FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

N3.

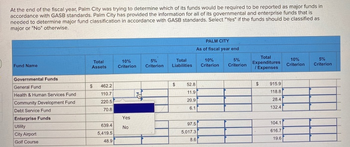

Transcribed Image Text:At the end of the fiscal year, Palm City was trying to determine which of its funds would be required to be reported as major funds in

accordance with GASB standards. Palm City has provided the information for all of its governmental and enterprise funds that is

needed to determine major fund classification in accordance with GASB standards. Select "Yes" if the funds should be classified as

major or "No" otherwise.

Fund Name

Governmental Funds

General Fund

Health & Human Services Fund

Community Development Fund

Debt Service Fund

Enterprise Funds

Utility

City Airport

Golf Course

Total

Assets

$

462.2

110.7:

220.5

70.8

639.4

5,419.5

48.9

10%

Criterion

Yes

No

5%

Criterion.

Total

Liabilities

$

STON

52.8

11.9

20.9

6.1

PALM CITY

As of fiscal year end

97.5

5,017.3

8.6

10%

Criterion

5%

Criterion

Total

Expenditures

/ Expenses

$

915.9

118.8

28.4

132.4

104.1

616.7

19.6

10%

Criterion

5%

Criterion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- But why? for number 3arrow_forwardZina Manufacturing Company started and completed Job 501 in December with the following Job Cost Sheet and transferred it to the warehouse. Direct Materials Date Dec 17 Dec 30 Total Direct Labor Amount Date Amount $2,000 Dec 20 $4,000 8,000 Dec 30 3,800 Total Job Cost Sheet - Job No. 501 Total Cost The journal entry to record the transaction is A) WIP Inventory FG Inventory B) Cost of Goods Sold WIP Inventory C) FG Inventory WIP Inventory D) FG Inventory WIP Inventory Debit Credit 35,800 17,800 17,800 Manufacturing Overhead Date Amount Dec 24 $10,000 Dec 30 8,000 Total 35,800 35,800 17,800 17,800 35,800arrow_forwardG and H are mutually exclusive events. P (G) = 0.5 P (H) = 0.3 P( H | G) = 0.6 Find P (H OR G) Are G and H independent or dependent events? why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education