FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

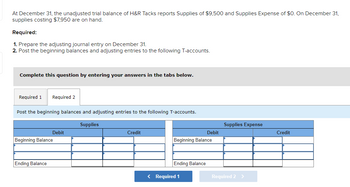

Transcribed Image Text:At December 31, the unadjusted trial balance of H&R Tacks reports Supplies of $9,500 and Supplies Expense of $0. On December 31,

supplies costing $7,950 are on hand.

Required:

1. Prepare the adjusting journal entry on December 31.

2. Post the beginning balances and adjusting entries to the following T-accounts.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Post the beginning balances and adjusting entries to the following T-accounts.

Supplies

Debit

Beginning Balance

Ending Balance

Credit

Beginning Balance

Ending Balance

Debit

< Required 1

Supplies Expense

Required 2 >

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello! I need some help with accounting. I need to jurnalize the adjusting entries. Journalism the adjustments in the order given in the question. General Jurnal Date description. Post debit credit 20-- adjusting entries Mar.31 ______ ______ Mar.31 ______ ______ Mar.31 ______ ______ Mar31 ______ ______ Mar.31 ______ ______ Mar.31 ______ ______ Then I must prepare an income statementarrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forwardDecember 31, 20, according to the Trial Balance, the Office Supplies account has a balance of 2,100.00.Adjustment data reveals that 960.00 of office supplies are on hand at the end of the period.Journalize the adjusting entry.arrow_forward

- Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid or Accrual. Calculate the adjusted balance and use a Bal. post reference to show the ending balance of each account. 1. Completed services that were paid for six months earlier, $970. The Service Revenue unadjusted balance as of December 31 is $9,100. The Unearned Revenue balance as of December 31 is $8,100. 2. Incurred interest expense of $2,900. 3. A two year insurance policy for $1,320 was purchased on November 1 of the current year. Record the transaction for the year ended December 31.arrow_forward02.arrow_forwardRequirement 1. Journalize the adjusting entries using the letter and March 31 date in the date column. (Record debits first, then able. Check your spelling carefully and do not abbreviate. Use the account names provided in the problem.) a. Service revenue accrued, $600. Date (a) Mar. 31 Accounts and Explanation Debit Creditarrow_forward

- CLOSING ENTRIES AND POST-CLOSING TRIAL BALANCE Refer to thework sheet in Problem 6-7A for Megaffin's Repairs. The trial balanceamounts (before adjustments) have been entered in the ledger accountsprovided in the working papers. If you are not using the working papersthat accompany this book, set up ledger accounts and enter thesebalances as of January 31, 20--. A chart of accounts is provided attached. REQUIRED 1. Journalize (page 10) and post the adjusting entries.2. Journalize (page 11) and post the closing entries.3. Prepare a post-closing trial balance.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. amount due for employee salaries, $4,800 actual count of supplies inventory, $ 2,300 depreciation on equipment, $3,000arrow_forwardPlease answer complete question,,,answer in text form please (without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education