FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:(9)

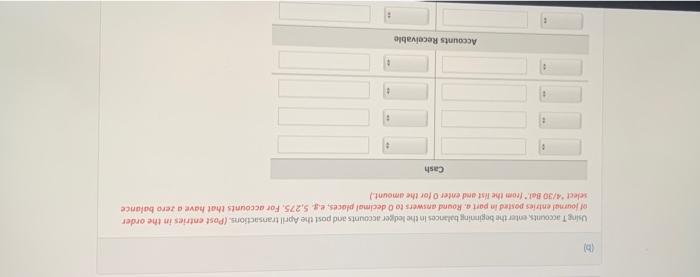

Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions. (Post entries in the order

of journal entries posted in part a. Round answers to 0 decimal places, e.g 5,275. For accounts that have a zero balance

select 4/30 Bal. from the list and enter O for the amount.)

Cash

Accounts Receivable

Transcribed Image Text:At the beginning of the current season on April 1, the ledger of Carla Vista Pro Shop showed Cash $3,095; Inventory $4,095; and

Common Stock $7.190. The following transactions occurred during April 2022.

Purchased golf baps, clubs, and balls on account from Arnie Co. $1.785, terms 3/10, n/60,

Paid freight on Arnie Co. purchases $95.

Apt.

Received credit from Arnie Co. for merchandise returned $485.

10

Sold merchandise on account to members $1,595, terms n/30.

12

Purchased golf shoes sweaters, and other accessories on account from Woods Sportswear $988, terms 2/10, n/30.

14

Paid Amie Co. in full.

17

Received credit from Woods Sportswear for merchandise returned $188.

20

Made sales on account to members $964, terms n/30.

21

Paid Woods Sportswear in full

27

Granted credit to members for clothing that did not fit properly 595.

:30

Received payments on account from members $1452

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare journal entries for the selected transactions Sept. 1 - Purchased inventory from Orion Company on account for $60,000. Darby records purchases gross and uses a periodic inventory system. Dr Cr Oct. 1 - Issued a $60,000, 12-month, 8% note to Orion in payment of account. Dr Cr Oct. 1 - Borrowed $85,000 from the Shore Bank by signing a 12-month, zero-interest-bearing $92,000 note. Dr Crarrow_forwardPost the following November transactions to T-accounts for Accounts Payable, Inventory, and Cash, indicating the ending balance. Assume no beginning balances in Accounts Payable and Inventory, and a beginning Cash balance of $21,220.A) purchased merchandise inventory on account, $9,900B) paid vendors for part of inventory purchased earlier in month, $6,500C) purchased merchandise inventory for cash, $4,750arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. Apr. Jun. Jul. Aug. Dec. 1 Purchased merchandise on account from Kirkwood Co., $396,000, terms n/30. 31 Issued a 30-day, 4% note for $396,000 to Kirkwood Co., on account. 30 Paid Kirkwood Co. the amount owed on the note of March 31. 1 Borrowed $174,000 from Triple Creek Bank, issuing a 45-day, 4% note. 1 Purchased tools by issuing a $258,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 15 30 1 22 31 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6.5% note for $174,000. (Journalize both the debit and credit to the notes payable account.) Paid Triple Creek Bank the amount due on the note of July 16. Paid Poulin Co. the amount due on the note of July 1. Purchased equipment from Greenwood Co. for $400,000, paying $114,000 cash and issuing a series of ten 4% notes for $28,600 each,…arrow_forward

- Instructions: Using both periodic and perpetual inventory system, you are required to prepare the following: 1. Chart of Accounts 2. Comparative Journal Entriesarrow_forwardplease help mearrow_forwardok nces Bryant Company sells a wide range of inventories, which are initially purchased on account. Occasionally, short-term notes payable are used to obtain cash for current use. The following transactions were selected from those occurring during the year. a. On January 10, purchased merchandise on credit for $21,000. The company uses a perpetual inventory system. b. On March 1, borrowed $46,000 cash from City Bank and signed a promissory note with a face amount of $46,000, due at the end of six months, accruing interest at an annual rate of 6.50 percent, payable at maturity, Required: 1. For each of the transactions, indicate the accounts, amounts, and effects on the accounting equation 2. What amount of cast, is paid on the maturity date of the note? 3. Indicate the impact of each transaction (increase, decrease, and no effect) on the debt-to-assets ratio. Assume Bryant Company had $360,000 in total liabilities and $560,000 in total assets, yielding a debt-to-assets ratio of 0.64,…arrow_forward

- On October 23, Johnson Company purchased $100,000 of inventory on credit with payment terms of 1/15, net 45. Using the net price method, prepare journal entries to record Johnson Company's purchases if it pays on October 31.View Solution:arrow_forwardDon't give answer in image formatarrow_forwardCurrent Attempt in Progress Sandhill Company uses special journals and a general journal. The following transactions occurred during September 2022 Sold merchandise on account to H. Drew, invoice no. 101. $745, terms n/30. The cost of the merchandise sold was $455. Sept. 2 10 12 21 25 27 Purchased merchandise on account from A. Pagan $600, terms 2/10, n/30. Purchased office equipment on account from R. Cairo $6,200. Sold merchandise on account to G. Holliday, invoice no. 102 for $785, terms 2/10, n/30. The cost of the merchandise sold was $430 Purchased merchandise on account from D. Downs $860, terms n/30. Sold merchandise to S. Miller for $665 cash. The cost of the merchandise sold was $420.arrow_forward

- Jan. 2 Purchased merchandise on account from Nunez Company, $27,600, terms 3/10, n/30. (Wildhorse uses the perpetual inventory system.) 1 Issued a 9%, 2-month, $27,600 note to Nunez in payment of account. Feb. Mar. 31 Accrued interest for 2 months on Nunez note. Apr. 1 Paid face value and interest on Nunez note. July 1 Purchased equipment from Marson Equipment paying $10,200 in cash and signing a 10%, 3-month, $68,400 note. Sept. 30 Accrued interest for 3 months on Marson note. Oct. 1 Paid face value and interest on Marson note. Dec. 1 Borrowed $27,600 from the Paola Bank by issuing a 3-month, 8% note with a face value of $27,600. Dec. 31 Recognized interest expense for 1 month on Paola Bank note. Prepare Journal entries for the listed transactions and events. Post the accounts Notes Payable, Interest payable, and Interest Expense. Show the balance sheet presentation of notes and interest payable at December 31. What is the total interest expense for the year?arrow_forwardQuestionarrow_forwardPrepare Statement of Financial Position as of December 31, 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education