Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Do not give answer in image

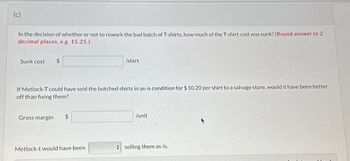

Transcribed Image Text:(c)

In the decision of whether or not to rework the bad batch of T-shirts, how much of the T-shirt cost was sunk? (Round answer to 2

decimal places, e.g. 15.25.)

Sunk cost $

If Metlock-T could have sold the botched shirts in as-is condition for $10.20 per shirt to a salvage store, would it have been better

off than fixing them?

Gross margin

$

/shirt

Metlock-t would have been

/unit

selling them as-is.

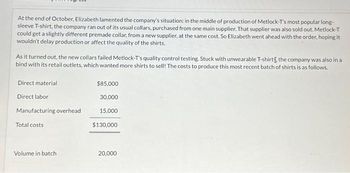

Transcribed Image Text:At the end of October, Elizabeth lamented the company's situation: in the middle of production of Metlock-T's most popular long-

sleeve T-shirt, the company ran out of its usual collars, purchased from one main supplier. That supplier was also sold out. Metlock-T

could get a slightly different premade collar, from a new supplier, at the same cost. So Elizabeth went ahead with the order, hoping it

wouldn't delay production or affect the quality of the shirts.

As it turned out, the new collars failed Metlock-T's quality control testing. Stuck with unwearable T-shirt, the company was also in a

bind with its retail outlets, which wanted more shirts to sell! The costs to produce this most recent batch of shirts is as follows.

Direct material

Direct labor

Manufacturing overhead

Total costs

Volume in batch

$85,000

30,000

15,000

$130,000

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress At the end of October, Debra lamented the company's situation: in the middle of production of Blossom-T's most popular long-sleeve T-shirt, the company ran out of its usual collars, purchased from one main supplier. That supplier was also sold out. Blossom-T could get a slightly different premade collar, from a new supplier, at the same cost. So Debra went ahead with the order, hoping it wouldn't delay production or affect the quality of the shirts. As it turned out, the new collars failed Blossom-T's quality control testing. Stuck with unwearable T-shirts, the company was also in a bind with its retail outlets, which wanted more shirts to sell! The costs to produce this most recent batch of shirts is as follows. Direct material $75,000 Direct labor Manufacturing overhead Total costs 29,000 15,000 $119,000 Volume in batch 20,000arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 182 40 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. 30% Bacon Hessel Hessel 3,000 $198 20 15% The Accounting Department recorded $255,450 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 188 60 25% Exercise 10-38 (Algo) Activity-Based Costing of Suppliers (LO 10-3, 4) Required: Assume that the average quality, measured by the percentage of…arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon Hessel Total Total purchases (cartons) 5,000 3,000 8,000 Average purchase price (per carton) $ 170 $ 186 $ 176 Number of deliveries 40 20 60 Percentage of cartons delivered late. 30% 15% 25% The Accounting Department recorded $243,750 as the cost of late deliveries to customers. Required: Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the past. Also…arrow_forward

- Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon Hessel Total Total purchases (cartons) 5,000 3,000 8,000 Average purchase price (per carton) $ 176 $ 192 $ 182 Number of deliveries 40 20 60 Percentage of cartons delivered late. 30% 15% 25% The Accounting Department recorded $249,600 as the cost of late deliveries to customers. Exercise 10-38 (Algo) Activity-Based Costing of Suppliers (LO 10-3, 4) Required: Assume that the average quality, measured by the percentage of late…arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 192 40 30% Bacon Hessel Hessel 3,000 $ 208 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. The Accounting Department recorded $265,200 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 198 20 15% Required: Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the…arrow_forwardFeinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national sporting goods chain recently submitted a special order for 4,600 pairs of weight-lifting gloves. Feinan Sports was not operating at capacity and could use the extra business. Unfortunately, the order’s offering price of $12.80 per pair was below the cost to produce them. The controller was opposed to taking a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs and would help maintain the community image of the company. The full cost to produce a pair of weight-lifting gloves is presented below. Direct materials $ 7.50Direct labor 3.90Variable overhead 1.60Fixed overhead 3.10Total $16.10 No variable selling or administrative expenses would be associated with the order. Non-unit- level activity costs are a small percentage of total costs and are therefore not considered.…arrow_forward

- Feinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. Anational sporting goods chain recently submitted a special order for 4,000 pairs of weight-liftinggloves. Feinan Sports was not operating at capacity and could use the extra business.Unfortunately, the order’s offering price of $12.70 per pair was below the cost to produce them.The controller was opposed to taking a loss on the deal. However, the personnel manager arguedin favor of accepting the order even though a loss would be incurred; it would avoid the problemof layoffs and would help maintain the community image of the company. The full cost toproduce a pair of weight-lifting gloves is presented below.Direct materials $ 7.40Direct labor 3.80Variable overhead 1.60Fixed overhead 3.10 Total $15.90No variable selling or administrative expenses would be associated with the order. Non-unitlevel activity costs are a small percentage of total costs and are therefore not considered.Required:1. Assume…arrow_forwardFeinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national sporting goods chain recently submitted a special order for 4,000 pairs of weight-lifting gloves. Feinan Sports was not operating at capacity and could use the extra business. Unfortunately, the order's offering price of $12.70 per pair was below the cost to produce them. The controller was opposed to taking a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs and would help maintain the community image of the company. The full cost to produce a pair of weight-lifting gloves is presented below. Direct materials $ 7.40 Direct labor 3.80 Variable overhead 1.60 Fixed overhead 3.10 $15.90 Total No variable selling or administrative expenses would be associated with the order. Non-unit- level activity costs are a small percentage of total costs and are therefore not considered.…arrow_forwardLL is a company that makes and sells clothing made out of wool. It has been having problems manufacturing sufficient garments for its customers for several years as demand has increased significantly. LL's current wool spinning process has been identified as a bottleneck process.It is considering the purchase of an automated spinning machine that it believes will significantly improve the speed of its manufacturing process. In addition it will allow LL to lay off around fifty members of staff (who are heavily unionised).The machine will cost around $5m. LL does not have this cash available, but believes that it will be able to raise these funds from its investors.LL will only purchase the machine if it is: suitable acceptable; AND feasible From the information given above, which of these three criteria does the acquisition of the machine meet? Suitable and acceptable only Suitable only Acceptable and feasible only Suitable and feasible onlyarrow_forward

- [The following information applies to the questions displayed below.] Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon Hessel Total Total purchases (cartons) 5,000 3,000 8,000 Average purchase price (per carton) $ 190 $ 206 $ 196 Number of deliveries 40 20 60 Percentage of cartons delivered late. 30% 15% 25% The Accounting Department recorded $263,250 as the cost of late deliveries to customers. Required: Assume that the average quality, measured by the percentage of late deliveries,…arrow_forwardFusion Metals Company is considering the elimination of its Packaging Department. Management has received an offer from an outside firm to supply all Fusion’s packaging needs. To help her in making the decision, Fusion’s president has asked the controller for an analysis of the cost of running Fusion’s Packaging Department. Included in that analysis is $9,100 of rent, which represents the Packaging Department’s allocation of the rent on Fusion’s factory building. If the Packaging Department is eliminated,the space it used will be converted to storage space. Currently Fusion rents storage space in a nearby warehouse for $11,000 per year. The warehouse rental would no longer be necessary if the Packaging Department were eliminated. Required:1. Discuss each of the figures given in the exercise with regard to its relevance in the departmentclosing decision.2. What type of cost is the $11,000 warehouse rental, from the viewpoint of the costs of the Packaging Department?arrow_forwardBlossom’s flour supplier has announced a shortage of gluten-free flour. As a result, Blossom will only be able to purchase 44,600pounds of flour.How many batches of each type of cookie should the company bake? The company’s contribution margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub