FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

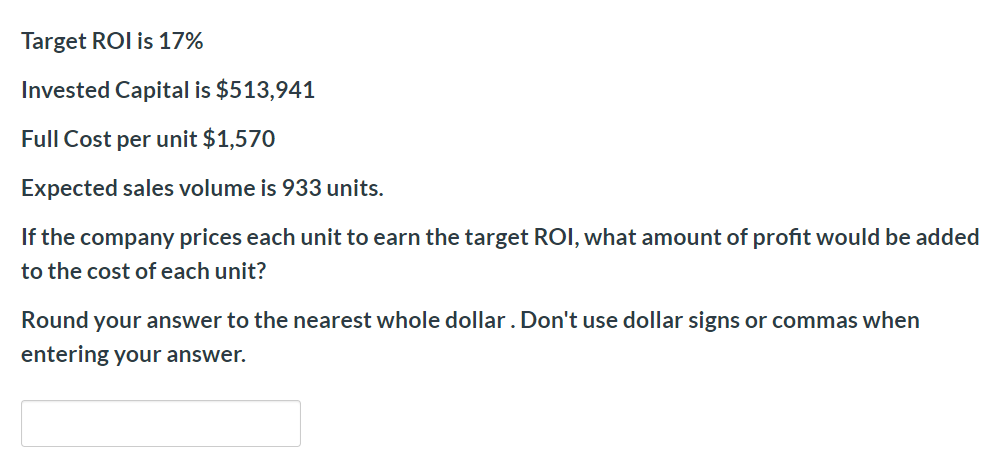

Transcribed Image Text:Target ROI is 17%

Invested Capital is $513,941

Full Cost per unit $1,570

Expected sales volume is 933 units.

If the company prices each unit to earn the target ROI, what amount of profit would be added

to the cost of each unit?

Round your answer to the nearest whole dollar . Don't use dollar signs or commas when

entering your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please help me with show all calculation thankuarrow_forwardAssume that markup is based on cost. Calculate the cost and selling price. Note: Round your answers to the nearest cent. Cost Selling price Dollar markup $ 6.00 Percent markup on cost 101.69 %arrow_forwardAssume the following (1) selling price per unit = $30, (2) variable expense per unit = $18, and (3) total fixed expenses = $31,800. Given these three assumptions, the unit sales needed to achieve a target profit of $11,700 is: Multiple Choice O O 3,625 units. 15,325 units. 58,825 units. 43,500 units.arrow_forward

- Use the accompanying Profit_Analysis spreadsheet model to answer the following questions. Assumptions: Fixed cost: $ 5,000.00 Material costs per item: $ 2.25 Labor costs per item: $ 6.50 Shipping costs per 100 items: $ 200.00 Price per item: $ 12.99 Quantity: 2000 Outputs: Total revenues: $ 25,980.00 Total costs: $ 26,500.00 Total profits: $ -520.00 1. Use the data table tool to show the impact of quantity ranging from 1,500 to 5,000 with 500 unit increments on the total revenues, total costs, and total profits. What are the revenues, costs, and profits for 3,500 units? 2. Use the data table tool to show the impact of labor costs ranging from $5.00 to $8.00 with $0.50 increments and price per item ranging from $10.99 to $15.99 with $1.00 increments on the total profits. What is the total profit if the labor costs are $6.50, and the price is $14.99? Note: Round your answers to 2 decimal places. 3.…arrow_forwardOn the CVP graph, the intersection between the total costs line and the Y axis represents: O a The loss area Ob. The profit area Oc The margin of safety Od. The total fixed cost Oe None of the given answers XYZ company expects the following in the next month: sales volume 50,000 units, contribution margin ratio 60%, the selling price $2per unit, and the total fixed costs $10,000. What will be the degree of operating leverage in the next month? O a 6 O b. 12 Oc 3 Od. None of the choices given O e 25 onarrow_forwardA firm in a perfectly competitive industry has a typical cost structure. The normal rate of profit in the economy is 6 percent. This firm is earning $15 on every $150 invested by its founders. Instructions: Enter your answers as whole numbers. a. What is its percentage rate of return? percent. b. Is the firm earning an economic profit? (Cick to select) If so, how large? O percent. c. Will this industry see entry or exit? (Click to select) d. What will be the rate of return earned by firms in this industry once the industry reaches long-run equilibrium? O percent.arrow_forward

- PA1. 10.1 When prices are rising (inflation), which costing method would produce thehighestvalue for gross margin? Choose between first-in, first-out (FIFO); last-in, first-out (LIFO); and weighted average (AVG). Evansville Company had the following transactions for the month. Number of Units Cost per Unit $6,000 7,000 7,500 Purchase 2 Purchase 3 Purchase 4 Calculate the gross margin for each of the following cost allocation methods, assuming A62 sold just one unit of these goods for $10,000. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardparesharrow_forwardPrepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- A company’s sales figure is £250,000 and its margin of safety ratio is 40%. Assuming that the fixed costs, the variable cost per unit and the selling price per unit do not change, the company’s margin of safety for sales of £325,000 will be: a. £175,000 b. £150,000 c. £100,000 d. £70,000arrow_forwardTrailblazer Company sells a product for $270 per unit. The variable cost is $150 per unit, and fixed costs are $576,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $224,640. a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $224,640 unitsarrow_forwardplease explain the four matchingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education