2022. How many shares of each stock did you purchase? Apple A 29.78% (1Y) T Tesla Buy Sell a 12.73% (1Y) S182.00 Buy Sell $1.230.00 $149.00 TW TY SY 10Y se97.00 Position Overview Transactions News TW TY SY 10Y Personal portfolio Value 0 $498.29 (a +27.10%) $106.24 Position Overview Transactions News Amount invested 0 $392.05 Share price O $809.87 % of portfolio 0 4% Today's change O A 1.14% Average price O $129.70 View more v Shares 0 3.02268arrow_forwardMila invested $6,700 and put it in two accounts. She put some in a money market account that earned 1 1/2 % simple interest and she put the rest in a certificate of deposit (CD) that earned 2 3/4% simpleinterest. At the end of the first year she earned a total of $149.25 in interest. How much did she depositin each account?arrow_forward

- A shoe store marks up the price of its shoes at 130% over cost. A pair of shoes goes on sale for 15% off and then on the clearance rack for an additional 35% off. A customer walks in with a 10% off coupon good on all clearance items and buys the shoes. Express the store's profits on these shoes as a percentage of the original cost.arrow_forwardA couple invested $20,000 in two retirement accounts, one at an annual simple interest rate of 4% and the other at 3% annual simple interest. The combined interest from the two investments was $740 for the first year. Find the amount invested in each account. $ invested at 4% 2$ invested at 3%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendentals

Calculus

ISBN:9781285741550

Author:James Stewart

Publisher:Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:9780134438986

Author:Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:9780134763644

Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:9781319050740

Author:Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:9781337552516

Author:Ron Larson, Bruce H. Edwards

Publisher:Cengage Learning