FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

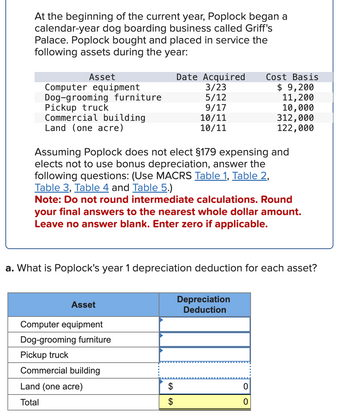

Transcribed Image Text:At the beginning of the current year, Poplock began a

calendar-year dog boarding business called Griff's

Palace. Poplock bought and placed in service the

following assets during the year:

Asset

Computer equipment

Dog-grooming furniture

Pickup truck

Commercial building

Land (one acre)

Asset

Computer equipment

Dog-grooming furniture

Pickup truck

Commercial building

Land (one acre)

Total

Date Acquired

3/23

5/12

9/17

Assuming Poplock does not elect §179 expensing and

elects not to use bonus depreciation, answer the

following questions: (Use MACRS Table 1, Table 2,

Table 3, Table 4 and Table 5.)

Note: Do not round intermediate calculations. Round

your final answers to the nearest whole dollar amount.

Leave no answer blank. Enter zero if applicable.

GA

10/11

10/11

a. What is Poplock's year 1 depreciation deduction for each asset?

$

Cost Basis

$ 9,200

11, 200

10,000

312,000

122,000

Depreciation

Deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manarrow_forwardIn its first year of business, Coronado purchased land, a building, and equipment on March 5, 2023, for $636,000 in total. The land was valued at $269,400, the building at $336,750, and the equipment at $67,350. Additional information on the depreciable assets follows: Asset Building Equipment (a) Land Residual Value Building Your answer is correct. $ $25,200 $ 4,000 Equipment $ Useful Life in Years Allocate the purchase cost of the land, building, and equipment to each of the assets. 60 8 254400 318000 Depreciation Method 63600 Straight-line Double diminishing-balancearrow_forwarda. What is Poplock's year 1 depreciation deduction for each asset? Asset Computer equipment Dog-grooming furniture Pickup truck Commercial building Land (one acre) Total (9 $ (9) (9 $ $ Depreciation Deduction 1,840 1,600 2,000 5,440arrow_forward

- dvubenarrow_forward9) Tom Tom LLC purchased a rental house and land during the current year for $150,000. The purchase price was allocated as follows: $100,000 to the building and $50,000 to the land. The property was placed in service on May 22. Calculate Tom Tom's maximum depreciation for this first year. (Use MACRS Table 3.) A) $1,605 B) $2,273 C) $2,408 D) $3,410 E) None of the choices are correct.arrow_forwardDengerarrow_forward

- Please help me. Thankyou.arrow_forwardFor federal tax purposes, how long should a sole proprietor keep records on a machine used for 100%? Until three years after the due date of the return: 1) in which the machine is disposed of in a taxable disposition 2) when the machine is purchased. 3) after the machine is disposed of in a taxable disposition. 4) when the machine is placed in service.arrow_forwardFor federal tax purposes, how long should a sole proprietor keep records on a machine used 100% for business? Until three years after the due date of the return for the year: When the machine is placed into service. When the machine is purchased. That ends four years after the machine was first placed into service. In which the machine is disposed of in a taxable disposition.arrow_forward

- Prepare the complete Depreciation and Amortisation Form 4562.arrow_forwardCity Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $20,800. In addition, City paid sales tax and title fees of $960 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,850. Required: a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education