FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

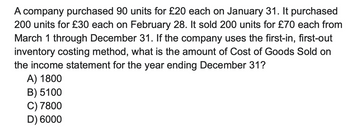

Transcribed Image Text:A company purchased 90 units for £20 each on January 31. It purchased

200 units for £30 each on February 28. It sold 200 units for £70 each from

March 1 through December 31. If the company uses the first-in, first-out

inventory costing method, what is the amount of Cost of Goods Sold on

the income statement for the year ending December 31?

A) 1800

B) 5100

C) 7800

D) 6000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company purchased 100 units for $30 each on January 31. It purchased 300 units for $20 each on February 28. It sold a total of 370 units for $110 each from March 1 through December 31. If the company uses the last – in, first – out inventory costing method, calculate the cost of ending inventory on December 31. (Assume that the company uses a perpetual inventory system.) A. $900 B. $600 C. $2,400 D. $30arrow_forwardSuppose that Target Corporation uses the periodic inventory system to account for inventories and has the following information at October 31. October 1 Beginning inventory 400 units $12.00 = $4,800 8 Purchase 800 units @ $12.40 = 9,920 16 Purchase 600 units @ $12.80 = 7,680 24 Purchase 200 units @ $13.60 = 2,720 Total units and cost 2,000 units $25,120 (a) Determine the ending inventory using the FIFO cost assumption if 500 units remain on hand at October 31. Ending inventory $arrow_forwardUse the following information to complete the calculations below. Cost of goods sold $195,640 Inventory: Beginning of year 20,500 End of year 18,628 a. Compute inventory turnover. b. Compute average daily cost of goods sold using a 365 day year. c. Compute number of days' sales in inventory. Round your answer to one decimal place. daysarrow_forward

- A company had beginning inventory of 11 units at a cost of $17 each on March 1. On March 2, it purchased 11 units at $28 each. On March 6 it purchased 5 units at $22 each. On March 8, it sold 26 units for $65 each. Using the FIFO perpetual inventory method, what was the cost of the 26 units sold?arrow_forward1. The following is a data transaction from PT Colorpop's records as the basis for making a Statement of Comprehensive Income for the period ended 31 December 2020: Rent Revenue $ 44,000 Interest Expense $ 20,000 Unrealized gain on non-trading equity securities, net of tax $ 35,000 Selling expenses $ 140,000 Income tax $ 30,600 Administrative expenses $ 185,000 Cost of goods sold $ 500,000 Net sales $ 954,000 Loss on sale of plant assets $ 10,000 Loss from Fixed Assets Revaluation, net of tax $2,000 Instructions: Create a Statement of Comprehensive Income using a two-statement approach! Calculate the value of Ending Per Share for 2020 if the number of shares outstanding is 100,000 shares.arrow_forwardMonroe Manufacturing, Inc. reported the following information related to inventory, which sells for $20 per unit: Beginning inventory: 3,000 units at $3 unit cost Purchase 1: 4,000 units at $4 unit cost Purchase 2: 5,000 units at $5 unit cost At the end of the period, the company has 4,000 units in ending inventory. Compute the cost of goods sold and ending inventory using the following methods: Weighted Average, FIFO, and LIFO methods.arrow_forward

- Garrison Company uses the retail method of inventory costing. It started the year with an inventory that had a retail sales value of $36,200.During the year, Garrison purchased inventory with a retail sales value of $771,100. After performing a physical inventory, Garrison computed the inventory at retail to be $54,700. The markup is 100% of cost.What is the ending inventory at its estimated cost? A. $27,350 B. $136,750 C.$82,050arrow_forward1. Westor Aldor had a beginning inventory balance on July 1 of 440 units at a cost of $3.50 each. During the month, the following inventory transactions took place: Purchases Sales Date Units Cost per Unit Date Units Price Per Unit July 10 1,300 $3.10 July 2 250 $6 13 700 $3.40 11 1,000 $6 27 550 $3.75 28 400 $6.50 a) Calculate the cost of goods available for sale and the number of units of ending inventory. Please explain how to find ending inventory when not given.arrow_forwardThe inventory records for Radford Company reflected the following Beginning inventory on May 1 First purchase on May 7 Second purchase on May 17 Third purchase on May 23 1,200 units @ $4.00 1,300 units @ $4.20 1,500 units @ $4.30 1,100 units@ $4.40 Sale on May 31 3,900 units @ $5.90 What is the amount of gross margin assuming the weighted average cost flow method is used? (Round your intermediate calculations to 2 dec Multiple Choice $10.920 $17160 $6,513 O $5.850arrow_forward

- Problem Hans Inc. is a merchandising company that resells equestrian saddles. The company's inventory data is as follows: Cost of Goods Available for Sale Jan. 1 Beginning Balance 2 units @ $200 $400 Jan. 5 Purchase 3 units @ $400 = $1,200 4 units @ $500 $2,000 Jan. 20 Purchase Retail Sales of Goods Jan. 15 Sales 3 units @ $900 = $2,700 Jan. 31 Sales 2 units @ $1,000 = $1,800 Assume Hans Inc. uses a perpetual inventory system. For the January 15th sale, the units sold consisted of 2 units from January 5th purchase and 1 unit from January 1st inventory balance. For the January 31st sale, the units sold consisted of 1 unit from the January 1st inventory balance and 1 unit from the January 20th purchase.arrow_forwardPerez Company had the following information for the year ending December 31: Units Unit Cost Beginning inventory 360 $34 Purchase: April 6 290 35 Sale: May 4 380 Purchase: July 19 590 39 Sale: September 9 450 Purchase: October 10 140 45 Perez uses the perpetual inventory system and the FIFO method. Required: Using FIFO (a) Compute the cost of ending inventory. (b) Compute the cost of goods sold for the year. Cost of ending inventory Cost of goods soldarrow_forwardA company had the following purchases and sales during its first year of operations: Purchases Sales February: January: 22 units at $180 14 units 32 units at $185 12 units May: 27 units at $190 16 units September: 24 units at $195 15 units November: 22 units at $200 28 units On December 31, there were 42 units remaining in ending inventory. Using the Perpetual LIFO inventory valuation method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.) Multiple Choice $9,387. $7,815. $9,315.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education