Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:45.90%

39.23%

48.20%

47.28%

43.61%

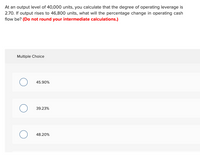

Transcribed Image Text:At an output level of 40,000 units, you calculate that the degree of operating leverage is

2.70. If output rises to 46,800 units, what will the percentage change in operating cash

flow be? (Do not round your intermediate calculations.)

Multiple Choice

45.90%

39.23%

48.20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If sales are $325,000, variable costs are 75% of sales, and operating income is $45,600, what is the operating leverage? a. 1.3 b. 1.8 c. 0.0 d. 5.3arrow_forwardConsider the basic setup of the Diamond-Dybvig (1983) model. Specifically, there are three periods, denoted t = 0, 1, 2, a single consumption good, and an illiquid investment opportunity that pays gross return 1 if liquidated at t = 1, or gross return 2.2 if liquidated at t = 2. There are 500 people in the economy, each endowed with 1 unit of the consumption good at t = 0. At t = 1, exactly 200 will randomly realize that they need to consume at t = 1 (the early consumers), the remaining 300 people will need to consume at t = 2 (the late consumers). The utility derived from consumption is 1 − (1/c1) 2 for early consumers, 1−(1/c2) 2 for late consumers, where the subscript denotes the time of consumption. Suppose a bank can offer an asset that is more liquid, with gross returns Rd 1 = 1.33 and Rd 2 = 1.71 (depending on the time of liquidation). (i) Calculate the bank’s profit after t = 2. In other words, what amount of funds remains at the bank once all depositors have withdrawn? Now…arrow_forwardUsing the following data, estimate the new Return on Investment if there is a 10% increase in sales - with average operating assets as the base. Sales $2,000,000 Variable 1,100,000 costs Contribution 900,000 margin 45% Controllable 300,000 fixed costs Controllable $600,000 margin Average operating $5,000,000 assetsarrow_forward

- Assume the following information: Amount Per Unit Sales $ 300,000 $ 40 Variable expenses 120,000 16 Contribution margin 180,000 $ 24 Fixed expenses 111,000 Net operating income $ 69,000 If the selling price per unit increases by 10% and unit sales drop by 5%, then the best of estimate of the new net operating income is: Multiple Choice $77,400. $82,200. $153,200. $88,500.arrow_forwardSales revenue from product X is $9,000, variable costs are $6,000, and allocated fixed costs are $4,500. If you drop product X in the short term, profit will: decrease by $1,500 O decrease by $5,250 increase by $3,000 O increase by $1,500 decrease by $3,000arrow_forwardIf sales equal $320,960, variable expenses equal $200,000, and the degree of operating leverage is 16, then the net operating income is: Multiple Choice $12,500 $20.060 $7.560 Seed Help Seve & Exit Submit $12.500 $20.060 $7.560 $27620arrow_forward

- What should be the unit selling price of its product to have a 20% return on investment? Baguio Corporation has these selected data: 25,000 P500,000 Units to be sold Total Cost of the units Fixed Capital investment Variable capital on sales 1,000,000 20%arrow_forwardSubject: Logistic management calculate EVA and suggest favorable or not ? Investment 1 mioSales 500,000All Expenses 400,000Market opportunity cost 15%arrow_forwardManagement anticipates fixed costs of $73,000 and variable costs equal to 47% of sales. What will pretax income equal if sales are $330,000? Multiple Choice $196,050. $257,000. $155,100. $101,900. $82,100.arrow_forward

- = $ A project has the following estimated data: price 104.00 per unit; variable costs = $60.50 per unit; fixed costs investment = $39,600.00; life = 6 years. What is the $37,500.00; required return = 8%; initial degree of operating leverage at the financial break - even level of output? a) 4.38 b) 7.38 c) 6.38 d) 3.38 e ) 5.38arrow_forward7. Assume a company is going to make an investment of $300,000 in a machine and the following are the cash flows that two different products would bring in years one through four. The company's required rate of return is 12%. Option A Option B Product A Product B $190,000 $150,000 190,000 180,000 60,000 60,000 20,000 70,000 Using the appropriate EXCEL spreadsheet in the Chapter11 NPV IRR Analysis.xlsx Download Chapter11 NPV IRR Analysis.xlsx, answer the following questions: What is the NPV for Option A? What is the NPV for Option B? What is the IRR for Option A? What is the IRR for Option B? PLEASE NOTE #1: The dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Round your IRR answers, in percentage format, to two decimal places (i.e. 12.34%). Given the above answers, which project should the…arrow_forwardB. Consider the following: Total variable costs $200,000 Total fixed costs $150,000 Annual volume of units 500 Average invested capital $400,000 Target Return on investment 20.0% To the nearest tenth, what is the markup percentage required to earn the target return on investments using the cost-plus formula based on total costs?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education