FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

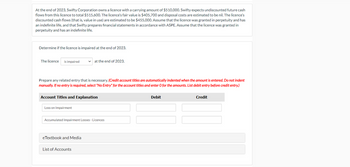

Transcribed Image Text:At the end of 2023, Swifty Corporation owns a licence with a carrying amount of $510,000. Swifty expects undiscounted future cash

flows from this licence to total $515,600. The licence's fair value is $405,700 and disposal costs are estimated to be nil. The licence's

discounted cash flows (that is, value in use) are estimated to be $455,000. Assume that the licence was granted in perpetuity and has

an indefinite life, and that Swifty prepares financial statements in accordance with ASPE. Assume that the licence was granted in

perpetuity and has an indefinite life.

Determine if the licence is impaired at the end of 2023.

The licence is impaired

at the end of 2023.

Prepare any related entry that is necessary. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Account Titles and Explanation

Loss on Impairment

Accumulated Impairment Losses - Licences

eTextbook and Media

List of Accounts

Debit

Credit

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- For the next two questions, a "+" sign is optional for any answer that is a net cash inflow, but a "-" sign is mandatory for any answer that is a net cash outflow. Reebok Ltd is purchasing a $7.7 million machine, which will cost the firm an additional $46,000 to have the machine transported and installed ready for use. The machine is depreciated to a value of zero over a tax life of 4 years via the straight-line method. It will also be worthless in the salvage market at this time. The machine is expected to generate incremental revenues of $4.4 million per year for the firm while also causing incremental costs of $1.6 million per year. Reebok's marginal tax rate is 37.5%. You are forecasting incremental free cash flows for Reebok Ltd (a) What is the incremental free cash flow associated with the new machine at t=0? The free cash flow at t=0 will be $ (Round your answer to the nearest dollar) (b) What is the annual incremental free cash flows each year from t=1 to t=4? The annual free…arrow_forwardDavid Ltd commences operations on 1 July 2020 On the same date, it purchases a machine at a cost of $1000 000 The machine is expected to have a useful life of 4 years, with benefits being uniform throughout its life. It will have no residual value at the end of 4 years Hence, for accounting purposes the depreciation expense would be $250 000 per year For taxation purposes, the ATO allows the company to depreciate the asset over three years—that is, $200 000 per year The profit before tax of the company for each of the next four years (years ending 30 June) is $600 000, $700 000, $800 000 and $900 000 respectively The tax rate is 30 per cent. Required: 1. Calculate the taxable profit on 30 June 2021, 30 June 2022, 30 June 2023.2. Record the necessary journal entries.arrow_forwardBangor Ltd operates under ideal conditions of uncertainty. On January 1, 2022, the company acquired an asset to be used in its operations. Its cash flows depend on the market conditions. The asset will last three years, at which time its salvage value will be £200. The company financed the asset purchase by issuing ordinary shares. In 2022, net cash flows will be £1600 if the market conditions are favourable and £700 if they are unfavourable. In 2023, cash flows will be £1800 if the market conditions are favourable, and £600 if they are unfavourable. In 2024, cash flows will be £2200 if the market conditions are favourable, and £900 if they are unfavourable. Cash flows are received at year-end. In 2022, the probability that the market conditions are favourable is 0.4 and 0.6 that they are unfavourable. In 2023 and 2024, the probability that the economic conditions are favourable is 0.7 and 0.3 that they are unfavourable. The interest rate in the economy is 9% in all three years. The…arrow_forward

- Ac.arrow_forwardProtection Company develops a patent on a new fingerprint security technology. On January 1, 2018, this patent is registered for a cost of $30,000,000 for a period of 10 years. The company does not expect this technology to be obsolete over at least the next 15 years and intends to use it over this period. At the end of 2020, the fair value of the patent is $15,000,000. The discounted value of future cash flows (value-in-use) is $16,000,000. The Company adopts the cost model. 1. What will the cost of patent be? 2. What will the useful life be? Justify your answer. 3. Prepare the entries for 2018, 2019 and 2020. Please show the workings. Dont provide handwritten or image based answers thank youarrow_forwardAt the end of 2020, Bonita Company is conducting an impairment test and needs to develop a fair value estimate for machinery used in its manufacturing operations. Given the nature of Bonita's production process, the equipment is for special use. (No secondhand market values are available.) The equipment will be obsolete in 2 years, and Bonita's accountants have developed the following cash flow information for the equipment. Year 2021 2022 2022 Net Cash Flow Estimate $5,440 9,500 $(460) 2,180 3,800 Scrap value $530 970 Probability Assessment 40% Click here to view factor tables 60% 20% 60% 20% 50% 50% Using expected cash flow and present value techniques, determine the fair value of the machinery at the end of 2020. Use a 6% discount rate. Assume all cash flows occur at the end of the year. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Sair Fair value of the machinery at the end of 2020 $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education